The Board of Directors of the CMA CGM Group met under the chairmanship of Rodolphe Saadé, Chairman and Chief Executive Officer, to review the financial statements for the second quarter of 2020.

Upon the release of the second quarter results for 2020, Rodolphe Saadé, Chairman and Chief Executive Officer of the CMA CGM Group, commented: “Despite the COVID-19 pandemic, our Group reported excellent results during the 2nd quarter, thus strengthening our financial structure. Thanks to our agile business model and synergies between our shipping and logistics business activities, we were able to adapt our service offerings to meet our customers’ fast-changing needs. We have also significantly reduced our costs and benefited from the drop in oil prices. CEVA Logistics’ turnaround plan is underway and in line with our expectations. During this public health crisis, preserving the safety of our employees was a top priority. Our teams have been working hard to ensure the Group’s and customers’ business continuity. Our expertise has been especially useful in combating COVID-19 by developing sea and logistical bridges to supply essential medical equipment. Third quarter results should mark a new improvement in our performance.”

Operating and financial performance for the second quarter 2020

Shipping and logistics industry is facing an unprecedented situation

The Group performed second quarter operations under unprecedented circumstances due to the COVID-19 pandemic. Container traffic volumes decreased for the first time since 2009 as a result of lockdown measures in several countries. This resulted in the shutdown of production units, in particular in China, during the first quarter. This was then followed by a sharp downturn in global consumer demand in March and April.

All supply chains were able to adapt to avoid disruption and deliver supplies—especially medical equipment. As lockdown measures were gradually lifted, carried volumes bounced back strongly as of May under the combined effect of inventory rebuilding and the sharp recovery in the consumption of goods, notably in the United States.

CMA CGM was able to leverage its shipping and logistics expertise to tackle this challenge while also improving profitability, in particular by actively adapting fleet capacity to demand and continuing its cost discipline.

Group: major improvement in operating performance and net income

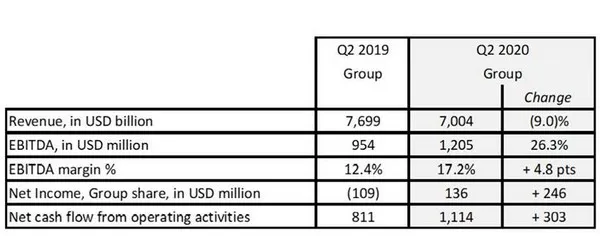

During the second quarter of 2020, CMA CGM improved profitability in all its business activities. Revenue for the period reached USD 7.0 billion, down 9.0% compared with the second quarter of 2019, due to a slowdown in volumes related to the impact of the global public health crisis on international trade.

EBITDA improved once again, increasing 26.3% compared with the second quarter of 2019, and reaching more than USD 1.2 billion. The EBITDA margin posted impressive gains, reaching 17.2% (vs. 12.4% during the second quarter of 2019). The operating margin was USD 530 million, i.e., 7.6%, versus USD 286 million (3.7%) for the second quarter of 2019.

During the second quarter of 2020, the CMA CGM Group posted positive net income, Group share of USD 136 million, up sharply, compared with a loss of USD 109 million during the second quarter of 2019, and a benefit of USD 48 million during the first quarter of 2020.

The Group’s operating performance generated operating cash flow in excess of USD 1.1 billion.

Moreover, the Group’s liquidity was further strengthened by securing a EUR 1.05 billion guaranteed bank loan, EUR 300 million of which was allocated to the CEVA Logistics capital increase.

As a result, the Group’s liquidity position (available cash and undrawn credit lines) totaled USD 2.6 billion at June 30, 2020, allowing the Group to comfortably meet future financial obligations.

In line with its prudent financial policy, CMA CGM continues to proactively evaluate all potential options to strengthen its financial structure, which may include refinancing opportunities across all available funding sources.

(1)EBITDA before capital gains/(losses) on the disposal of fixed assets and subsidiaries.

Shipping: strong EBITDA growth of 30%

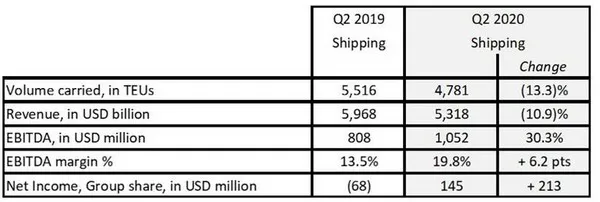

Due to the COVID-19 pandemic, volumes carried during the second quarter of 2020 were down 13.3% compared with the second quarter of 2019, more limited than initially expected. As a result, revenue for the quarter was down 10.9% compared with the second quarter of 2019, totaling USD 5.3 billion for shipping, thanks to average revenue per TEU (twenty-foot equivalent unit) of USD 1,112, up 2.8% year-on-year.

Shipping EBITDA grew by 30% during the second quarter of 2020 at USD 1,052 million (vs. USD 808 million during the second quarter of 2019). The operating margin was up an impressive 86% to USD 497 million, i.e., 9.3%.

Unit cost by TEU was down 4.6% compared with the second quarter of 2019, at USD 892 due to the decline in oil prices, the Group’s cost-cutting initiatives and the reduction in the fleet of vessels and containers deployed. CMA CGM demonstrated its ability to rapidly adapt its deployed capacity to demand, in line with the discipline seen more generally across all industry operators.

Logistics: continuation of the transformation plan, excellent airfreight performance, 78% recovery in operating margin

CEVA Logistics turnaround plan implementation remained on track despite the challenging environment. The COVID-19 crisis has confirmed the relevance of our strategy of offering complementary shipping and logistics services, such as CEVA Logistics’ commercial airfreight and warehousing solutions. The second quarter saw the initial signs of the recovery of the CMA CGM Group’s logistics subsidiary.

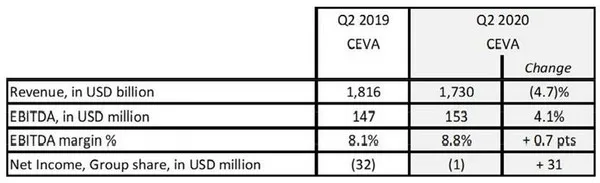

The Group’s logistics segment demonstrated its resilience during the past quarter, despite revenue being down 4.7% at USD 1.7 billion, also affected by adverse FX movements. EBITDA increased to USD 153 million, i.e., +4,1% compared with the second quarter of 2019, despite the negative impact of the health crisis on its results estimated at USD 7 million. This limited impact underscores the success of the wide range of measures implemented to offset the negative impact of the public health crisis.

These results benefited from the strong airfreight business thanks to air charters compensating the absence of regular capacity. Ground activities progressed further on their recovery. This performance offset the weakness of sea freight. The results of contract logistics were penalized during the quarter by the pandemic, which led to the closure of many sites.

The operating margin is strongly growing by 78% to USD 40 million.

Logistics net loss continued to recover during the second quarter, reaching USD -1 million, compared with a net loss of USD 32 million during the second quarter of 2019.

For more information:

CMA CGM Group

www.cma-cgm.com