The production of soft fruits in Serbia has a long tradition. It is a story based on entrepreneurship of small family farms in rural regions, as well as on the successful companies marketing the frozen product primarily for the EU market.

The 2020 soft fruit season brought many challenges to farmers in Serbia, starting with Covid-19 outbreak in early spring to the devastating weather conditions at the end of the season. Different areas of the country had to cope with different challenges but one challenge is mutual for all producers – they all agree that modernization and improvement of the production is a must in order to survive and remain as a player on the market.

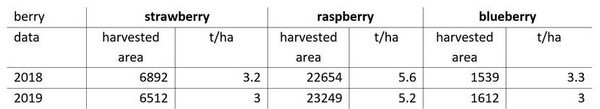

Weather condition is the main factor for the variation of quantities of produced fruit from season to season. Due to very good weather conditions total yields of harvested berry fruits were higher in 2018, compared to 2019. Please see the table below.

Source: Statistical Office of Serbia

The difference can be found in harvested quantities in different parts of Serbia. The average yields of raspberry production in 2019 was 5.2 t/ha, but the practice showed that yields in Western Serbia were 12-15 t/ha of raspberries. Blueberry production is gaining on importance over the last five years. Difference with this type of berry production is that majority of blueberry orchards meet high production standards known in the Western European countries: any-hail nets, drop irrigation systems; new varieties; certified planting material etc.

Prognoses for season 2020 show that the yields will be 30- 50% lower compared to the previous season due to serious weather influences in the recent period (see also our article here )

The soft fruit sector has been set as a priority sector in the bilateral relation between Serbia and the Netherlands, which has been further solidified through the launch of the project named Netherlands Soft Fruit Solutions, a public-private partnership brought by the Dutch government and a consortium of companies representing the Dutch fruit sector. The aim of this project is to assist in developing an efficient, sustainable soft fruit chain in Serbia, which is known for its production of soft fruit, particularily raspberries, strawberries, blueberries, and other berry-like fruit.

Looking at the trends in the overall production of soft fruit, Serbia acts as the absolute dominant raspberry producer in the Western Balkan region and beyond along with window of opportunities to export blueberries to the Western European market, and significant strawberry export on the Eastern markets.

There is a great ambition and willingness to further develop and improve its production on a variety with the existence of commercial professional producers with high productivity. Overall, this sector in Serbia is characterized by professional expertise of firms that exclusively specialize in soft fruit and adhere to excellent quality that reaches EU standards, and focused on marketing to the EU retail sector. It is no surprise that there are major potentials for the soft fruit sector in Serbia.

The biggest limitation is in the lack of technological solutions, combating the issues related to climate change, dealing with weather extremes, and the limitations of open-field produce-only. Dutch businesses are renowned in the region for being innovative and investing in production technologies. There is a specific demand in Serbia for modern variety and planting material, internal logistics and harvesting, mid and high-tech greenhouse solutions, climate control methods, and labor management systems.

Though soft fruit is a competitive sector, the majority of the producers emphasize that there is a need for drivers for development familiar to businesses in the Netherlands. On the one hand, drivers can be research and adopted international technologies, expanded and upgraded logistical facilities, strengthened vertical supply chains, and improved organizations for collective action. On the other hand, the need in associated services, such as packaging, equipment supply, and technical consulting, in turn contribute to the underlying competitiveness of the sector.

As such, Serbian growers are eager to obtain knowledge from Dutch counterparts in the benefit for both. All in all, trade partnerships and cooperation agreements in the Serbian Soft fruit sector, as well as with relevant knowledge centers in the fruit sector are open for new opportunities!

Source: Agroberichtenbuitenland.nl