AHDB has released a potato market outlook, looking at production, trade, demand and trends in the sector. You can see their findings below.

Production

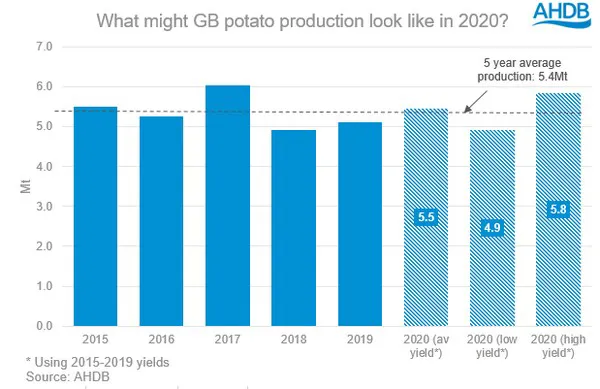

While the coronavirus pandemic has had a significant impact on demand this year, many growers planting decisions were set before the virus hit the UK and lockdown measures were imposed. While there were some cases where growers reduced their area, if they had the opportunity to do so, other reports cited growers replacing failed winter cereal cropping with potatoes.

The dry spring was welcome in the first instance, allowing planting to happen at pace. However, the prolonged nature of the arid weather proved worrisome for many, but the rains in June came at just the right time for a large proportion. Additionally, just over half the potato area in the UK has access to irrigation, with no restrictions at the moment.

With a major shift in area, or any large yield impacts currently expected, we could be set for production levels c.5.5Mt. However, there are still the critical last stages of the growing season to see through. The current longer-term forecast from the Met Office is for a “drier and warmer than average” period. Should this be realised, and to a significant extent, this could well affect yield potentials.

Trade

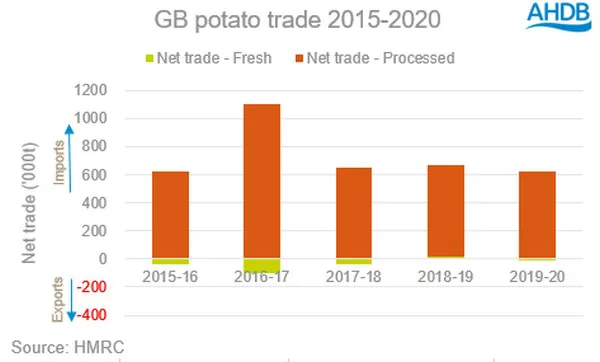

Before coronavirus hit, there were concerns of a shortfall between the 2019 and 2020 season. The closure of food service throughout Europe has debunked this.

This could mean two things. Firstly, the need for the UK to import processing potatoes (none withstanding a poor harvest) could be greatly reduced next season. Currently, processors are working through their contracted supply, with very few purchases on the free-buy market. Should harvest come in a timely fashion with adequate yields, UK processors could be well supplied by domestic material.

Secondly, there are reports of a 2Mt surplus of European potatoes needing to find a home from the 2019 season. At this time, European processors are honouring their contracted purchases, but some of the material is being used for AD and animal feed at a reduced price. There may be a push to export some of this material if better returns can be expected. This could potentially suppress any price rises on the domestic market.

In addition, there is still Brexit on the horizon. At the time of writing, with the UK set to leave the EU on 31 December 2020, third party equivalence status has yet to be granted to the UK. Our analysis earlier in the year explains the implications, but essentially, until a trade agreement or equivalence is granted, this could stop any UK exports of seed or fresh potatoes to the EU market.

Demand

The coronavirus pandemic has had an enormous impact on the potato industry. This has been felt differently by the packing and processing sectors, with their end markets dictating the size of the effect. But what could be the effect moving forwards?

The packing sector predominantly serves the retail market (c.80%). This saw a huge spike at the peak of the panic buying in March, although has since returned to levels that are more “normal”. While lockdown measures are easing, and the majority of food service reopening from 4 July, “at home” eating occasions may remain elevated for some time. The public are still not fully mobile and with social distancing measures in place, customer volumes in food service will not be at pre-pandemic levels for some time.

The reverse is true for the processing sector. With food service accounting for 55-60% of the market, the closure of this area has had a profound effect on the industry. While some processing material has been repurposed to packing markets, tighter specifications restrict volumes. Although food service is gradually reopening, social distancing measures will mute customer volumes and therefore demand. Equally, the forecast economic downturn will have a negative impact on dining out occasions, as we witnessed in the 2008 downturn.

The uptick in retail sales in the processing sector has not been enough to offset the loss of food service. In addition, with 2019 stocks still to work through, the possibility of decent production volumes for the 2020 harvest and an oversupply of processing potatoes on the continent, we could see this sector well supplied with pressured free-buy for some time to come.

Potatoes consumption trends

Prior to COVID-19, total potato performance was seeing volume declines in retail of -1.3% (Kantar, 52 w/e 23rd Feb 2020) and eating-out -3.1% (MCA, Y/E Dec 2019). Potatoes struggled as traditional meals lost share in favour of dishes from world cuisines. Cooking time was a barrier to in-home consumption, with fresh potato dishes, where the retail declines are coming from, taking nearly twice as long to cook and prepare, according to data from Kantar Usage. Coupled with health concerns, this contributed to more consumers saying they intend to cut back on their potato consumption (15%) than increase consumption (8%) (AHDB/YouGov Consumer Tracker Feb 20).

During COVID-19, potatoes in retail grew significantly with volume growth of +21.6%, much faster than total food and drink at +14.7% (Kantar, 12 we 17 May 2020). The fastest growth was for canned potatoes and crisps, which benefitted from long storage lives – with ‘use by’ dates increasing in importance for a third of potato shoppers. Fresh potatoes also saw an additional 71 thousand tonnes sold in the last 12 weeks. During lockdown, potatoes benefit from their versatility and price point. This helps compensate for the closure of foodservice and schools, which combined typically account for approximately 22% of potato volumes.

What next?

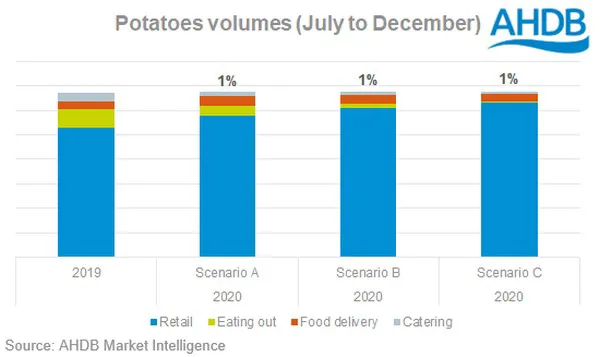

Looking at retail volumes for the remainder of the calendar year, overall potato consumption may see slight gains in our scenarios of market reaction from the coronavirus pandemic.

Whilst we may see an overall increase, there will be large changes to individual sectors with processing seeing possible reduced demand being offset by a continued strong period of fresh potato demand. For potatoes, retail usually accounts for approximately 78% of volumes and food takeaway & delivery 5%. Growth in these two areas under scenario A compensates for the eating out market contracting by half. Despite restrictions in the eating-out market being even tougher in Scenarios B and C, the price point of the staple spud makes it even more appealing for those extra in-home occasions. Therefore these growth levels maintain in the other two scenarios.

Maintain momentum:

Recessionary behaviour benefits fresh potatoes, being perceived as a filling and economic meal option. Inspire versatile in-home dish ideas in this area.

Frozen potato products, also lacking a price premium, can be supported to encourage consumers who are looking for good value.

It is likely to be chilled prepared options (e.g. pre prepared mash, dauphinoise or gratins) that will struggle due to perceived lower value for money.

Source: AHDB