The week ending June 21st was Father’s Day weekend and it resulted in a significant boost for fresh produce, both fruit and vegetables. As a result, grocery sales, and produce along with it, remained well above the 2019 base line. In fact, the fresh perimeter (meat, bakery, deli, produce, seafood and floral) doubled last weeks’ growth rate, at 19.1% for the week ending June 21 — three percentage points higher than the total store growth rate. 210 Analytics, IRI and PMA partnered to understand how produce sales continue to develop as states continued to loosen social distancing measures, including the reopening of restaurants.

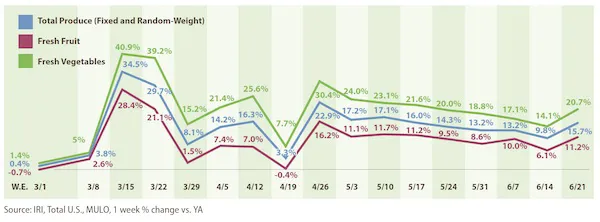

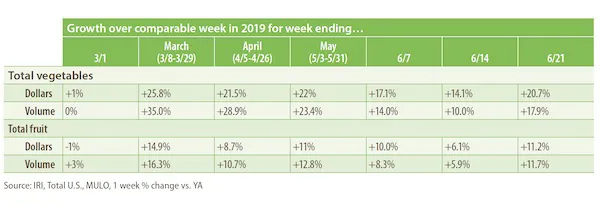

During the week ending June 21, the combination of elevated everyday plus the holiday demand drove gains of 15.7% for fresh produce. Frozen and shelf-stable fruits and vegetables were up 28.3% and 18.3%, respectively. Year-to-date, fresh produce sales are up 10.8% over the same time period in 2019. Frozen fruit and vegetables increased the most, up 28.4% year-to-date and during the third week of June. This gain is in spite of limited assortment availability for frozen vegetables and fruit, down 11.9% in average items per store selling.

- Fresh produce increased +15.7% over the comparable week in 2019.

- Frozen, +28.3%

- Shelf-stable, +18.3%

Source: IRI, Total US, MULO, 1 week % dollar growth vs. year ago

Fresh Produce

Fresh produce generated $1.4 billion in sales the week ending June 21 — an additional $193 million in fresh produce sales. Vegetables, up 20.7% from the prior year, easily outperformed fruit. However, at +11.2%, fruit had its highest gains since mid-May. Despite this significant bump in performance, the gap between fruit and vegetables was the widest in several weeks.

Jonna Parker, Team Lead, Fresh for IRI said: “Despite all that has changed in the past four months, meat and produce continue to rule the grocery world. Now the question is how we can maintain this positive momentum. Clearly, firing up the grill bodes well for fresh sales. Our survey data at IRI shows one-quarter of consumers cook more meals from scratch now than they did pre-pandemic, however, shoppers are running out of ideas. Grilling season provides us with a host of new recipes for tried-and-true vegetables and fruits.”

Fresh versus frozen and shelf-stable

The massive Father’s Day boost for fresh produce meant a nearly complete turnaround for the share of fresh produce to the total fruits and vegetables. At $1.4 billion in sales during the week of June 21, fresh produce is significantly larger than shelf stable ($164 million) and frozen fruits and vegetables ($133 million). The 15.7% sales increase drove the fresh produce share to 83% of combined sales, just one point shy of its 2019 average of 84% and the highest point since the start of the pandemic.

“After stalling at 82% for several weeks, fresh is now within one percentage point of its typical cross-store share,” said Watson. “To maintain this share, it will be important to keep people engaged with fresh produce across all meal occasions, from breakfast to dessert and the morning to the evening snack. This means an important role for fruit, that has seen a bit more of an up and down performance throughout the pandemic.”

Fresh Produce Dollars versus Volume

The volume/dollar gap narrowed Father’s Day week, to 1.5% from 2.2%. Compared with the 18-point volume/dollar gap in the meat department, produce inflation was relatively mild.

After tracking behind dollars the first two weeks of June, fruit volume once more outpaced fruit dollars the week ending June 21 by half a percentage point. In vegetables, dollar gains did outpace volume, at +20.7% versus +17.9%. At 2.8 percentage points, the gap has narrowed somewhat from 4.1 points the week prior.

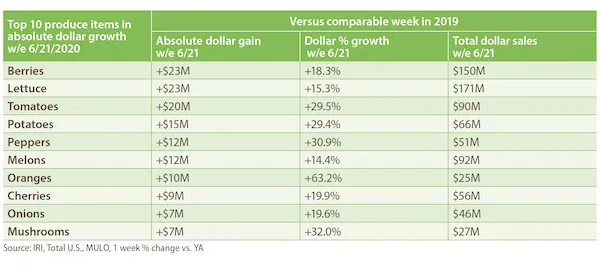

Berries took over as the top growth item in terms of absolute dollar gains for the week of June 21 versus year ago. Lettuce and tomatoes are second and third. “This week we are seeing many of the same suspects in the top 10, but a completely different order yet again,” said Watson. “Number one just a few weeks ago, cherries dropped to seventh place just behind oranges, that continued their hot streak with another +63.2% week. Melon was this week’s newcomer with an additional $12 million in dollar gains over the same week last year.”

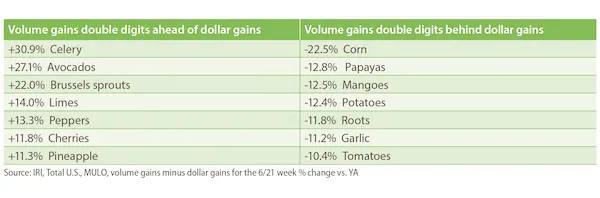

Dollar gains, however, do not tell the full story. Supply and demand continued to be out of balance for many categories. Ample supply is driving higher volume than dollar gains for items such as celery, avocados and Brussels sprouts. On the other hand, dollar gains are far outpacing volume for items such as corn, papayas and mangoes.

“The later Father’s Day meant a bit of a down week for melons and corn last week, but good recovery this week,” said Watson. “Corn is a strong item for cross-merchandising during grilling season. However, the corn market is making it hard for retailers to promote it at the moment and that is one of the reasons why we saw it drop out of the top 10 items in terms of absolute dollar gains.”

To read the full report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com