European physical markets

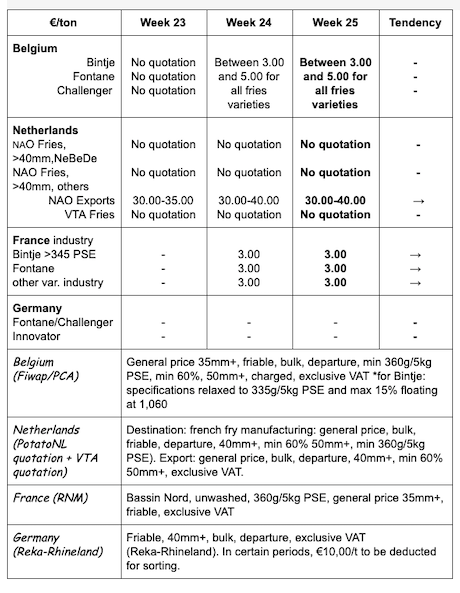

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Processed potatoes: Belgian factories continue to increase their working pace (it varies from 70 to 100% depending on the factories) since the loosening of the lockdown which reactivates the sales of finished products. Several manufacturers are buying, in addition to the contracts which are being removed just a little late. Producer prices vary between 3.00 and 5.00 €/q, on a market qualified as sustained. Fresh potato exports have almost ended. Deliveries for livestock continue at prices lower than those quoted for processing.

Preparers-packers for the domestic market continue to work at a higher pace than normal. The weather this week is crucial for the crop situation and yield prospects, and therefore also for market developments. Substantial rains should help relieve the current significant pressure on buyers. If it (almost) does not rain, this will increase the uncertainties as to the yields and the arrival of the early Belgian potatoes on the markets.

Bintje, Challenger, Fontane, Innovator, Markies…: 3.00 - 5.00 €/q, depending on the quality, buyer, volume and destination. Sustained market.

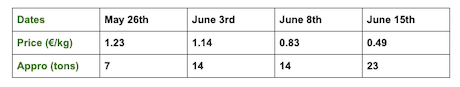

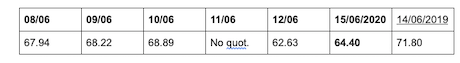

Weighted prices, (red and white varieties) at the Roeselare veiling (source: REO via PCA):

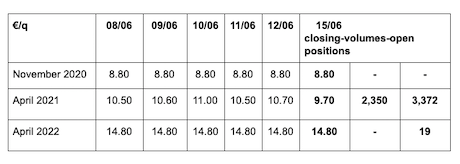

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

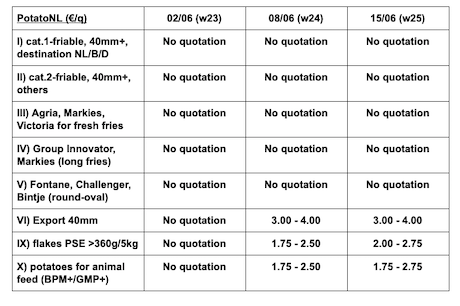

Netherlands

PotatoNL: also available on www.potatonl.com

The potato surplus begins to decrease thanks the dynamics in export, and for livestock, flakes and biogas. The free market is active again on a basis of 3.00 to 5.00 €/q for the friable quality, in order to meet the demand from factories which find outlets now that the lockdown has been lifted. Decrease in fresh potatoes exports (still some volumes towards Ukraine and Africa on a basis of 8.00 to 12.00 €/q, departure sorted and packed.

France

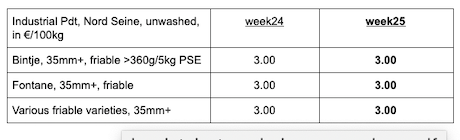

Industrial production, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

The use of contracts from the old harvest will continue in July/August to help get rid of the surplus. Manufacturers are buying again on the free market, for frozen fries (3.00 to 5.00 €/q), as well as flakes and chips. There is still some fresh potato export for chips towards Italy and England, on a basis of 10.00 €/q departure in big-bags.

Last week, the Minister of Agriculture announced some significant aid for non-processed potatoes for a total budget of 10 million euros [11.23 million USD], the amount and allocation methods still needing to be defined.

In the fields, some irregular rains (8 to 25 mm) have been observed in the past 10 days in the Hauts-de-France, Normandy and Grand Est regions, but they remain insufficient in many basins.

Germany

In the southwest (Baden country, along the Rhine, facing the Alsace), it rained between 15 and 25 mm a week ago, while the same quantities also fell in the northwest (Lower Saxony). In Rhineland, it rained less (but more than in Belgium) and irrigations continue. For the early potatoes, tubers are generally less significant than in 2019.

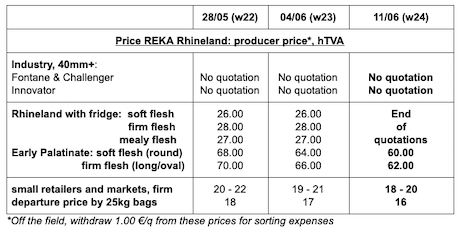

Fresh market for early native potatoes: sales at the farm and on the markets (Palatinate, Rhineland, Baden-Württemberg, early regions of Lower Saxony…) are progressively increasing. Prices remain firm, generally around 50 €/q. The first no-peel potatoes are expected mid-June. Rhineland, early potatoes: between 76 and 84 €/q, depending on variety, quality and location. Palatinate: between 60 €/q (soft flesh) and 62 €/q (firm flesh).

Processing market

Fontane/Challenger: no quotation. Quotations for other uses (biogas, livestock feed…): 1.50 - 2.00 €/qt (1.50 - 2.00 €/q last week).

Organic potatoes: the trade of indigenous organic potatoes continues. The stocks in crates-fridges should make it possible to sell for at least another week. Old potatoes have never been on the market so late. For the first 4 months of the year, we note a 5% progression in sales, compared to the same period in 2019. The organic potatoes from Spain arrived at high returned prices, around 95 €/q. In the Palatinate, the first organic natives are sold at the farm or on small local markets. At the end of June, the first “peaux faites” will be available in supermarkets.

Indigenous early potatoes, weighted average prices, for all Länder.

The price for Mediterranean potatoes continue to drop, due to the clash between the potatoes from Egypt (+/- 48 € returned) and the potatoes from Israel (returned around 55 €) and Spain (returned between 55 and 60 €)...

Great Britain

For more information: FIWAP

FIWAP

www.fiwap.be