The release of the end-March stocks estimate did enable the UK domestic market to encapsulate the partial impact that the coronavirus is having on the potato industry. However, it does not allow us to paint the whole picture as we finish this marketing year and head into next season, according to the AHDB.

As retail took a surge in demand, which has since subsided finding its equilibrium to on-year average. The processing sectors linked to food services, in large, have taken a significant hit as mobility has diminished due to the coronavirus impact.

What could that mean for the domestic market?

At the end of March, an estimated 417Kt of ‘processing and other ware’ was still in grower stores, 90Kt (+27%) above the same point last year.

With the closure of food service, much of this material needed to find another home. Alternative uses for the excessive processing material is limited, with only certain varieties suitable to be packed in the retail market, which levies stricter specifications.

Although data has shown an increase in the purchases of processed retail products since the coronavirus outbreak, the retail-processing sector only accounts for c.40-45% of the processing market. Therefore, this growth does not outweigh the loss of food service.

As we enter summer and large gathering events such as Wimbledon and Glastonbury are cancelled, this will cause increased lack of demand given the outlet these events are for processed potato products. Therefore, it is only likely that the impact of an over supplied market may pressure prices into the next marketing year.

An over supply of processing material on the continent?

While the coronavirus pandemic hit during the planting window for European potatoes, planting intentions for the season had already been set. Anecdotal reports suggest that many growers had not changed their intentions due to pre-purchased seed and fertilisers.

Given that the European area for processing potatoes has grown over the past few years, many growers sticking to their original planting decisions and a reduced demand for the end product, we could see significant pressure going into next year from the continent. Cold stores are full with old crop and many factories are operating at a greatly reduced capacity. Alternative markets, such as animal feed and AD, are being utilised for some of the current over supply. However, there is still a sizeable surplus of processing potatoes both domestically and on the continent.

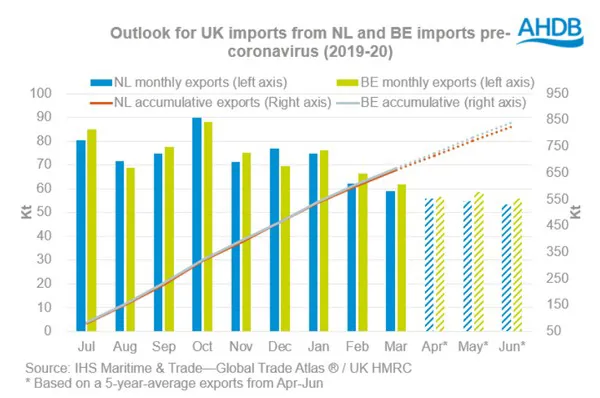

So far this marketing year (July – April) Netherlands have exported c.320Kt of finished processed potatoes to the UK. This means the raw equivalent[1] of c.660Kt of potatoes will have been utilised.

Based on a 5-year-average, approximately 25% of processed potatoes are exported from the Netherlands to the UK between April and June. Under ‘normal’ circumstances, we should in theory be expected to import the raw equivalent of around 164Kt of processed potatoes between April and June.

The situation is similar in Belgium, as so far this season we have imported c.340Kt of processed potatoes, in raw terms this is c.669Kt.

Based on a 5-year-average, 28% is exported from Belgium to the UK between April and June. Therefore in ‘normal’ circumstances we should be importing the raw equivalent of c.171kt of processed potatoes. It is worth noting that many processing plants in Belgium utilise French crops, so this will pressure their domestic pricing too.

So from just the Netherlands and Belgium, the UK may have the raw equivalent of c.335Kt of processed potatoes entering the market from April to June, during a time when food service demand has substantially diminished. These could displace some domestic product.

Conclusion

However, these remaining import figures for April to June may increase further as a decreased demand on the continent increases price competitive surplus. In addition, the free-buy market for the largest five European producing nations has ground to a halt.

Given the remaining surplus in Europe, the UK faces a risk of importing cheap raw and processed potatoes, which will undercut domestic prices.