European physical markets

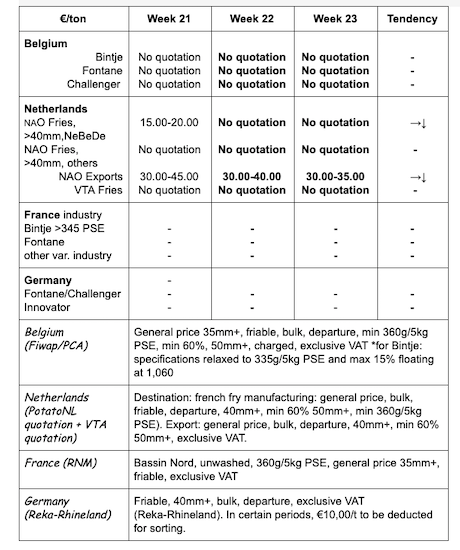

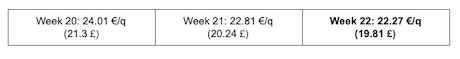

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Industrial potatoes: no quotation because there is almost no free market. The working pace of the different Belgian factories has increased again slightly (30 to 100%) depending on the type of products (fresh fries, frozen fries, specialties, flakes, chips/croustilles…) and the type of markets (European supermarkets, fast-food, European and global export…). We note the presence of a few buyers at prices around 3.00 €/q for delivery within 2 to 4 weeks. Fresh potato exports are gradually ending. Quality is getting lower (compression spots, loss of firmness) and buyers almost entirely turned to the new imported or indigenous potatoes. Deliveries for livestock continue at prices between 0.50 and 1.00 €/q. Preparers-packers for the domestic market continue to work at a faster pace than usual.

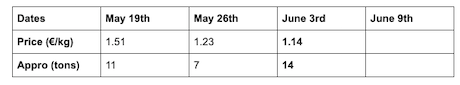

Weighted prices (red and white varieties) at the Roeselare veiling (source: REO via PCA):

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery: Bintje, Fontane, Challenger: no quotation due to a lack of transactions for the industry.

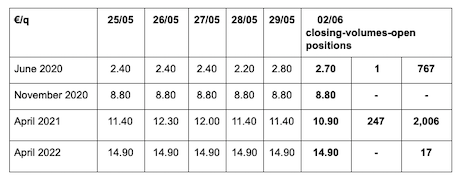

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

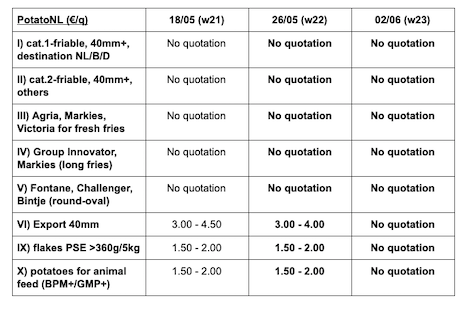

Netherlands

PotatoNL: also available on www.potatonl.com

According to VTA, the secondary market (flakes, livestock and biogas) is buying at prices from 1.50 to 2.50 €/q. In export (purchases at the producers between 3.00 and 5.00 €/q), for potatoes in bags and on pallets, prices are between 7.00 and 9.00 €/qt. Exported volumes are decreasing, the season is gradually ending, even if some volumes still leave for Ukraine. In crates, prices reach 10.00 and 18.00 €/q. On the fresh market, producer prices are between 10.00 and 18.00 €/q, depending on varieties and qualities. Melody between 10.00 and 16.00 €/q.

France:

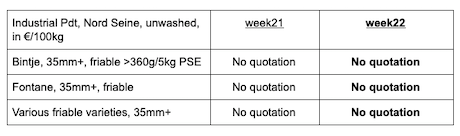

Industrial production, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

Still no quotation for the industry, while the demand for livestock is growing with the increasing influence of the drought. But prices remain low between 0.5 and 2.00 €/q (depending on transportation costs).

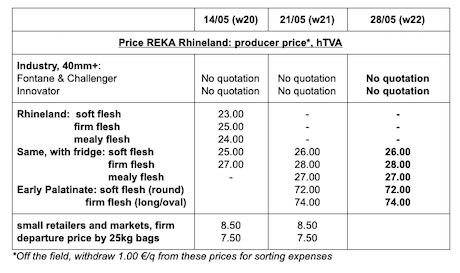

Germany

Fresh market: unchanged prices both for firm flesh at 24.75 €/q (compared to 24.75 €/q) and for soft and mealy flesh at 23.63 €/q (compared to 23.63 €/q).

Early indigenous potatoes: sales at the farm and on the markets (Palatinate, Rhineland, early regions of Lower Saxony…) are increasing progressively. Prices remain firm. The first no-peel potatoes are expected for mid-June.

Imported early potatoes: prices are down because of the larger coupled offer and clash with the productions from the South (Egypt/Israel) and from the North (Spain) of the Mediterranean. The Egyptian potatoes are around 40 €/qt, and the Spanish ones (depending on markets and varieties) are between 30 and 70 €/qt.

Processing market

Fontane/Challenger: no quotation. Quotations for other uses (biogas, livestock feed…): 1.50-2.00 €/qt (1.50-2.00 €/q last week).

Organic potatoes: the trade of indigenous organic potatoes continues. The stocks in crates-fridges should make it possible to sell until June. But in March, we noted a decrease in sales by 3.5% compared to the previous year.

Producer prices returned trade: between 63 and 65 €/qt.

For organic potatoes, between 78 €/q for Egypt, and 80 €/q for Israel. The first organic potatoes from Italy and Spain have started arriving.

Great Britain

For more information:

FIWAP

www.fiwap.be