Physical European markets

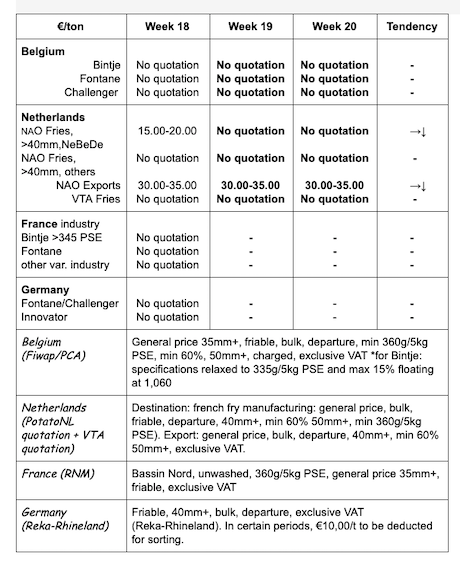

Price summary €/t (source: NEPG):

Belgium

Fiwap / PCA market message:

Processed potatoes: no quotation, as there is no free market. The working pace of the various Belgian units has slowed down slightly (30 to 50%) depending on the type of products (fresh fries, frozen fries, specialties, flakes, chips/croustilles…) and the type of markets (European supermarkets, fast-food, European and global export…). Removing contracts is the priority. The few “purchases” on the free market concern the extra tons on the contracted trucks, at prices between 1.00 and 1.50 €/q. The other transactions observed are related to animal feed or biogas, with prices between 0.50 and 1.50 €/q. The export of fresh potatoes to the East (inside and outside the EU, to Moldova and Ukraine), continues with higher volumes than in previous weeks. Prices are between 1.00 and 1.50 €/q. Preparers-packers for the domestic market are more or less working at normal speed and capacity.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl.VAT, direct delivery: Bintje, Fontane, Challenger: no quotation due to a lack of transaction for the industry.

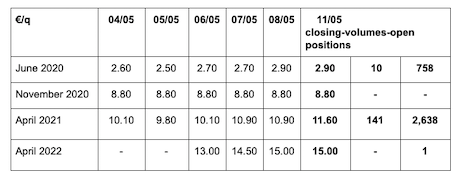

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm +:

Netherlands

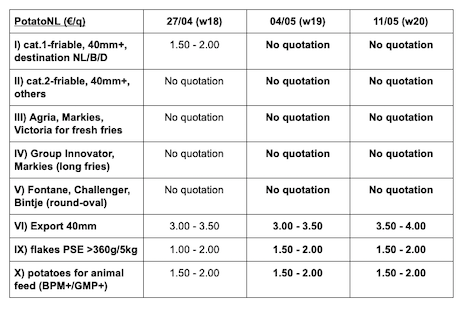

PotatoNL: also available on www.potatonl.com

The secondary market, for flakes, animal feed and biogas, is buying at prices between 1 and 3.00 €/q. In export, potatoes in bags and on pallets are sold between 8 and 12.00 €/qt, the latter price being for Africa. On the fresh market, producer prices are between 10 and 18.00 €/q, depending on the quality and variety. Melody between 12 and 16.00 €/q and firm flesh of the best quality “crates-fridges” up to 20.00 €/q.

France

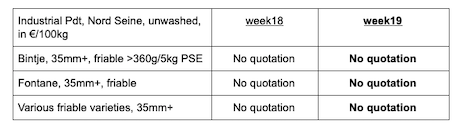

Industrial pdt, bulk, departure, excl.VAT, Nord Seine, €/qt, min-max (moy)(RNM)

RNM Weekly report - Week 19 (May 4th-7th, 2020)

“The industry market segment has been in status quo since the beginning of the lockdown. No activity on the free market. Only a few contract removals continue to be observed. As for processing, few chains are working, in order to supply supermarkets with frozen products and chips/croustilles. Stocks are weighing heavily on the market and the varieties originally intended for processing are now on the fresh market, which is now disturbed.

Other outputs also appear by default, such as food banks, even animal feed or methanization. The fresh market shows irregularities in the expressed demand. Obviously, activity is revived in local shops, markets are open again and the take-away sales set up by restaurants, in order to maintain a minimum of activity, feed a continued need. On the other hand, supermarket restocking is more uncertain. The holidays in May play a role in this market irregularity, depending on the anticipation from buyers. In export, the campaign is nearing its end. The market is qualified as very calm this week by the operators.

Shipments to Spain and Portugal are decreasing strongly, competing with the harvest of early potatoes, already started in Spain under better weather conditions. We observe some exports to Eastern countries (Hungary, Romania…) and even England. With the campaign ending in export, several operators are already focused on imports of early potatoes from Spain, while waiting for the French ones.”

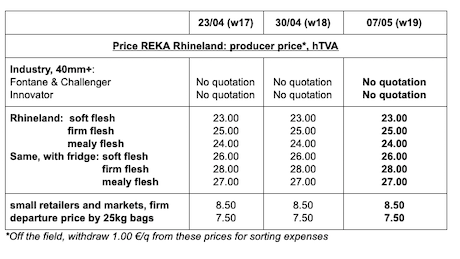

Germany

Fresh market, higher prices both in firm flesh at 24.25 €/q (compared to 24.17 €/q) and in soft and mealy flesh at 24.13 €/q (compared to 22.92 €/q). An increasing number of flaws are observed (silver scurf, lack of firmness...) in some fresh batches. Additionally, some supermarket chains also disturb the fresh market with promotional offers for “fries” at low prices, from batches initially intended for processing.

Native early potatoes: we observe, and it is historic, the first grubbing of native early potatoes at a producer in Lower Saxony, on May 1st, 2020! Extra-early variety, pre-germinated plants, cultivation under tarps...Producer prices vary between 80 and 120 €/qt (for early potatoes in 25 kg bags) and up to 150 €/q in 10 kg bags.

Processing market: the situation on the German market is less catastrophic than in the Benelux. In Lower Saxony, the 2019 yields were limited, and there were not a lot of free volumes left when the Coronavirus crisis started. Part of the “excess” was shipped to Poland and Scandinavia. Another part has already been used (and still will be!) by starch manufacturers (especially in Bavaria) or by bio-methanizers (in the various Länder). Finally, we observe an increased use for animal feed in general.

The free Markies went to chips/croustilles manufacturers, and part of the other industries were packed for supermarkets. In Rhineland, which mostly supplies factories in the Benelux, the situation is more complicated, although the outputs are more varied in France. The first sowings indicated stabilized surfaces, with fewer “fries” and more “fresh market” or “chips/croustilles”. Experts estimate that, unless we have a dry season, we could easily have enough potatoes.

Fontane/Challenger: no quotation. Quotations for other uses (biogas, animal feed…): 1.50-2.00 €/qt (1.50-2.00 €/q last week).

Organic potatoes: producer prices returned trade: between 63 and 65 €/qt.

In March (partly before and partly during the Covid-19 crisis), we observe, compared to March 2019, more purchases of organic potatoes. Fewer small packages but more larger packages, contrary to a few weeks ago. The 13% increase is marked mainly for natives (+27%!), the Dutch and Austrian productions being less popular among consumers. Overall, there is a 5% increase for the first trimester.

For more information:

FIWAP

www.fiwap.be