European physical markets

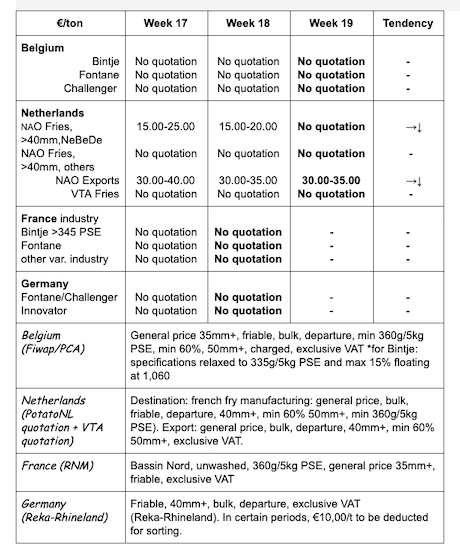

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Processed potatoes: No quotation, as there is no free market. The working pace of the various Belgian units has slowed down slightly (30 to 50-60%) depending on the type of products (fresh fries, frozen fries, specialties, flakes, chips/croustille) and the type of markets (European supermarkets, fast-food, European and global export).

Removing contracts is the priority. No purchase on the free market. The only transactions observed are related to animal feed or biogas, with prices between 0.50 and 1.50 €/q. The export of fresh potatoes to the East continues (in or outside the Union), but volumes are low because of the increased competition from German, Dutch and French exporters, which are closer geographically. Prices are around 2.00 €/q or slightly higher. Preparers-packers for the domestic market are working more or less at a normal rate and capacity.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery: Bintje, Fontane, Challenger: no quotations due to a lack of transactions for the industry.

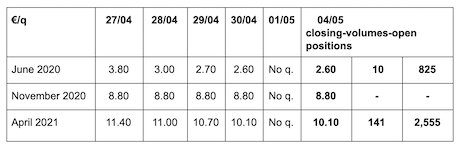

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

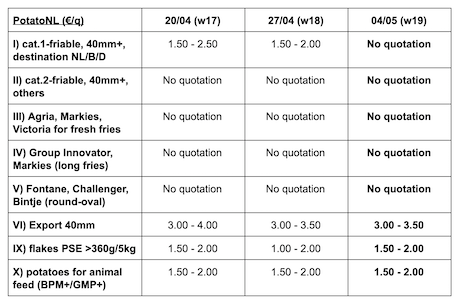

Netherlands

The Dutch LNV (Ministerie van Landbouw, Natuur en Voedselkwaliteit) has arranged a compensation of 5.00 €/q for the potatoes intended for the fry industry that will be redirected towards animal feed, food for pets, food banks, the production of bioethanol, alcohol and starch. The LNV minister estimates that this will concern one million tons of free potatoes, with a maximum of 100,000 € per farm (max. 2,000 t). These 5.00 €/q correspond to 40% of the average value between September 2019 and February 2020.

PotatoNL: also available on www.potatonl.com

France

Planting is almost complete, having progressed to more than 90% on April 22nd (estimation by UNPT). No demand from factories on the free market. The industrial activity revolves mainly around chips and flakes.

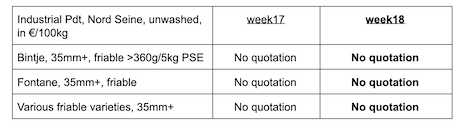

Industrial pdt, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

Germany

The last week of April is often the last week when “natives” still dominate...Then, imports (southeast of the Mediterranean), and introductions (north of the Mediterranean) progressively gain importance. In the southwest (Bade - Wurtemberg), we observe quite a few French introductions, like every year.

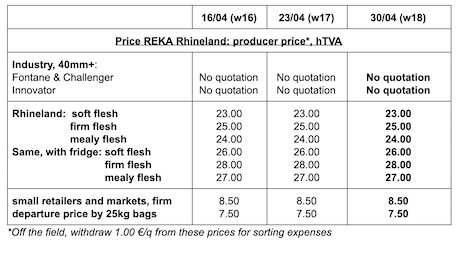

Fresh market: unchanged prices for firm flesh at 24.17 €/q (compared to 24.17 €/q), and firmer prices for soft and mealy flesh at 22.92 €/q (compared to 22.83 €/q). Better prices (up to 3.00 €/q more) for the “crates-fridges” origins. Processing market: Fontane/Challenger: no quotation. Innovator: no quotation. Quotations for other uses (biogas, animal feed…): 1.50 - 2.00 €/qt (1.50 - 2.00 €/qt last week).

Organic potatoes: producer prices returned trade: between 63 and 65 €/qt.

In January, the volume of organic potatoes sold in supermarkets decreased by 3% compared to January 2019, but the total value of the purchases increased as a result of the higher sales of smaller packages (between 1.00 and 1.5 or 2.00 kg). In February, sales increased by 3% compared to 12 months earlier. The German production is systematically completed by imports from Austria and the Netherlands. The production of organic potatoes in the Netherlands is indeed increasing for shipments to Germany in particular.

Producer prices - 63 to 65 €/100kg - were confirmed to us personally these past few days. These are table variety batches from storage in crates-fridges. Organic potatoes have gained in popularity since the beginning of the coronavirus crisis.

For more information:

FIWAP

www.fiwap.be