The fundamentally different consumer engagement with produce amid COVID19 continued to show a three-way split of the produce dollar between fresh, frozen and shelf-stable during the week of April 5. 210 Analytics, IRI and PMA partnered to understand the effect for produce in dollars and volume throughout the pandemic.

- Fresh produce increased 14.2% over the comparable week in 2019.

- Frozen, +47.4%

- Shelf-stable, +48.1%

Source: IRI, Total US, MULO, week ending April 5, 2020

Fresh Produce

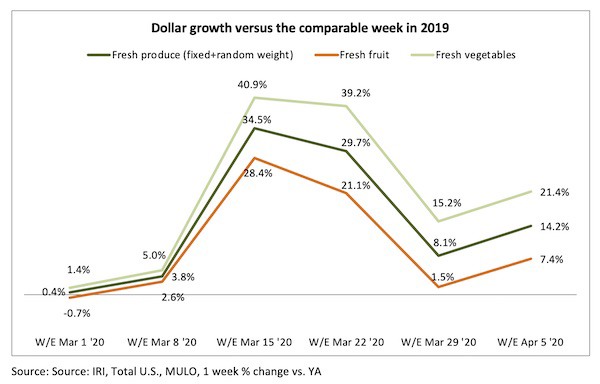

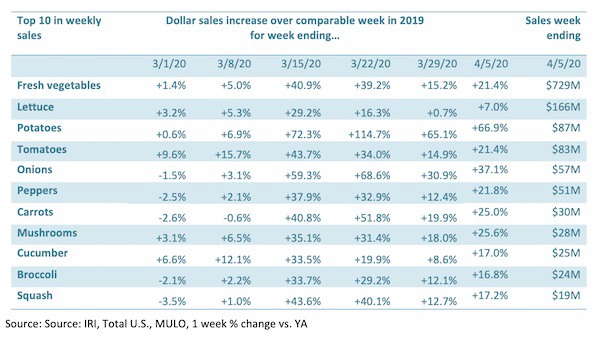

The March dollar growth trend line for fresh fruit shows very strong results for the week endings March 15 and March 22. The subsequent two weeks continued to have elevated sales, particularly for fresh vegetables. Compared with the same week in 2019, fresh produce generated an additional $170 million in sales, of which $129 million was generated by vegetables.

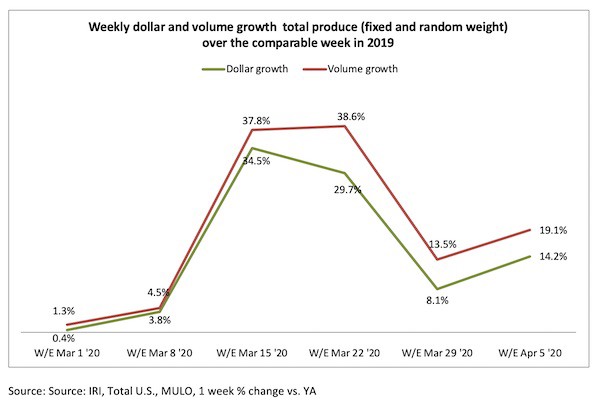

At the onset of coronavirus in the U.S., dollar and volume sales were close together for total produce, at +0.4% for dollars and +1.3% in volume. Starting with the week ending March 22, volume sales far exceeded dollar sales, which would indicate deflation setting in at retail for some areas. For the week of April 5, volume increases exceeded dollars by nearly five percentage points.

The gap was widest for vegetables, particularly the last two weeks. For the week ending April 5, volume sales gains for vegetables were more than 10 points higher than dollar growth.

Potatoes sold $35 million more than in the comparable week in 2019, or +66.9%. Others that gained big in dollars were berries (+$17 million), onions and tomatoes (+$15 million, each) and oranges (+$14 million). However big differences between dollars and volume were observed for some fruits and vegetables as well. “Avocados, onions and carrots are three big ones that jump out at me,” said Watson. “Others outside the top 10 in absolute dollar growth were limes (16 percentage point volume/dollar gap), asparagus (13 points), Brussels sprouts (14 points), cabbage (12 points) and celery (30 points). Celery has been a top seller amid the juicing trend, but for the week of April 5, dollars are down 3% whereas volume sales were up 27%.”

Fresh Fruit

Fresh fruit sales growth rebounded to an increase of 7.4%. Big contributors in dollars avocados (+$9 million or +19.6%), bananas (+$6.5 million or +10.4%) and lemons (+$6 million or 42.2%). Berries, apples and bananas remained the largest categories. “

Fresh vegetables

On the fresh vegetable side, potatoes continued to have extremely impressive growth, up 66.9%. Other impressive growth categories were onions, carrots and mushrooms.

Fresh Versus Frozen and Shelf-Stable

Consumers continued to split their produce dollar three ways during the week of April 5. Frozen and canned vegetables had ongoing strong growth during the first week of April and have been leading sales growth since the onset of coronavirus during the early weeks of March.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com