European physical markets

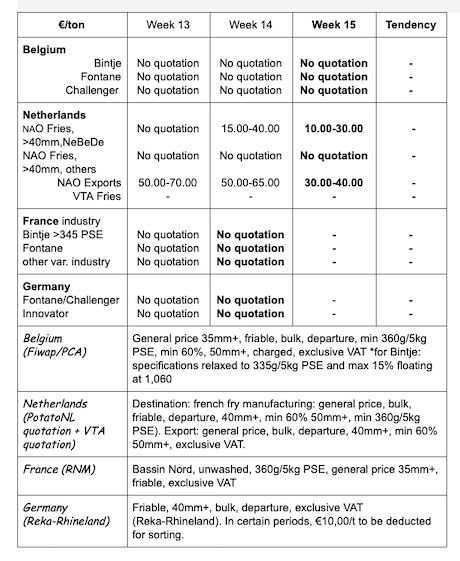

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Industrial potatoes: the industrial activity continues to decrease. As a result, there is absolutely no free demand. The priority still goes to contracts which are picked up late for some buyers, while others are on time. Packing remains very active, for the fresh domestic market as well as for export (small volumes to Romania, Poland, Czech Republic - with some growing competition from Germany - and to England).

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl.VAT, direct delivery: Bintje, Fontane, Challenger: no quotation due to the lack of transactions from manufacturers.

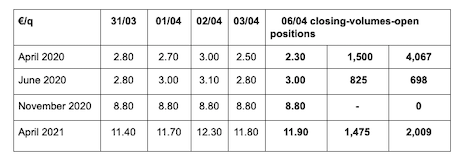

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

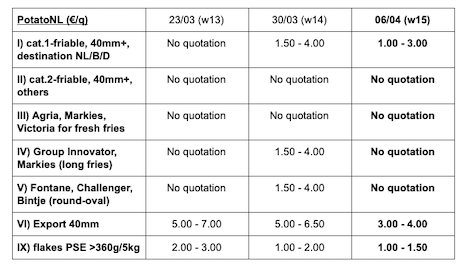

Netherlands

Factories are running at half capacity for frozen products, while most of the lines for fresh fries are practically stopped. With the lack of free market, potatoes without contract go to flakes, starch or cattle at prices around 1.00 to 1.50 €/q. Several contracted excess charges are quoted between 1.00 and 3.00 €/q. The fresh domestic market is calmer again and sees a decrease as well. Prices nevertheless remain between 7.00 and 12.00 €/q for specific soft flesh varieties stored in bulk, and 14.00-15.00 €/q for the ones stored in refrigerated crates. The firm flesh varieties benefit from higher prices. Export also dropped and new impulse purchases are expected, namely from Eastern Europe. Prices between 11.00 and 14.00 €/q (sorted, packed in bags) were reported last week for the basic quality.

PotatoNL: also available on www.potatonl.com

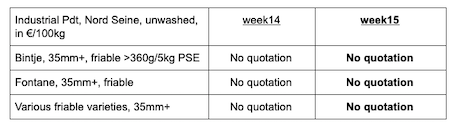

France

For the industry, the demand from factories is nonexistent. We must continue to follow the evolution of the Covid-19 crisis and its direct/indirect effects on the global economy and on the trade of finished products. In France, 1 single line of fries is still running, but lines could start again to make flakes. The main French manufacturer has cancelled 250 ha of early potatoes in the Landes and converted early varieties to later ones in other regions. It also plans to extend the current campaign until the end of July. Export to Eastern countries continues (in reduced volumes for Poland) on a basis of 8.00 to 12.00 €/q sorted in big-bags, 14.00 to 15.00 €/q in 10 kg bags. The closure of Fish&Chips shops in Great-Britain however interrupted shipments to England. The fresh domestic markets tend to slow down, from 15.00 and 22.00 €/q for soft flesh varieties, and 30.00 to 35.00 €/q for firm flesh with good washability.

Industrial pdt, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

Germany

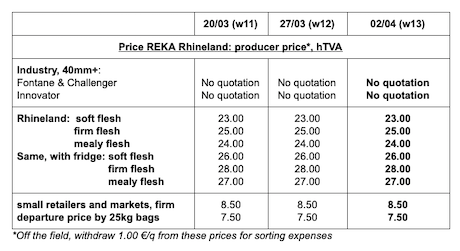

Fresh market, prices are slightly down both for firm flesh at 23.88 €/q (compared to 24.00 €/q), and for soft and mealy flesh at 22.25 €/q (compared to 22.67 €/q). Better prices (up to 3.00 €/q more for the “refrigerated crates” origins. Some varieties usually used by the industry are found on supermarket shelves and in export. Processing market: Fontane/Challenger: no quotation (2 weeks ago: 10.00 €/q). Innovator: no quotation (last week, 11.00 €/q). Quotations for other uses (biogas, livestock feed…): 1.50-2.00 €/qt. Given the evolution of the pandemic and the market, it seems more and more obvious that the industry will not need all the early potatoes (or later varieties, as a matter of fact). That is why, in a common call, Reka Rhineland, trade and manufacturers have called for producers to reduce their surfaces, whenever possible. These reductions must be done after consulting with the different players of the chain.

Organic potatoes: producer prices returned trade: between 63 and 65 €/qt.

Great Britain

The serious disruptions from the closure of fast-food restaurants and collective catering, as well as Fish&Chips shops greatly impacted the sector last week. Thousands of tons of stocks are now left with practically no market for now. Factories are running to fill up the available fridges. Given the uncertainty for next week, some producers are trying to cancel their orders for plants and get off their contracts to rent plots in order to reduce their surfaces. Manufacturers support the initiative by cutting their early potato areas. Regarding the consumers, fish&chips home-delivery services are being put in place. On the fresh markets, a sales peak was reached last week but the pace is now returning to “normal”. Stocks of Markies intended for the industry are proposed to preparers. A little export is reported towards the Canaries.

For more information:

FIWAP

www.fiwap.be