The situation in mainland Europe closely echoes current trends in the UK. Fresh retail sales have been reported to have increased significantly and potatoes are moving from countries such as France and Germany to help meet demand in eastern Europe. Meanwhile the widespread closure of restaurants and other food service outlets has meant that demand for processed potato products has fallen significantly.

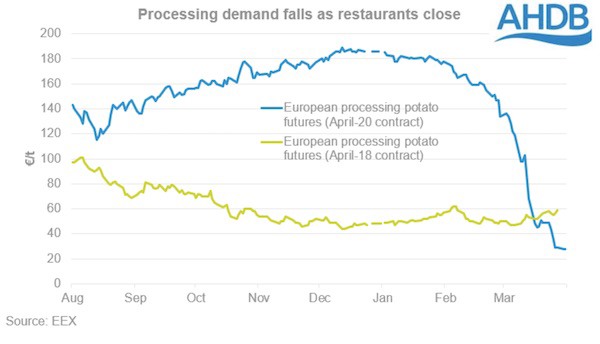

This has been reflected in the April 2020 potato futures contract with prices falling over €100/t since the start of March to close at €28/t at the end of the month. This has even fallen below the equivalent futures prices equivalent contract in the oversupply year of 2017/18. Physical movement is now limited to contracts with free-buy sales almost non-existent.

The loss of such a large end market for processed products has led to many factories shutting down lines and scaling down production. This is particularly the case for lines producing fresh chips and other products which are harder to store for any length of time. Production is continuing for frozen products, for the time being, and retail sales of frozen products are expected to increase due to the public stocking up on non-perishable foodstuffs.

However, retail sales only make up a small proportion of total sales and even with a potential increase it will not offset loses. Using the Netherlands as an example, according to a recent press release by the Dutch Processors Association (Vavi) approximately 80% of its members output is sold into food service. Over the next four months (April-July) Dutch processors produce on average 581Kt of pre-cooked product. This means that if factories were running at full capacity there could hypothetically be up to 486Kt of product that would be left without an end market.

For the week ending in April 3rd, 2020, free buy trade quietened for all sectors. Retail demand lessened slightly that week, with the requirement for free buy supplies minimal. Anecdotally it is said that both supermarkets and packers may have overbought last week and are still working through supplies this week.

Trade in the chipping market is at almost a complete standstill as most chip shops remain closed across the UK. Another week of good weather nationwide has meant that for many, planting of potatoes has continued at pace. Soil conditions are currently “ideal” in most parts of the country, although night time temperatures are still low.

The uncertainty of how long certain markets may be unavailable is hanging over some growers who are trying to make planting decisions.

To read the full potato weekly report for the week ending in April 3rd, click here.

To see the price tables for the week ending in April 3rd, click here.

To read the full release about the effects of coronavirus on European potato processing, click here.

For more information:

For more information:

Aiden Wright

AHDB

Tel: +44 024 7647 8894

Email: Aidan.Wright@ahdb.org.uk

www.ahdb.org.uk