For the European potato sector, the direct consequences of the Covid-19 health crisis are many. Several processing units are shut down (totally or partially) in Western Europe, particularly those who supply fast-food restaurants and fresh fry outlets. It is especially the case in France and the Netherlands.

The processing activity in Belgium is maintaining a certain pace because our factories are more oriented towards the (European) distribution of frozen products, but we fear a gradual slowdown in the coming weeks because fridges are getting full. The flake lines continue to rotate. Maritime transportation is getting back on track towards Asia, but it is more the demand for processed products that is lacking.

Several types of measures are being taken by buyers to compensate for the lack of demand for finished products: searching for additional freezers, contracted volumes delayed until the months of June to August, searching for alternative outlets (livestock, for example), reduction or removal of areas planned for early potatoes in the Landes, and a desire to reduce areas and/or contract volumes of early potatoes (even conservation varieties) in Belgium. Because no one knows when (and at which pace) the global markets will start again after the crisis. The objective remains to honor the current contracts, but this is more or less realistic depending on the segments (fresh fries vs. frozen fries) and on the varieties.

Planting in 2020

Throughout the European northwest, calls for a reduction in the 2020 areas multiply. Note that it is exceptional and unprecedented that even the processing industry is calling for these decreases. Some buyers of signed contracts are opting out, with compensation. The very first planting (attempts) took place in Liège Hesbaye

European physical markets

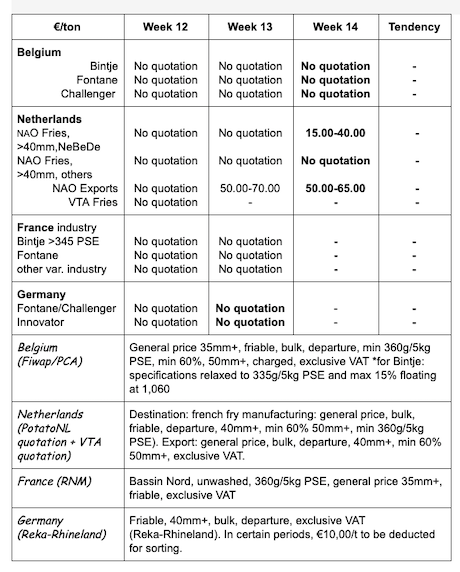

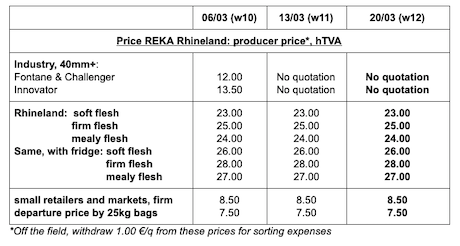

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Processed potatoes: there is almost no free trade at the moment, as the markets are blocked by the total absence of industrial demand. However, we observe prices from 1.50 to 2.50 €/q, mostly for the surcharges in various varieties.

Export continues correctly to Romania and Poland in particular. The domestic fresh market also maintains a good activity. Prices for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl.VAT, direct delivery:

Bintje, Fontane, Challenger: no quotation due to lack of transactions for the industry.

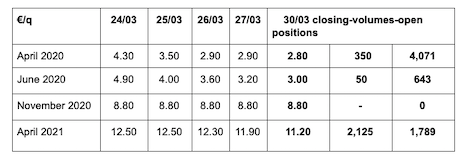

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

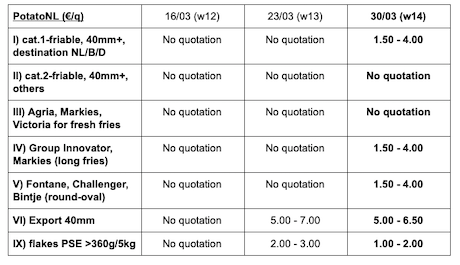

Netherlands

The sector is going through an unprecedented situation no operator has any experience with. The processing activity was reduced by half and there is no demand at all, given the great uncertainties about the end of the season.

The path towards the starch industry (with or without public aid) remains open to dispose of a few volumes. Preparers for the domestic fresh market have been through the craziest weeks when consumers wanted to stock up. The demand is now calmer but the activity remains higher than “normal”. Prices were sustained last week (9.00 to 13.00 €/q in bulk for the basic quality; 14.00 to 17.00 €/q for the superior quality in crates), then the trend weakened under the influence of the processing market. Exporters also worked very well but since the middle of last week, the pressure has eased.

PotatoNL: also available on www.potatonl.com

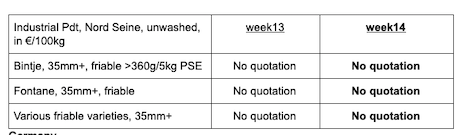

France

For the industry there is no demand from the factories. We must continue to follow the evolution of the Covid-19 crisis and its direct and/or indirect effects on the global economy and on the trade of finished products.

On the fresh markets, trade remains regular, without reaching the volumes of the previous week. The activity for the washed varieties remains constant. In export, the more active presence of some Eastern destinations (Poland, Romania) keep the brushed potato activity more sustained. Germany and England are also buying. Prices are very heterogeneous depending on the segments, but they are globally up: between 10.00 and 20.00 €/q for basic varieties depending on caliber and washability, from 20.00 and 30,00 €/q for firm flesh varieties.

Industrial Pdt, bulk, departure, excl.VAT, Nord Seine, €/qt, min – max (moy)(RNM):

Germany

The demand on the fresh market remains very good and, as expected, the largest bags and packagings have reappeared in supermarkets and even more at grocers and in local shops. In some cases, the choice has been reduced, in order to favor the treated volumes.

This good demand has not - yet? - allowed for prices to go up. Besides, some double-end varieties initially intended for the industry are ending up on the fresh market. The asparagus season is starting now, along with the early imported potatoes. But the shipments could be slightly disturbed and benefit the local productions. The demand for consumption potatoes should increase for Easter. Planting of the early potatoes continued at full speed all last week.

Fresh market, prices slightly up for firm flesh at 24.00 €/q (compared to 23.83 €/q) and stable for soft and mealy flesh at 22.67 €/q (compared to 22.67 €/q). Better prices (up to 3.00 €/q more for the “crates-fridges” origins). The sales in supermarkets are still very good, and the activity of the preparers-packers is dynamic! Processing market: Fontane/Challenger: no quotation (10.00 €/q 2 weeks ago). Innovator: no quotation (11.00 €/q last week).

Organic potatoes: producer prices returned trade: between 63 and 65 €/qt.

Great Britain

With the current closure of restaurants and fast-foods, the processing industry has no sales guarantee for the coming year. It seems that producers were informed by the buyers that there would be no need to purchase free volumes for the 2019 harvest. The harvest which is now being harvested and under contract will be received, but with the values of November.

In some cases, plants have been delivered for the coming season, but contracts are suspended “until the situation clears up”. Some Markies which were intended for the fries and fish&chips shops now go to the packers. For chips, the demand is described as “massive”.

On the fresh markets, the activity is down again after the rush of the past 2 weeks. We are expecting household consumption to stabilize at around 20% more than normal.

For more information:

FIWAP

www.fiwap.be