In the financial year 2019, revenues at BayWa AG, Munich, Germany, increased to €17.1 billion (2018: €16.6 billion), thereby exceeding the mark of €17 billion for the first time. As planned, the company also generated a significant improvement in earnings, with EBIT rising to €188.4 million (2018: €172.4 million). BayWa therefore achieved its targets for the year and plans to increase the dividend by 5 cents to 95 cents per share for 2019.

“The positive development in the Energy Segment made the largest contribution to BayWa’s good overall development in the past year. Global Produce – our fruit business – was also successful, and Agricultural Equipment developed significantly better than expected even following the record year seen in 2018. Building Materials also put on a show of strength,” said Klaus Josef Lutz, Chief Executive Officer of BayWa AG.

All told, agricultural trade activities fell short of expectations, he added. International trade disputes negatively impacted earnings, as did the dry conditions in many regions of Germany over the summer. “In particular, the renewed increase in earnings in the renewable energy and conventional energy business more than compensated for the effects resulting from the difficult market conditions in agriculture,” Lutz explained. He also pointed out that the burdens related to the antitrust proceedings, which were concluded at the end of the year, and the associated costs had been included in the annual result without jeopardising the efforts to achieve the targets for 2019.

At present, it is not possible to make a serious assessment of the results for 2020 due to the incalculable effects of the Covid-19 crisis. “Thanks to our diversified business model, however, we believe that we are well positioned despite the difficult situation, plus we are absolutely determined to deliver on our mission of helping people to meet their basic needs,” Klaus Josef Lutz said.

Agriculture: development varied in the business units

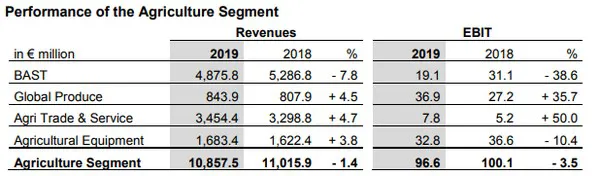

The Agriculture Segment finished the financial year 2019 with a slight decline in revenues and a decline in EBIT. Revenues stood at €10.9 billion (2018: €11.0 billion), while EBIT came in at €96.6 million (2018: €100.1 million).

National and international agricultural trade activities were burdened by the effects of the trade disputes between the US and China and by the widespread dry summer weather in Germany. As a result, international trade volume involving grain and oilseed meal fell by 1.6 million tonnes to 25 million tonnes in the BayWa Agri Supply & Trade (BAST) business unit, due primarily to the suspension of bread grain business with Iran. Soya bean trading was significantly impacted by the trade dispute between the US and China.

Following a good, early start to the season, the domestic agricultural input business in the Agri Trade & Service business unit was, in some cases, significantly impacted by the ensuing dry conditions in many German regions. With regard to fertilizers, business was affected by price increases compared to the previous year and the impact of the German Fertiliser Application Ordinance.

Despite a good first quarter, trade in agricultural products saw a series of challenging developments in the second half of the year. Grain prices fell consistently as a result of positive harvest expectations and a good supply situation, thereby reducing the propensity of farmers to sell their grain and resulting in lower harvest inventories and margins with a corresponding impact on earnings.

By contrast, the national and international fruit business developed positively in the past year. The Global Produce business unit increased its marketing volume by a total of 8%, bringing it up to 380,550 tonnes. Processing and packaging services allowed the domestic fruit business to benefit in the first half of the year from the higher inventories as a result of the record harvest in the previous year, albeit at a relatively low price level.

The new harvest brought better fruit quality and higher prices. The New Zealand Group company T&G Global Limited (T&G Global), which was particularly successful in the Asia-Pacific market, recorded an increase in vegetable fruits and tropical fruit. Development differed in the business involving apples, as New Zealand’s harvests were negatively impacted by late frosts, leading to smaller fruit sizes and lower quality. The sale of T&G Global’s office building generated special income.

As forecast, the Agricultural Equipment business unit failed to full match the record set in 2018 but outperformed expectations by a wide margin. This development was primarily attributable to the strong new machinery sales in 2018, when customers ordered their machinery ahead of schedule on account of the mild weather at the end of the year. Both used machinery sales involving vehicle trade-ins and the service business recorded a significant increase. The same goes for sales of machinery and accessories for liquid fertilizer technology and mechanical weed control.

For the full financial report, please click here.

For more information:

Marion Danneboom

BayWa

Tel.: +49 89 9222-3680

Email: marion.danneboom@baywa.de

www.baywa.com/en