In all NEPG countries (EU-04 + UK), we observe an increase in the demand for fresh potatoes in recent days. Some preparers-packers worked all weekends to supply the demand (caused by “panic buying”, as well as the logical and obvious increase of household consumption) and to keep the shelves stocked. We also report better retail sales of processed products (crisps/croustilles, frozen fries, prepared potato dishes). Restaurants and canteens may be closed, but consumers are buying frozen products and prepared dishes to eat at home.

For the industry, things are much less rosy. Factories are closed or run at reduced capacity, delayed contracts, no purchases on the free market. It will take days and weeks to see how the situation will evolve in terms of shipment (within the 27) and export (overseas) of processed products.

European physical markets

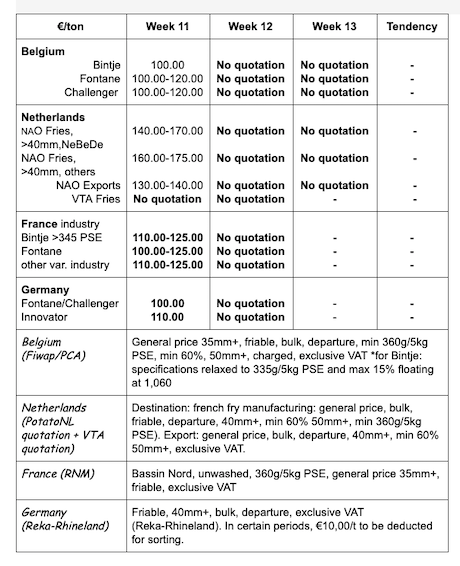

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Industrial potatoes: no industrial buyer at all on the free market. Export trade continues, with small volumes towards Romania, and mostly contracted volumes. The fresh market is still going well, both for retailers and for short-circuit sales or sales at the farm. Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl.VAT, direct delivery: Bintje, Fontane, Challenger: no quotation due to a lack of transaction for the industry.

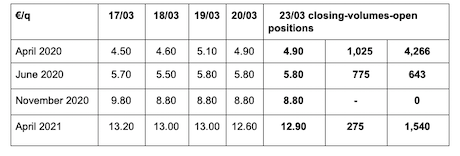

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm+:

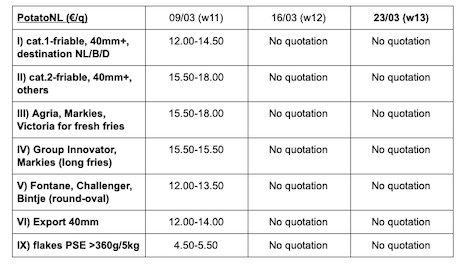

Netherlands

The markets are completely disrupted with, as a consequence, no quotation for the Netherlands, Belgium or France. For friable potatoes, there is a general decline given the slower activity of the processing plants. Almost no demand for fresh fries with the closure of restaurants. The production of frozen goods continues but only based on contracts. The free market is thus taken hostage by the circumstances, and a new balance will have to be found in the coming weeks. For those wishing to get rid of some potatoes, the starch industry could be a way out, but under what price conditions?

PotatoNL: also available on www.potatonl.com

France

Industrial pdt, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

For the industry, the free market was (almost) nonexistent, hence the lack of quotation. There are many questions regarding the impact of Covid-19 in relation with the disruptions in logistics (sick staff, slower international transport, slower port and maritime flows…). The domestic fresh market, on the other hand, is dynamic, with higher prices to supply the demand boosted by household consumption and supplying retailers. The demand is also high in export, towards Eastern countries, Spain and Portugal, despite the growing uncertainties regarding logistics.

Good industrial activity in February: according to GIPT, French factories worked 835,000 tons from August 2019 until the end of February 2020, which is 0.5% more than in 2018/19 at the same time. Approximately 77% of this volume was contracted, and 15% imported.

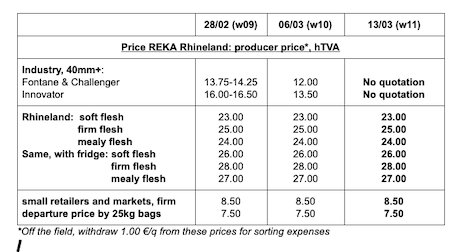

Germany

With some delay, the planting of early potatoes has made a good start, at least in all the light and/or draining soils. Fresh market, stable and unchanged prices for firm flesh at 23.83 €/q (compared to 23.83 €/q) and for soft and mealy flesh at 22.67 €/q (compared to 22.67 €/q). Better prices (up to 3.00 €/q more, for the “crates-fridges” origins). Supermarket sales are good, and preparers-packers have been working a lot! Processing market: Fontane/Challenger: no quotation (last week: 10.00 €/q). Innovator at 11.00 €/q (11.00 €/q).

Organic potatoes: producer prices returned trade: between 63 and 65 €/qt.

For more information:

FIWAP

www.fiwap.be