European physical markets

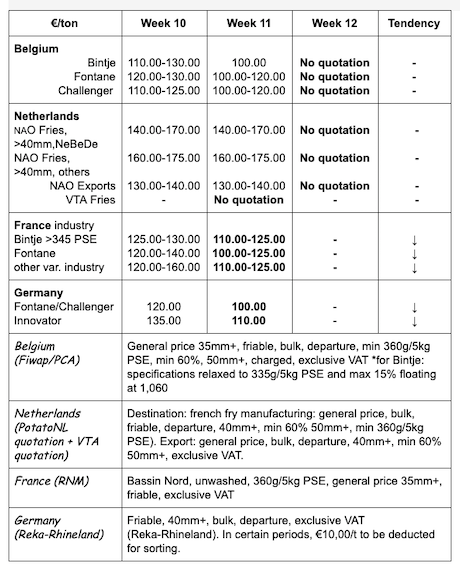

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Processing potatoes: no quotation this week due to an almost complete lack of industrial buyers (given the great uncertainties on the short-term trade of finished products). However, packaging is going well, for the domestic fresh market as well as for export (mainly Romania, England and Poland). The most recent transactions (until last Monday) were reported between 7.50 and 10.00 €/q for various varieties.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery:

Bintje, Fontane, Challenger: no quotation due to a lack of transactions for the industry.

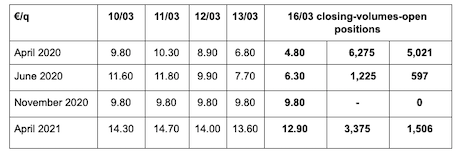

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for processing, 40 mm+, min 60% 50 mm +:

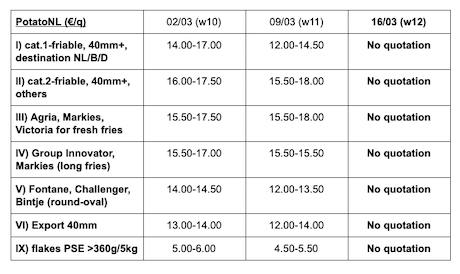

Netherlands

The potato markets are not entirely immune to the consequences of the Covid-19 pandemic. Industrials are absent from the free market. Fear of transport and production restrictions are making the industrial markets very nervous. Only the fresh domestic trade is still normal, with some (very) good activity and dynamic sales for retail: consumers are stocking up! Exporters are also doing well, especially to other MS, even if some destinations are waiting to buy. Long-distant export, on the other hand, is not very active.

No Potato NL quotation this week because the Committee considered that the observed prices were too disparate, between the fresh market trade which is firm, and the industrial trade in free fall. The Committee therefore considered that no price range could reasonably represent the current situation.

PotatoNL: also available on www.potatonl.com

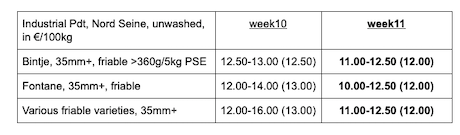

France

Industrial production, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

For the industry, quotations were generally down last week, with few or no industrial buyers due to the uncertainties on the impact of Covid-19. The fresh market, however, is active for the washed and packaged, with a sustained demand as a result of the greater household consumption. Prices were down nonetheless, also for export (Romania, Portugal, Spain), with all the uncertainties about the logistics towards the Italian market.

Germany

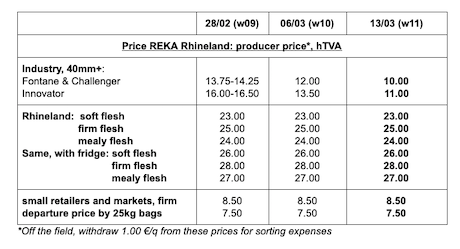

Fresh market, stable and unchanged prices for firm flesh at 23.83 €/q (compared to 23.83 €/q) and for soft and mealy flesh at 22.67 €/q (compared to 22.67 €/q). Supermarket sales are good! Processing market: quotations are down for Fontane/Challenger at 10.00 €/q (12.00 €/q) and Innovator at 11.00 €/q (13.00 €/q).

Organic potatoes: producer prices returned trade: between 63 and 65 €/qt. The organic market has been looking better in recent weeks: household consumption has increased (because they eat out less) as well as retail consumption. Smaller bags (from 2.0 and 1.5 kg to 1.0 kg) have increased sales. Large retailers plan to work with natives until May (with some imports from the Netherlands and Austria to complete the demand). Organic potatoes from Spanish will allow for a transition between the older and the newer natives.

In 2019, according to a survey by GfK (Gesellschaft für Konsumforschung, Society for the Study of Consumption), the Germans have consumed 25% more organic potatoes and potato products (especially fries and croquettes) than in 2018.

For more information:

FIWAP

www.fiwap.be