AgroFresh Solutions, Inc. announced its financial results for the fourth quarter and full year ended December 31, 2019.

AgroFresh Solutions, Inc. announced its financial results for the fourth quarter and full year ended December 31, 2019.

Jordi Ferre, Chief Executive Officer, commented “We are pleased with this year’s financial performance in spite of the adverse weather events that affected our business in European and eastern United States markets. AgroFresh is a resilient business that is supported by our global geographic reach, extensive registration portfolio and unique service-oriented platform. We are experiencing positive trends in our core SmartFresh business in key markets that were previously disrupted by competitive entrants, which speaks to the value of AgroFresh's brand reputation and unmatched service. We continue to leverage our global reach to diversify sales of products such as Harvista into new crops and geographies, and grow existing platforms, such as Tecnidex. Innovation remains an important element of our culture and we are encouraged by the planned future introduction of some novel technologies that we believe will support our long-term diversification efforts.

“Our continuous cost optimization efforts translated into a 10% reduction in selling, general and administrative expense for full year 2019. The efficiencies we’ve created are driving improved EBITDA and we are pleased to deliver 160 basis points of adjusted EBITDA margin expansion for full year 2019, despite facing weather-related obstacles and unfavorable currency trends which tempered our top-line results. Looking to 2020, we will look to enhance EBITDA through further expense reductions and to relaunch some of the diversification initiatives such as RipeLock, where we redefined the overall strategy during 2019.”

Financial Highlights for the Fourth Quarter and Full Year of 2019

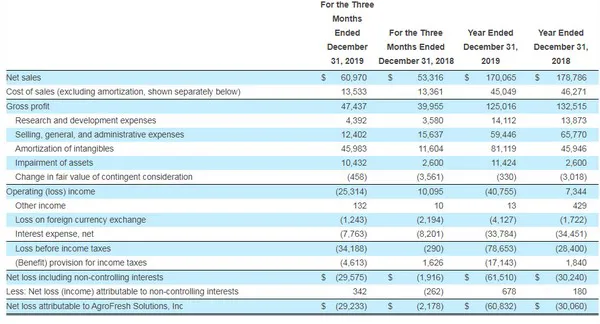

Net sales for the fourth quarter of 2019 increased 14.4% to $61.0 million, as compared to $53.3 million in the fourth quarter of 2018. Excluding the impact of foreign currency exchange, which reduced revenue by $1.0 million compared to the fourth quarter of 2018, revenue increased 16.3%, driven by a late apple harvest in North America and Europe compared to 2018, which shifted sales into the fourth quarter.

Net sales for the full year 2019 decreased 4.9% to $170.1 million versus $178.8 million in the prior year. The impact of the change in foreign currency exchange rates compared to 2018 reduced revenue by $3.3 million; excluding this impact, revenue decreased approximately 3.0%. The decrease in net sales was primarily due to weather disruptions in North America and Europe. Additionally, Tecnidex sales were $19.8 million, a decrease of 4.7%, or 0.1% on a constant currency basis versus the prior year period. Offsetting these decreases was growth in SmartFresh in Latin America, growth of Harvista in North America and Latin America and new revenue associated with FreshCloud.

In the fourth quarter of 2019, gross profit increased 18.7% to $47.4 million compared to $40.0 million in the prior year period, and gross margin increased 290 basis points to 77.8%. The higher gross margin was primarily a function of the increase in sales related to the timing of the apple harvest across the northern hemisphere.

For the full year 2019, gross profit decreased 5.7% to $125.0 million compared to the full year 2018. Gross margin was relatively stable at 73.5%.

Research and development costs were $4.4 million in the fourth quarter of 2019, up $0.8 million versus the prior year period due to timing. For the full year 2019 research and development costs were $14.1 million compared to $13.9 million in the prior year.

Selling, general and administrative expenses decreased 20.7% to $12.4 million in the fourth quarter of 2019, as compared to $15.6 million in the prior year period. Included in selling, general and administrative expenses were $2.5 million in the fourth quarter and $2.3 million in the prior year quarter of costs associated with non-recurring items that included M&A, litigation and severance. Excluding these items, selling general and administrative expenses decreased 25.6% in the fourth quarter versus the prior year period, which reflects the Company's ongoing cost optimization initiatives.

For the full year, selling, general and administrative expenses decreased 9.6% to $59.4 million, and decreased by 10.7% versus the prior year when excluding non-recurring items such as M&A, litigation and severance in both periods.

Fourth quarter 2019 net loss was $29.6 million, compared to net loss of $1.9 million in the prior year period. For the full year 2019, net loss was $61.5 million, compared to net loss of $30.2 million in 2018. The net loss in the fourth quarter and the full year 2019 was impacted by $34.0 million of accelerated amortization expense for RipeLock intangibles.

Adjusted EBITDA increased $10.2 million to $34.6 million in the fourth quarter of 2019 as compared to $24.4 million in the prior year period. For the full year, adjusted EBITDA decreased to $66.4 million compared to $66.9 million in the prior year. Adjusted EBITDA margin for the full year improved 160 basis points to 39.0%.

As of December 31, 2019, cash and cash equivalents were $29.3 million.

For the full financial report, please click here.