European physical markets

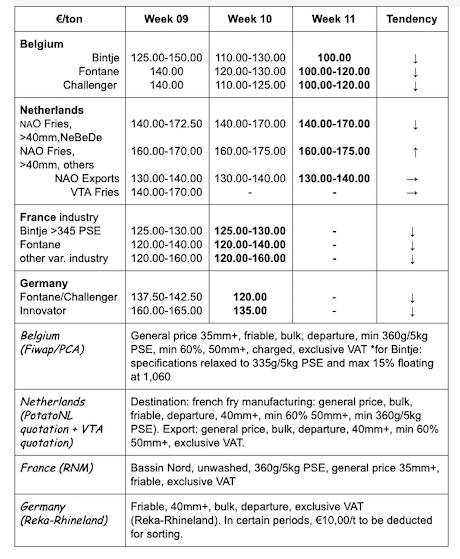

Price summary (source: NEPG):

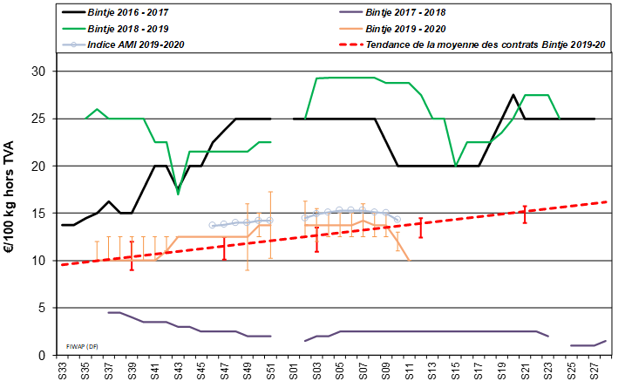

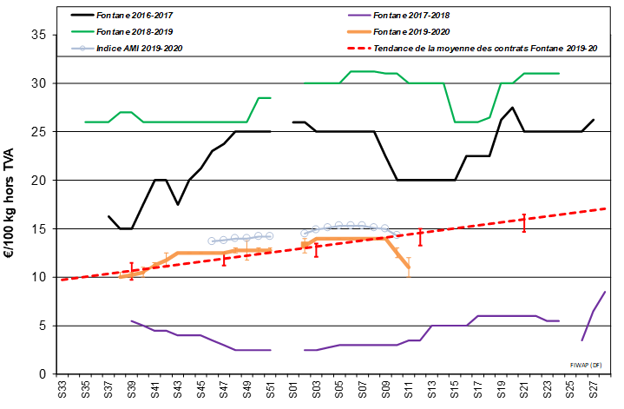

Belgium

Fiwap/PCA market message:

Industrial potatoes:

Markets are down, very few transactions observed. Industrial buyers are scarce. Only a few transactions are reported from intermediary trade. Export is limited to England.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl.VAT, direct delivery:

Bintje: around 10.00 €/q, slightly sustained.

Fontane, Challenger: 10.00-12.00 €/q, slightly sustained, depending on the destination (industry or export).

Bintje plant: no quotations, due to lack of transactions and great variation in prices. Dutch plant, class A, returned March 2020, by 10 tons, in big-bags exclVAT:

Caliber 28-35 mm: /€/q

Caliber 35–45 mm: /€/q

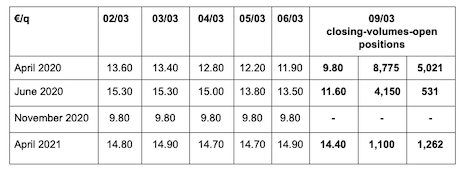

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for conversion, 40 mm+, min 60% 50 mm+:

Netherlands

Barely sustained trend last week due to uncertainties linked to Covid-19. The negative influence on the global economy is real and visible, with the decline of all stock exchanges and the slowdown of freight transport. For the potato, the impact is not clear yet. Industrials are monitoring the availability and costs of refrigerated containers, but the factories seem to be running normally for now. The rare free transactions are between 13 and 14 €/q for Fontane/Challenger, and up to 15.50 €/q for Innovator. The export rhythm for fresh potatoes is slower, with a price range going from 14 to 20 €/q depending on variety/quality/packaging.

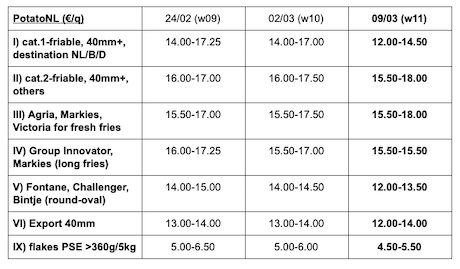

PotatoNL: also available on www.potatonl.com

France

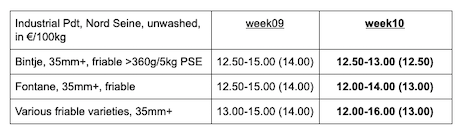

Industrial pdt, bulk, departure, exclVAT, Nord Seine,€/qt, min–max (moy)(RNM):

For the industry, prices are down on a market under pressure. Almost no buyers and prices are weaker, although Innovator continues to benefit from a little “advantage”. Transactions last week remained between 13.00 and 13.50 €/q for basic varieties, and up to 15.00 €/q for Innovator, with (very) few transactions. On the fresh domestic market, the situation is very disparate: a lot of activity for the washed and packaged (in anticipation of the coronavirus crisis), and more complicated for the packaged/brushed export. Prices are rather stable but negotiated. In export, presence of Germany and Eastern countries, a lot less from Southern Europe.

Germany

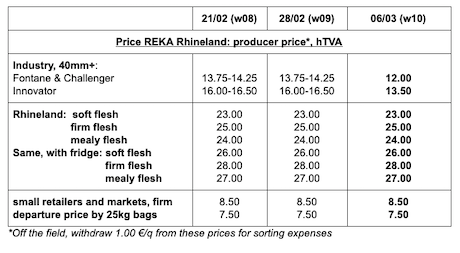

Markets are calm, both for crates-pallets-fridges and varieties for the fry industry. Fresh market, stable prices for firm flesh at 23.83 €/q (compared 23.83 €/q), and a little more firm for soft and mealy flesh at 22.67 €/q (compared 22.42 €/q). For “crates-pallets-fridges”, prices are higher! Processing market: quotations are down in Fontane/Challenger at 12.00 €/q (13.75-14.25 €/q), as well as Innovator at 13.50 €/q (16.00-16.50 €/q). The Coronavirus destabilizes and plagues the markets. Reka recommends to its members to follow up with the gassing programs in order to maintain conservation qualities...

Organic potatoes: producer prices returned trade: between 63 and 65 €/qt.

For more information:

FIWAP

www.fiwap.be