European physical markets

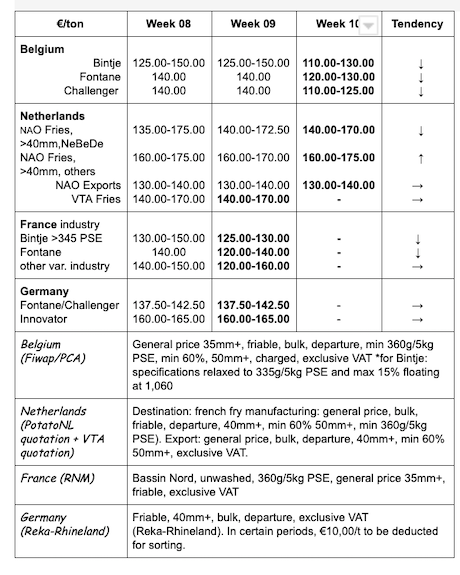

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Industrial potatoes:

The industrial markets are not very sustained. Most manufacturers have pulled back, due to a shared offer. Export remains complicated (some volumes to Romania).

Prices for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl.VAT, direct delivery:

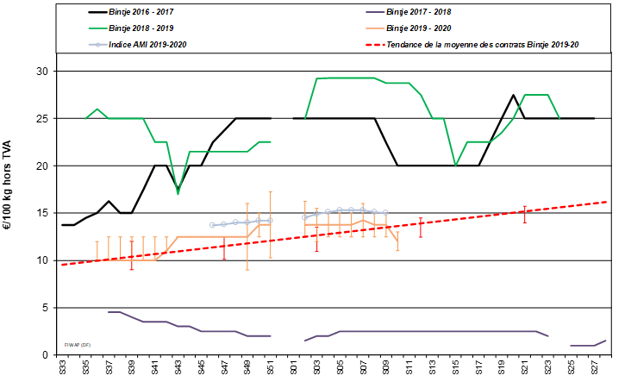

Bintje: 11.00-13.00 €/q, depending on wholesaler, quality and destination. Calm market.

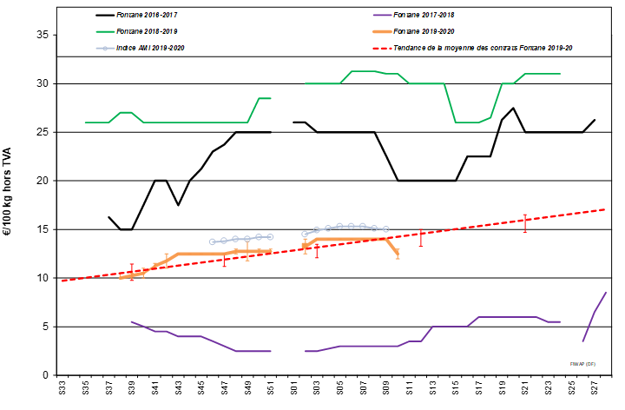

Fontane: 12.00-13.00 €/q, calm;

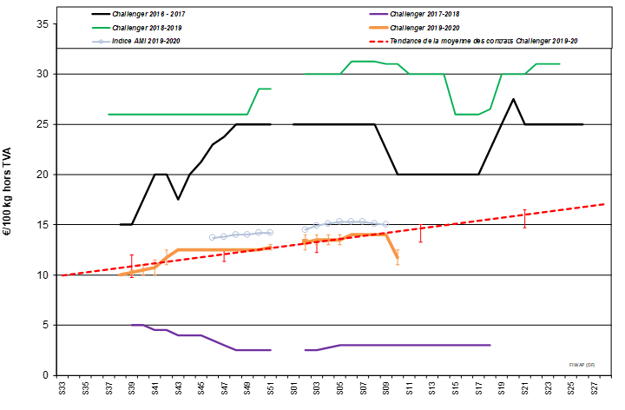

Challenger: 11.00–12.50 €/q, poorly sustained;

For these last 2 varieties, a Belgian processor offers lower prices.

Bintje plant: no quotation due to a lack of transactions and great variability in prices. Dutch plant, class A, returned March 2020, by 10 tons, in big-bags excl.VAT:

Caliber 28-35 mm: /€/q

Caliber 35–45 mm: /€/q

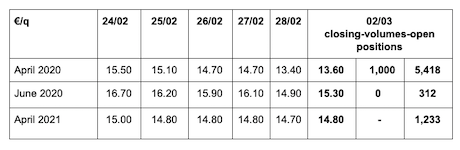

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for conversion, 40 mm+, min 60% 50 mm+:

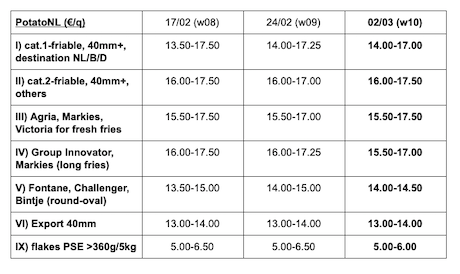

Netherlands

Concern over the spread of the coronavirus Covid-19 is growing and influencing the market trend through a possible slowdown of global trade. It is difficult to say how much the potato sector is affected, but what is certain is that the flow of merchandise is suffering from a shortage of containers. The Dutch fries factories are running normally but they are not buying on the free market. Quotations this week are nevertheless maintained, with a few ups and downs depending on the category. Export remains calm with moderate volumes, on a basis of €16.00 packaged departure.

Quotation PotatoNL: also available on www.potatonl.com

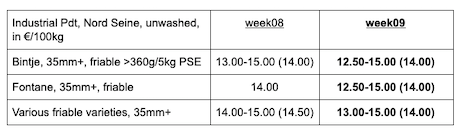

France

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min–max (moy)(RNM):

For the industry, prices were less firm last week, quotations are stable or slightly lower. The players are waiting. The purchase activity on the free market varies depending on the factory, but the global demand is (very) limited (school holidays in France), prices are discussed and negotiated for export. Some buyers are also returning (Eastern Europe, Germany).

French processing figures: according to GIPT via UNPT, French factories worked 729,000 tons from July 2019 to the end of January 2020, a stable tonnage compared to the same period in 2018/2019. 76% of this supply was contracted.

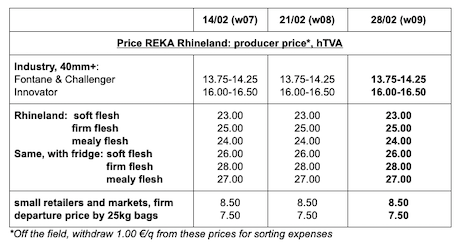

Germany

Markets are calm, both for crates-pallets-fridge and for varieties for the fry industry. Fresh market, prices are still quite stables for firm flesh at 23.83 €/q (compared to 24.00 €/q), and for soft and mealy flesh at 22.42 €/q (compared to 22.42 €/q). For the “crates-pallets-fridge”, prices are up! Processing market: unchanged quotations both for Fontane/Challenger at 13.75–14.25 €/q (13.75–14.25 €/q) and for Innovator at 16.00–16.50 €/q (16.00–16.50 €/q), which are particularly popular.

Organic potatoes: producer prices returned trade: between 63 and 65 €/qt.

Great Britain

In varieties for fries, the market is described as “calm but firm”, with more interest from buyers who wish to secure the supply of superior quality in the short and long term. The industry is paying between 16.80 and 21.00 €/q for friable Maris Piper, depending on the frying quality. More specific varieties start from 21.60 €/q until above 24.00 €/q. Fontane imported from the continent is quoted above 32 €/q in bags for peelers. The heavy rains of last week prevented the planting of early potatoes in Cornwall, and only very small areas could be planted in Jersey.

Spain

According to VTA Nederland, the surfaces for early potatoes are growing in Spain. The very-early ones have just been planted, and we are expecting an increase of about 15% of surfaces in Andalusia, Cartagena and Valencia. The surfaces (figures from the Ministry of Agriculture) would go from 11,489 and 13,212 ha.

European Union

The export of finished products was very good last December (source: VTA Nederland): the European export of finished products last December reached 156,724 tons, a 29% increase, after an already strong increase during the previous month (+14% for November).

For more information:

FIWAP

www.fiwap.be