European physical markets

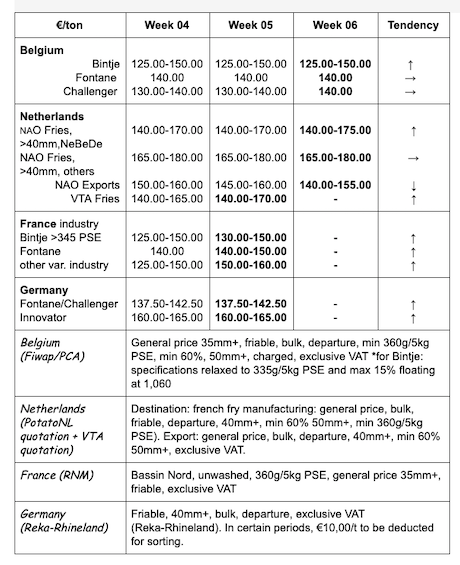

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Industrial potatoes:

Industrial markets are less active, with a more limited demand and a sufficient offer. In export: negotiated prices, very few transactions. Markets are temporarily blocked,

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery:

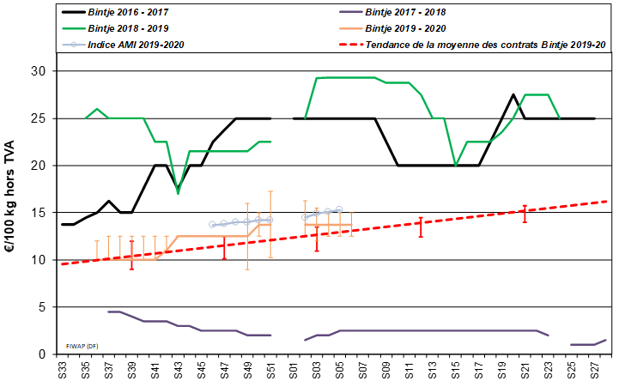

Bintje: 12.50-15.00 €/q, depending on wholesaler, quality and destination. Sustained market. Prices are higher are observed for batches of large caliber, high volume and/or for delayed delivery.

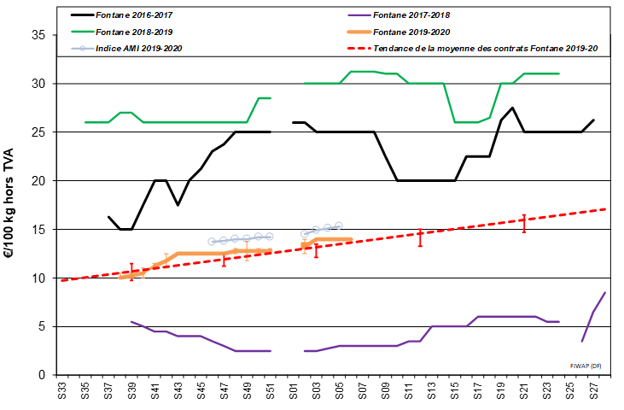

Fontane: around 14.00 €/q, stable;

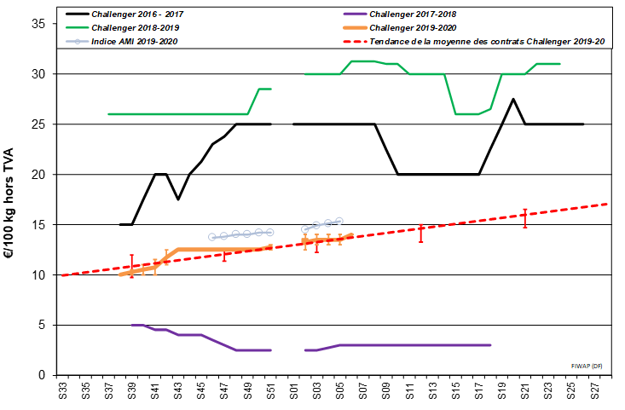

Challenger: around 14.00 €/q, stable;

Innovator: 15.00–16.00 €/q, sustained.

Bintje plant: lower prices, almost no trade. Dutch plant, class A, returned March 2020, by 10 tons, in big-bags, excl.VAT:

Caliber 28-35 mm: 55.00-58.00 €/q

Caliber 35–45 mm: 34.00-36.00 €/q

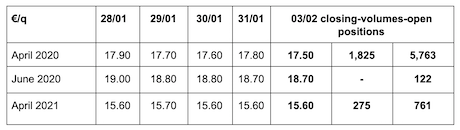

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for conversion, 40 mm+, min 60% 50 mm+:

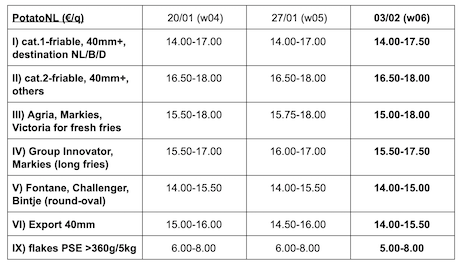

Netherlands

Interest in industrial demand was once again qualified as limited last week, after a period of more intense activity and purchases with immediate or delayed delivery. Little activity on the free markets, factories are using their contracted volumes. Export remained calm, especially to Africa, with downward pressure on prices and relatively little concrete activity. Producer prices were between 13.00 and 16.00 €/q. Firm flesh varieties for the domestic fresh market were between 17.00 and 25.00 €/q, some specific top-quality varieties reaching 30.00 €/q.

Quotation PotatoNL: also available on www.potatonl.com

2019 production scaled down: CBS (Central Statistics Bureau) revised the Dutch 2019 production down to 3.72 million tons (excl. plants and starch), which is an average yield of 47.9 t/ha. The multi-annual average is 49.3 t/ha. Close to 1,342 ha were not harvested, which represents 1.7% of the surface area. The Netherlands remain highly on the productions from neighboring countries since the Dutch industry consumes between 3.8 and 4.0 million tons and the domestic market + export needs, year in year out, 1.3 million tons of fresh potatoes.

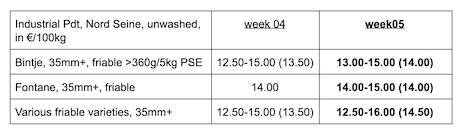

France

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min–max (moy)(RNM):

Industrial markets: prices vary depending on quality and variety, but there is an upward trend and demand is progressing significantly on the free market.

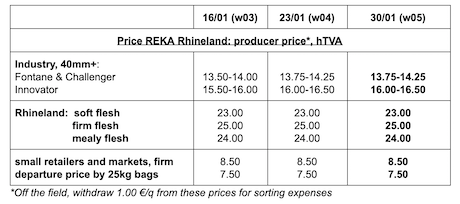

Germany

Markets are firm, for crates-pallets-fridges as well as for industrial friable varieties. Fresh market, prices are still firm for the firm flesh at 24.00 €/q (compared to 23.50 €/q), and for the soft and mealy flesh at 22.25 €/q (compared to 21.75€/q).

Processing market: quotations are up again for Fontane/Challenger at 13.75-14.25 €/q (13.50-14.00 €/q), and for Innovator at 16.00-16.50 €/q (15.50-16.00 €/q) which are particularly popular. The industry is operating at full speed and there are reports of warehouses getting empty (“friable” and “crispy/chips”)..Buyers do not want to pay more, sellers are expecting higher prices at the end of winter/beginning of spring.

Poland

The national production was revised downwards (source: VTA Nederland). The Polish institute for Agriculture and Industry reduced the estimate for the 2019 harvest to 6.5 million tons, which is 13% less than in 2018. The 2019 harvest is therefore nearing the historically low record of 2015. The 2019 average yield is down 15% at 21.4 t/ha.

Prices remain high on the Polish market, between 19.00 and 23.50 €/q at the producer. The weak harvest leads to a need to import since early in the season. From July until November included, more than 100,000 tons have been imported, mainly from Germany (54,000 tons), England (15,000 tons) and the Netherlands (11,000 tons).

For more information:

FIWAP

www.fiwap.be