Retail sales of organic fruits and vegetables grew by slightly more than five percent in 2019 - more than double the two percent growth for conventional produce - according to the 2019 Organic Produce Performance Report released exclusively by the Organic Produce Network and Category Partners. At the same time, the report indicates organic fresh fruit and vegetable volume increased by 4.6 percent, compared to growth of less than one percent for conventional produce for 2019.

The 2019 Organic Produce Performance Report utilized Nielsen retail scan data covering total food sales and outlets in the United States.

“Organic growth in retail produce departments continues to be strong,” said Matt Seeley, CEO of the Organic Produce Network. “Last year, sales of organic fruits and vegetables established a new record, hitting $5.8 billion in retail sales.”

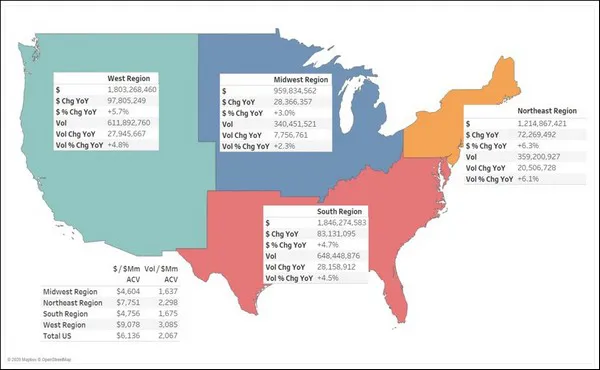

“One finding that jumped out is the increase in organic produce in the Northeast region of the U.S,” said Seeley. “The Northeast is the second strongest overall region for organics, and in 2019 had dollar and volume increases of over six percent. Conventional produce in the Northeast region was flat in volume and conventional sales dollars increased by less than one percent. In every region of the U.S., it’s organic produce that is driving dollar increases for retailers.”

Steve Lutz, senior vice president of Insights and Innovation at Category Partners which prepared the report, says a challenge and opportunity for the industry is in broadening the base of organic retail volume. “What we see in the Nielsen data is that organic produce at retail is concentrated within fewer categories than conventional produce,“ said Lutz. “The top 10 organic categories in produce drive nearly 70 percent of volume. These same categories contribute only 53 percent to total volume in conventional.”

In organic dollar performance, packaged salads and berries are top performers. Packaged salads drove nearly 20 percent of total retail organic sales. The combined berry category (strawberry, blueberry, raspberry, blackberry) added an additional 15 percent of total volume. Each of these berry categories had total dollar growth of more than 10 percent in 2019.

Lutz noted the new study shows the top three organic categories (bananas, carrots and apples) drive 41 percent of total organic volume.

“Like the volume totals, in dollar performance we also see a concentration of sales around a narrower group of top categories,” said Lutz. “The top 10 organic categories drive 61 percent of total dollars versus only 38 percent in conventional.”

Seeley believes the data reinforces the strong organic opportunity for producers and retailers. “It’s clear that capturing future growth will require that the mix of organic volume be spread across a broader base of products,” Seeley said. “As supermarkets increase organic assortment, expand shelf sets, and improve the visibility of organics at retail level, we believe the data shows consumer purchases will follow.”

For more information:

Matt Seeley

Organic Produce Network

Tel: +1 (831) 884-5058

Email: matt@organicproducenetwork.com

www.organicproducenetwork.com