A recently released USDA report, which looks at the annual fresh deciduous fruit market in Brazil, shows that for market year (MY) 2018/2019 there is a 2-percent drop compared to the previous year for the apple production. For MY 2019/2020 (January – December 2020), apple production is forecast to increase two percent to 1.095 MMT.

The 2018/2019 apple crop is smaller in volume but superior in quality to the previous harvest, according to producers. Smaller fruit size was a prevailing trait in the MY 2017/2018 growing season in the two varieties that dominate the sector, but there was a recovery on that score with the MY 2018/2019 crop. The 2019 crop has larger fruit with less damage, along with good color and taste.

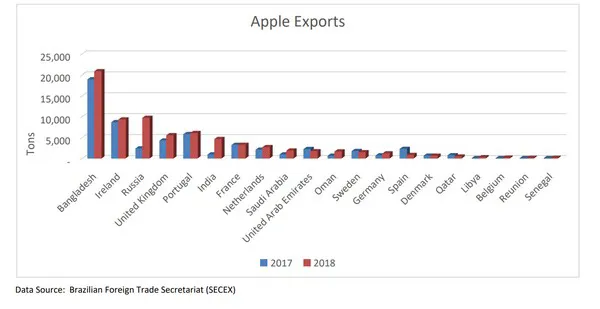

The 2019 export situation was similar to the previous year, as the domestic market continued to experience economic turmoil, leading apple producers to continue prioritizing exports. The principle change from the previous year is that the crop is 3-percent smaller. The outlook for MY 2019/2020 is similar.

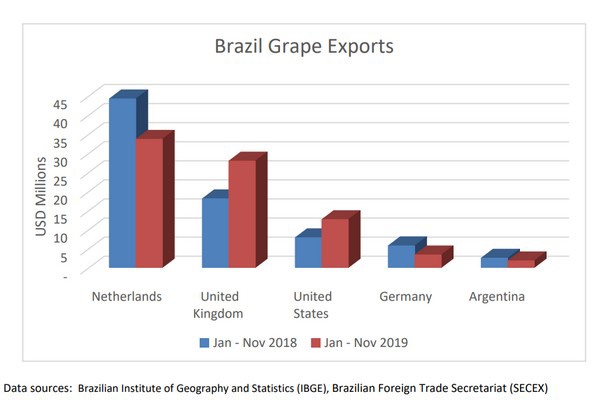

Grape exports increased in 2019

For grapes, the total planted area for MY 2018/2019 is expected to be similar to the MY 2017/2018 area, at roughly 75,000 hectares. Due to high land prices in comparison to the profitability of grape production, producers are working to increase productivity without bringing new area into production.

Grape exports decreased 11 percent in MY 2017/2018, to an estimated 39,818 MT. Large global supplies and restrained demand kept prices low. With low export demand, farmers focused on the domestic market, sending the low-quality fruit for juice processing. The situation has been different in MY 2018/2019 as producers have shifted their focus to the export market, due to weaker domestic demand resulting from economic turmoil.

Even though the harvest was smaller than last year, producers are hoping for higher export prices. Grape exports increased 3 percent in quantity from January to November 2019 when compared to the same period from last season. Part of this increase is due to a growing number of nontraditional importing countries purchasing Brazilian fruit. This includes Denmark, Thailand, China, Portugal, Japan, India, and Turkey, among others. Brazil expanded the number of grape export markets from 26 to 65 in MY 2018/2019.