The European apple market has consolidated for the time being. Due to a 20% decline in the European harvest compared to last year, 10.5 million tons of apples have to be accommodated this year. This should be achieved without difficulty. The positive market expectations for the current marketing year are based above all on below-average to average yields across all countries and the massive harvest shortfall in Poland due to late frost. The consequence of constant demand and significantly reduced quantities is a positive apple price development throughout Europe.

In November, the largest producer countries in Europe (PL, IT, FR, DE) reported an average of 63.00 EUR/dt for sorted and packed dessert apples. Thus the European wholesale price is 15% above the 5-year average.

Poland's apple production will end in 2019 with a deficit of - 2.1 million tonnes, or - 44% compared to the previous year. With an estimated harvest of 2.7 million tonnes and own consumption of +/- 2.1 million tonnes (fresh market 30%, processing 70%), this year will be a tight year for large-scale exports. As a rule, Poland exports about 1 million tons of apples per marketing year. Thereof 30% intra- and 70% extra-EU. It will be important for Polish marketers to serve the core markets this year. These include Belarus, Egypt, Kazakhstan and Romania to a large extent. Strong Polish domestic prices are already inhibiting exports to these traditionally price-sensitive countries.

As a result of weaker availability, the Polish price level rose by 75% to 38.00 EUR/dt by November, compared to the five-year average. The third largest apple producer in the world is looking forward to a mixed season.

In Europe, Italy is not only the main producer of apples for the fresh market, but also the export champion in third countries. Since 2015, the national cultivation area for apples has increased by 10% at the expense of stone fruit. With this year's harvest of 2.2 million tonnes, the Italian harvest fell just short of the previous year's level by just under 3 %. Italy will thus have an average harvest in 2019. The large proportion of small calibres requires corresponding price reductions this year.

Valued at EUR 68.00/dt, the apple price is at the Italian level of the previous year and at the same level as the 5-year average.

Contrary to the European trend, France produced an above-average apple harvest of 1.65 million tonnes; +12 % on the previous year and +6 % on the long-term average. In a comparison of the largest apple producers in Europe, this nation holds the highest value of production over the entire value chain. The French wholesale price has more or less adjusted to the long-term average this year. In November, the price was 85.00 EUR/dt, 35% above the EU 4 average.

949,000 tonnes of apples from commercial plants were produced on 34,000 hectares in Germany in 2019. This represents a weather-related production decline of about 21 % compared to the previous year. Late frost and hailstorms were the order of the day in many places, but especially in the eastern regions. Many stocks also alternated after last year's record harvest.

In November, the German wholesale price of EUR 60.00/dt remained at an adequate level and is 25 % above the 5-year national average and 5 % below the European average.

EU agricultural markets - Outlook 2030

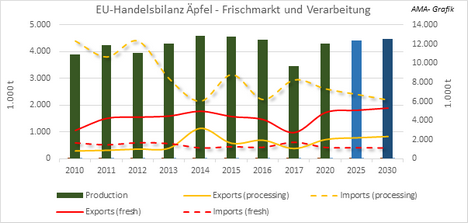

The forecast models expect European apple production to grow to an average of 12 million tonnes per year by 2030. The modernisation and mechanisation of plants will continue to be advanced and old stocks will increasingly be converted in favour of more competitive varieties. Exports of dessert apples are expected to grow by 0.7 %/year, while imports will remain constant at about 500,000 t/year.

European per capita consumption of fresh apples/year remains slightly lower. However, the decline is expected to slow down slightly from -0.6 %/year to -0.3 %/year. The European Commission therefore assumes a constant development of the European apple market. In addition to the climatic conditions, Poland's cultivation and marketing strategy, intra-European demand and the availability of new export markets will be decisive for a balanced internal market.