Calavo Growers, Inc. reported sharply higher fiscal 2019 fourth quarter results as compared with the final period last year. The strong operating performance propelled the company – the global avocado-industry leader and an expanding provider of value-added fresh food – to record 12-month results with revenues, gross profit, operating income, adjusted net income and adjusted diluted earnings per share reaching new all-time highs.

Net income for the three months ending Oct. 31, 2019 rose to $5.2 million, equal to $0.30 per diluted share, versus a net loss of $1.3 million, or negative $0.08 per diluted share, in the fiscal 2018 fourth quarter. Excluding certain items impacting comparability, adjusted net income(1) climbed by 59 percent to reach $8.0 million, or $0.45 per diluted share, from $5.0 million, or $0.29 per diluted share, in the year-earlier final quarter.

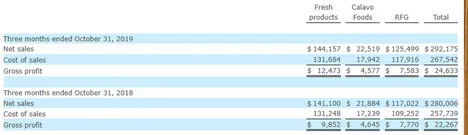

Final-quarter revenues grew to $292.2 million, edging up four percent from $280.0 million in the corresponding quarter last year. Gross profit rose by 11 percent to $24.6 million, or 8.4 percent of revenues, from $22.3 million, or 8.0 percent of revenues, in the year-earlier fourth period. Operating income registered a 31 percent increase, advancing from $7.5 million in last year’s fourth quarter to $9.8 million in the most-recent period.

Chairman, President and Chief Executive Officer Lee E. Cole stated: “I am enormously gratified to report that Calavo posted another outstanding year in fiscal 2019, shattering multiple records. This was paced by a final period performance during which revenues rose in each of the company’s three business segments, total gross profit grew by double digits, and adjusted net income advanced by 60 percent—a strong showing indeed.”

“Calavo’s Fresh segment – containing our core avocado business – paced our performance in the quarter and for the year. Once again during the fourth quarter, we ably managed shifting market conditions, growing both segment sales and gross profit year over year while industry avocado prices moderated significantly. As indication of the fundamental strength in this business, for the full year Fresh segment sales grew by double digits, while gross profit soared by nearly 60 percent from $54 million to over $86 million.”

Final-quarter sales in the Calavo Foods segment rose about three percent to $22.5 million from $21.9 million in the corresponding period of fiscal 2018. Gross profit in the Foods segment was unchanged at $4.6 million, while gross profit margin equaled 20.3 percent of segment sales in the most-recent quarter versus 21.2 percent of segment sales last year. However, on a sequential basis, Foods segment gross profit and gross profit margin rebounded sharply from gross profit of $2.8 million, or 11.4 percent of segment sales, in this year’s fiscal third quarter. As foreshadowed in the company’s third quarter earnings announcement, this improvement owes primarily to fresh avocado input costs that trended lower, benefiting the Foods segment in the final period.

Total selling, general and administrative (SG&A) expense in the most recent quarter equaled $14.9 million, or 5.1 percent of revenues, which compares with $14.8 million, or 5.3 percent of revenues, in the final period of fiscal 2018. For the full year, total SG&A expense increased modestly to $59.1 million from $57.1 million, even while supporting the double-digit percentage increase in Calavo revenues.

Results for the final quarter include a non-cash, unrealized loss of approximately $1.5 million on the company’s ownership interest in Limoneira Company. (Owing to a recent generally accepted accounting principle – or “GAAP” – rule change, unrealized “paper” gains and losses on investments are now included in the company’s income statement.) The company’s loss from unconsolidated subsidiaries narrowed to $2.1 million in the most recent quarter from approximately $8.5 million in the fiscal 2018 final quarter. The reduced loss from unconsolidated subsidiaries, both on a sequential and year-over-year basis, reflects a narrower loss in the most recent period at FreshRealm.

Outlook

Commenting on the course ahead, CEO Cole stated: “Building upon our record-setting year, Calavo begins fiscal 2020 in an enviable position – financially, operationally and through our depth of human capital and other resources – from which we can continue to drive the company’s growth moving forward. The extended upward arc in consumer demand for fresh avocados is expected to be met in 2020 with an all-source U.S. supply that, by early industry estimates, should be more than 10 percent above the recently concluded year. With ample supply, we anticipate considerable opportunities to boost Calavo’s avocado sales both domestically and abroad while continuing to leverage our ability to execute across a range of industry conditions.”

Click here for the full report on Calavo's financial results.

For more information:

Lee E. Cole

Calavo Growers, Inc.

Tel: (805) 525-1245

www.calavo.com