Alico, Inc. (“Alico” or the “Company”) announced financial results for the fourth quarter and fiscal year ended September 30, 2019.

Results of operations

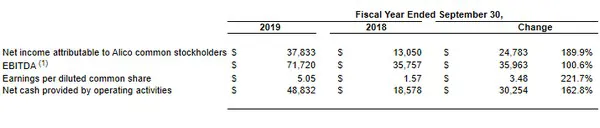

For the fiscal year ended September 30, 2019, the Company recorded net income attributable to Alico common stockholders of $37.8 million and earnings of $5.05 per diluted common share, compared to net income attributable to Alico common stockholders of $13.1 million and earnings of $1.57 per diluted common share in the prior year. The increase in net income attributable to Alico common stockholders is primarily due to increased processed box production in the current fiscal year, as compared to the prior fiscal year, funds awarded through the federal disaster relief program and the impact of a valuation allowance resulting in tax expense for the fiscal year ended September 30, 2018. Partially offsetting this increase are higher harvesting and hauling costs directly related to the greater processed box production, and a one-time deferred tax benefit attributable to the federal corporate tax rate change enacted on December 22, 2017, that was recorded in the fiscal year ended September 30, 2018.

When both years are adjusted for certain non-recurring items, the Company had adjusted earnings of $2.86 per diluted common share for the fiscal year ended September 30, 2019, compared to an adjusted loss of $0.19 per diluted common share for the fiscal year ended September 30, 2018. Adjusted EBITDA for the fiscal years ended September 30, 2019 and 2018 was $48.5 million and $21.2 million, respectively.

For the fiscal year ended September 30, 2019, Alico Citrus harvested 8.1 million boxes of fruit, an increase of 68.1% from the prior fiscal year. The increase was directly related to the negative impact of Hurricane Irma on the prior fiscal year harvest. As a result of Hurricane Irma, the Company experienced a greater amount of fruit drop and consequently harvested a smaller number of boxes in fiscal year 2018. The Company also saw an overall increase in pound solids per box, which was 5.91 for the fiscal year ended September 30, 2019, as compared to 5.64 for the fiscal year ended September 30, 2018. Last season, the Company experienced a reduction in the price per pound solids, largely due to the Florida citrus crop being greater than initially anticipated and the continued inflow of imported fruit.

During the 2018-2019 harvest season, the Florida citrus industry benefited from a historically low rate of post-greening fruit drop. We estimate that our production in the 2019-2020 harvest season will be slightly higher than in the prior year. However, we anticipate there is likely to be a continued reduction in market prices during the 2019-2020 harvest season because of excess supply from domestic and international growers. Continued scrutiny and aggressive management of all costs and expenses in this pricing environment will remain one of the Company’s highest priorities.

Water resources and other operations division results

Operating results for the Water Resources and Other Operations Division for the fiscal year ended September 30, 2019 improved by $1.7 million from the fiscal year ended September 30, 2018, primarily due to the Company selling its cattle herd in late January 2018, and no longer incurring expenses relating to calves and culls. As part of this transaction, the Company entered into a long-term arrangement with the purchaser for grazing rights on the ranch. The Company continues to own the property and conduct its long-term dispersed water program and wildlife management programs. Alico is still working to obtain approvals necessary to secure required permits to begin construction of the dispersed water project.

Management comment

John Kiernan, President and Chief Executive Officer, is proud of Alico’s financial results over the past year. “While the majority of our improved earnings was generated from increased revenues, we continued to execute our Alico 2.0 Modernization Program. We have developed a strong and stable management team, maintained a culture of accountability and respect throughout the Company, focused our resources and attention on our core strength in citrus and made decisions that are designed to benefit Alico in the long term. The Alico 2.0 program saw the sale of several underperforming assets and a continued reduction in operating costs while investing in new plantings to create higher density in our groves. I believe that Alico is now an industry-leading high-quality, low-cost producer of citrus fruit in the U.S.”

“Our net income attributable to Alico common stockholders’ margin was 30.9% and our adjusted EBITDA margin was 39.6%, both measured as a percentage of revenue, and these margins generated strong rates of return for our stockholders. Our Return on Assets was 9.0%, our Return on Invested Capital was 10.1%, our Return on Capital Employed was 12.6% and our Return on Equity was 20.7%. Going forward, Alico expects to use cash generated from the sale of underperforming assets, as well as from business operations, to seed new innovation initiatives, to accelerate debt repayments, to continue to increase our quarterly dividend, and to fund working capital needs and tree plantings. I believe that Alico is well-positioned to continue generating operating income and positive cash flow.”

Mr. Kiernan continued, “In addition, our Board of Directors has decided to increase the quarterly dividend by 50%. This decision is a significant endorsement of our business momentum and strategic plan. Since 2014, Alico has returned almost $100 million of capital to shareholders and lenders through dividends, buybacks, a tender offer and debt repayments. At the same time, our debt balance has been reduced by over 17% over the past three years.”

For the full financial report, please click here.

For more information:

For more information:

Richard Rallo

AlicoInc

Tel: (239) 226-2000

Email: rrallo@alicoinc.com