The European export of fries increased slightly last September compared to September 2018. In the 12 months from October to September, the total volume exported by the European Union to third countries reached 1.64 million tons, which is 5.2% less, due to the lack of availability of products during the recent season. The decrease is the strongest towards Asia and South America.

However, trade to North America progressed sharply with more than 100,000 tons of fries exported (almost a 50% increase!). The 2019 north-american production is expected to be much lower (-1 to 1.5 million tons) due to the rains and frost of the past months. As a consequence, the prospects for the European products are rather favorable. European shipments to central America also increased (73,000 tons, or +17%...), a region usually supplied by the American factories (source: VTA, NEPG).

European physical markets

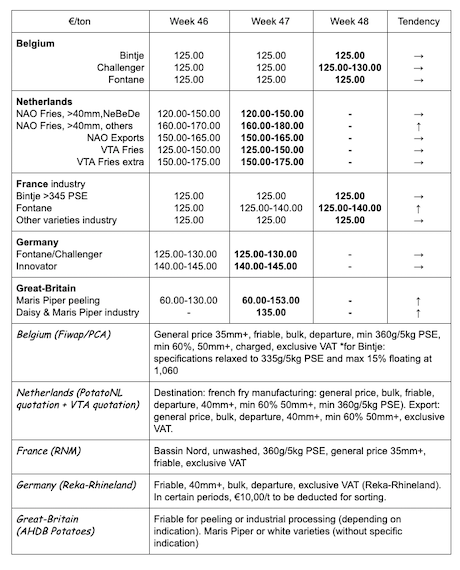

Price summary (source: NEPG):

Belgium

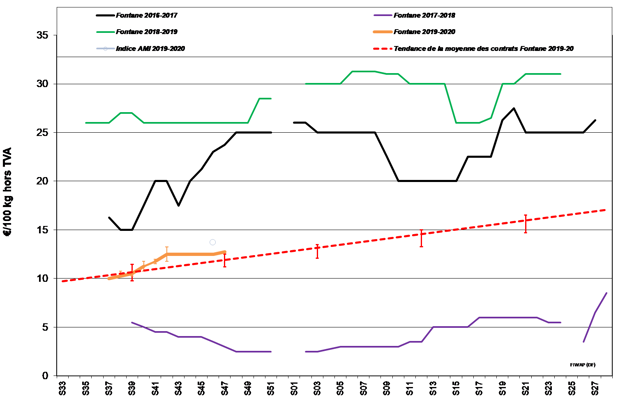

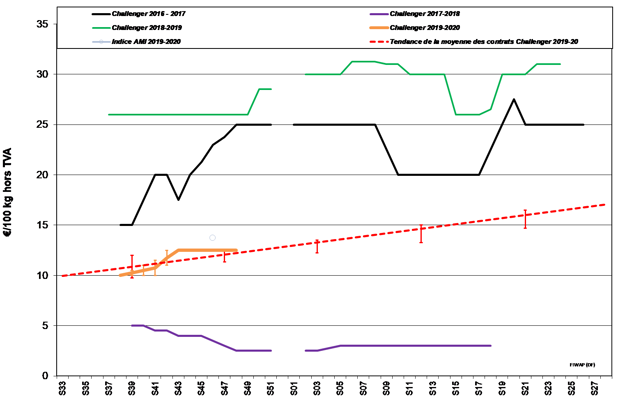

Fiwap/PCA market message: industrial potatoes: all markets remain stable, with nuances between Challenger (offer present due to preservation difficulties, prices slightly under pressure) and Fontane (factory priority, little offer, prices slightly up). The export demand persists to Eastern Europe and now also to England.

Price for all comers, 35mm+, min 60% 50mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery:

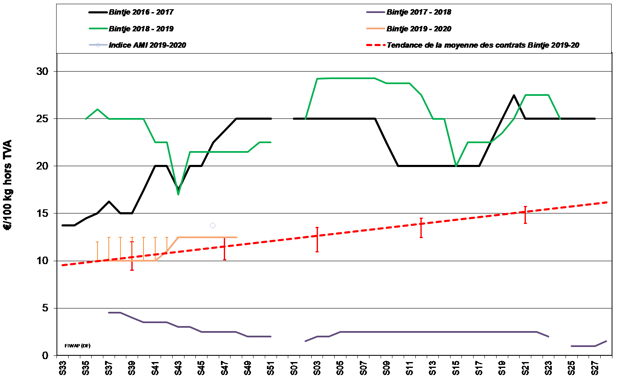

Bintje: around 12.50 €/q, for the average quality. Large caliber and good cooking lots benefit from better prices depending on the practice (up to 15.00 €/q for peeling). Stable market.

Fontane: 12.50–13.00 €/q, stable market.

Challenger: around 12.50 €/q, stable market.

Innovator: 13.00–14.00 €/q, stable market.

Bintje plant: very little trade, low demand. Indicative prices. Dutch plant, class A, returned March 2020, by 10 tons, in big-bags exclVAT:

Caliber 28–35mm: 59.00-61.00 €/q

Caliber 35–45mm: 39.00-41.00 €/q

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm+:

Netherlands

Grubbing started again last weekend in the west of the country at a very slow pace. The clay soils will probably not be harvested before winter. 5% of the plots still need to be grubbed. Markets are “calm but sustained” with little offer due to the planting of cereals and the harvest (beets, endives, carrots…). The demand is also low (factories call their contracts). For the industry, prices are globally unchanged, between 12.50 and 15.00 €/q, up to 18.00 €/q for specific industrial varieties (cat 2) which show a little “more”. On the domestic fresh markets, the price levels are easily maintained, the preparers have “a lot of work”. The offer of dry lots is down. Purchases are between 18-29 €/q. Export pays from 19 to 22 €/q (in bags, 45 mm+, departure preparer).

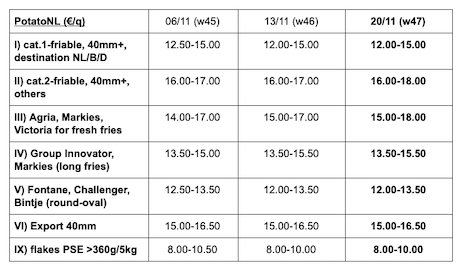

Quotation PotatoNL: also available on www.potatonl.com

France

For the industry: stable markets for all varieties at 12.50 €/q, with always a little “more” for Innovator, sometimes reaching 14.00 €/q. Purchases on the free market continue moderately, with no rush from the buyers which easily clear the offer of products departure fields and/or batches with storage issues.

The domestic fresh market is calm and export is also less dynamic with volumes waiting. Prices are rather stable within a wide range between 18 and 32 €/q for soft flesh varieties, with the heart of the market at 25.30 €/q. The firm flesh are between 30 and 40 €/q. In export, many questions but few concrete actions. Spain, Italy and Eastern European countries (Romania) are the main clients, with prices under pressure and down for the basic unwashed merchandise (17 to 20 €/q). The best batches for Spain reach 27 to 31 €/q, and the average quality is at 23-24 €/q.

Grubbing is not completed yet and remains very complicated (Normandy, Hauts-de-France...).

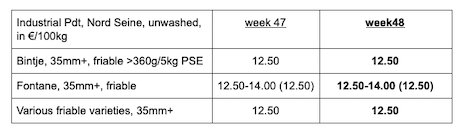

Unwashed industrial potato, bulk, departure, exclVAT, Nord Seine, €/q, min-max (moy) (RNM):

Germany

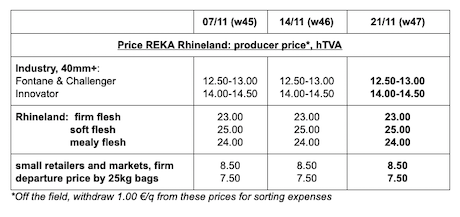

Fresh market, unchanged for the firm flesh at 22.33 €/q (compared to 22.33 €/q last week) and increase for the soft and mealy flesh at 20.83 €/q (compared to 20.75 €/q). The market is sustained both by the domestic demand and the shipments (=within the Union) / exports (outside of the EU).

Processing market: unchanged quotations for Fontane/Challenger at 12.50-13.00 €/q; same for Innovator at 14.00-14.50 €/q.

Organic potatoes: prices renewed around 65.00-67.00 €/q.

Great Britain

Average AHDB prices on the industrial free markets in week 47:

- Maris Piper for peeling: 5.90 to 15.30 €/q, depending on quality/caliber;

- Daisy and Maris Piper for the industry: 13.50 €/q.

Price increases observed on many markets, especially for the top quality. Significant defects are signaled regularly, and the offer remain very weak.

Frost came particularly early this year, with several nights below zero last week. Despite the few dry days, grubbing remained very difficult. At the moment, the weather forecast announces new consequential rains, so the surfaces not harvested (11% on November 18th - source AHDB, which is about 13,000 ha) will not be grubbed before New Year, and might be lost. This 11% average hides important regional differences, with about a third of the plots to be grubbed in the Northwest! The total rainfall in September and October in the UK was recorded at 220mm, with a multiannual average at 133 mm.

For more information:

FIWAP

www.fiwap.be