European physical markets

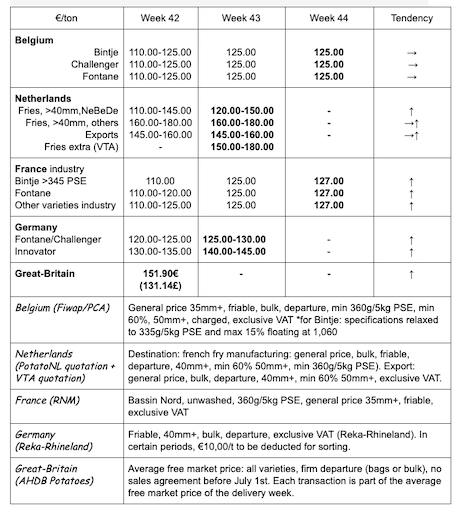

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

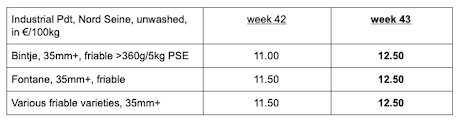

Industrial potatoes:

Prices remain identical for the three main varieties after going up for the past 2 weeks. The markets remain firm however because grubbings are still ongoing and the offer is therefore not pressing. The industrial demand seems calmer this week than the previous one. Peelers are looking for ideal batches of Bintje (sufficient caliber and non-excessive PSE). Export is calmer (after some nice activity last week) towards various countries in the East, especially Poland and Romania, where a part of the harvest cannot be stored and must be consumed now.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery:

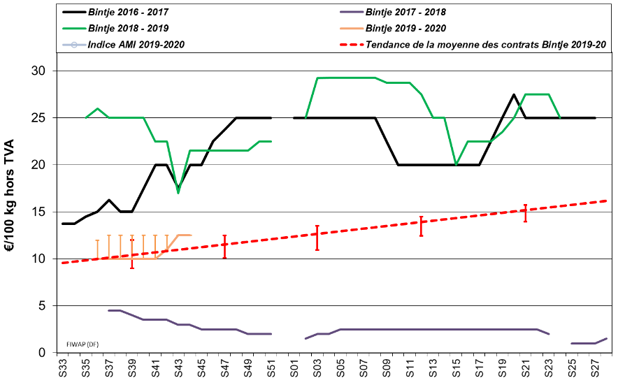

Bintje: around 12.50 €/q, depending on caliber and destination; sustained market;

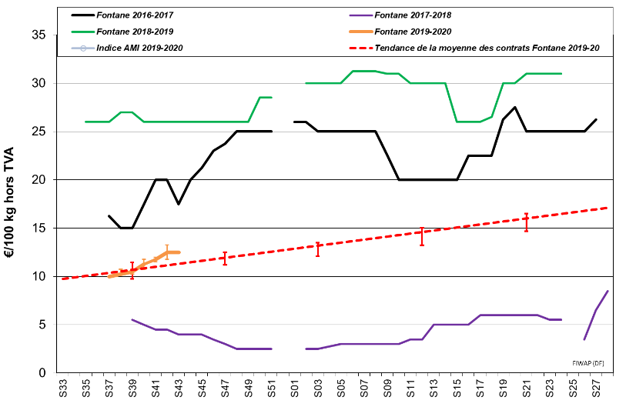

Fontane: around 12.50 €/q, sustained market;

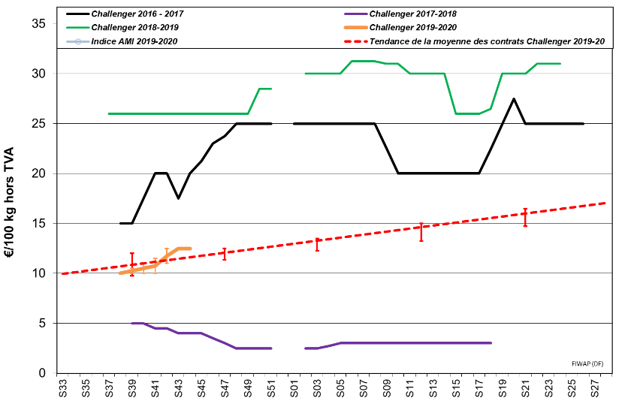

Challenger: around 12.50 €/q, sustained market.

Innovator: between 13.00 and 14.00 €/q. Firm.

Bintje plant: little trade, few sales, expectant market. Indicative prices. Dutch plant, class A, returned March 2020, by 5 tons, in bags, excl.VAT:

Caliber 28–35 mm: 60.00-62.00 €/q

Caliber 35–45 mm: 40.00-42.00 €/q

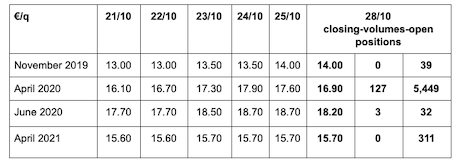

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm+:

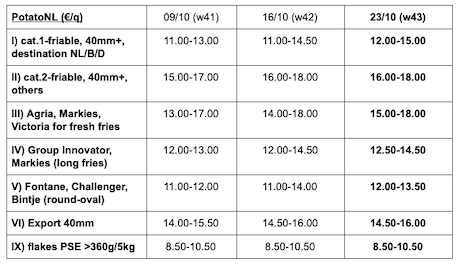

Netherlands

All quotations were up last week because grubbing is progressing slowly and the offer is very limited. It is especially in the West and Southwest of the country, in the clay soils, that grubbing is difficult. Prices went up for the dry and hard batches which export needs. Export prices on a basis of 14.50 to 16.00 €/q, departure at the producer to export to Eastern Europe, Africa and the Caribbean. Some demand from industry and trade, with the main “NeBeDe 40mm+” quotation up between 12 and 15.00 €/q.

Quotation PotatoNL: also available on www.potatonl.com

France

Firm market, upward prices; increased offer as grubbing progresses, but the demand is also higher.

Unwashed industrial potato, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

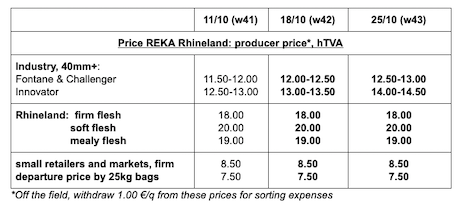

Germany

The fresh market is variable, more firm for firm flesh at 20.00 €/q (compared to 19.33 €/q last week) and up for soft and mealy flesh at 18.58 €/q (compared to 18.08 €/q). For the batches with completed healing, add 5 €/qt! Demand is still good from Eastern and Southeastern Europe, with important volumes leaving.

Processing market: quotations more firm for Fontane/Challenger at 12.50-13.00 €/q (compared to 12.00-12.50 €/q), and more firm for Innovator between 14.00 and 14.50 €/q (compared to 13.00-13.50 €/q). Slow progress at the end of the campaign in fields that were irrigated in the summer and then received a lot of rain.

Organic potatoes: prices renewed around 65.00-67.00 €/q.

Great Britain

Average AHDB price free markets week 42 (ending on October 19th): 15.19 €/q (compared to 14.58 €/q in week 41, all varieties, all markets). The market is up for 2 reasons: better demand, but also more expensive varieties in the “basket of varieties” for the week’s free prices.

For more information:

FIWAP

www.fiwap.be