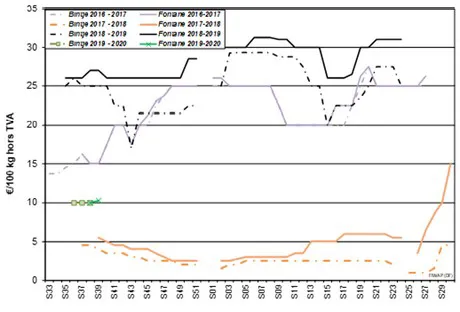

European physical markets

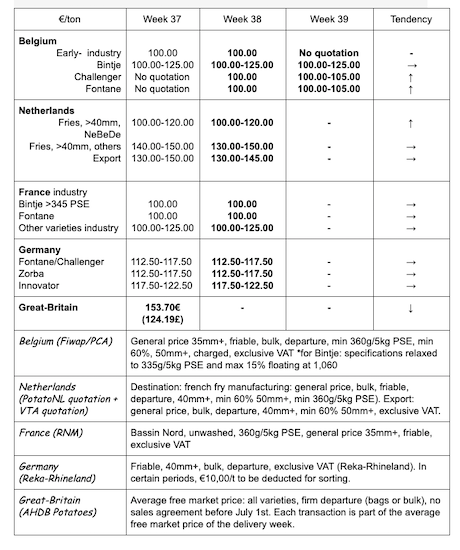

Price summary (source: NEPG)

Belgium

Fiwap/PCA market message:

Markets are still firm, with almost no price change and (very) few free transactions.

Few industrial buyers actively looking for potatoes. Limited offer due to harvest difficulties and prospects of low average yields. The demand for exports is very strong from various destinations in Southern and Eastern Europe, as well as the Middle East and Africa.

Price for all comers, 35mm+, min 60% 50mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery:

Early industrial potatoes: no quotation, end of season;

Bintje: 10.00 to 12.50 €/q, depending on caliber and destination; firm market for Fontane and Challenger: 10.00 to 10.50 €/q, firm market.

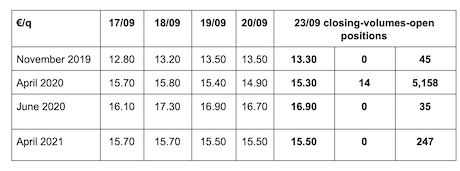

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm+:

France

For the industry, free purchases remain limited, given the very high rate of contractualization. But some industrials are buying (a little). Prices did not evolve last week, despite the increase of the forward market: quotations between 10.00 and 12.50 €/q, depending on the variety. On the fresh markets, prices are stable (soft flesh between 18 and 25 €/q, firm flesh between 30 and 45 €/q). The offer is globally limited in non-irrigated situations. In export, the interest from Italy, Spain and Eastern Europe is obvious (Romania buys on a basis of 18 €/q for conditioned, unwashed) and there is also some bigger export activity.

In the fields, the conditions are too dry, which worries producers and buyers. In the Hauts-de-France, detopping multiplies but grubbing is not making any progress because of soils that are too dry or detopping that took place too early. Yields are confirmed to be very heterogeneous. In Centre Beauce, there is only 5 to 10% left to harvest. Irrigation continues to help before the harvest to humidify the ground. In Grand Est/Champagne, half of the harvest is done. Prices remain between 20.00 and 25.00 €/q at the producer (fresh market).

About 30% of the French crops have been harvested (estimation UNPT).

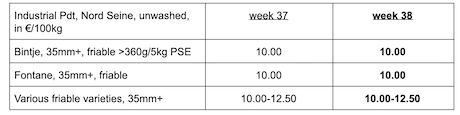

Unwashed industrial potato, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

Netherlands

Markets are still firm but with no real evolution in prices. The base remains at 10.00 €/q, with a range widening up to 12 €/q for Innovator, and 13 to 14 €/q for Agria. Given how detopping is progressing, the peak of supply for the field output should be in the first half of October. The markets are also sustained by the prices of starch potatoes and flakes, which are similar to the potatoes for fries, given the disappointing yields for the starch potatoes in Germany and the Netherlands. On the fresh markets, the preparers are busier than last year, with a retail base at 14 to 25 €/q at the producer, and some significant export to Poland, Romania, the Middle East, the Caribbean and Africa, around 16 to 18 €/q, calibrated in (big) bags departure.

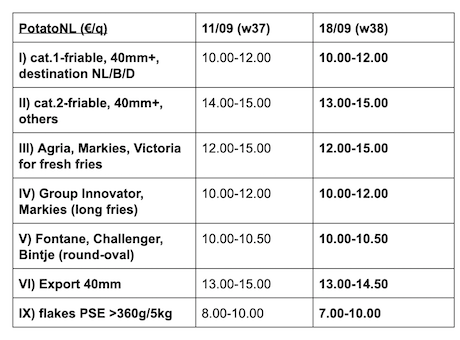

Quotation PotatoNL: also available on www.potatonl.com

Germany

In some Länder or sub-regions, grubbing is rendered difficult by the drought. However, there is enough supply to cover the various demands, including those for shipments/export to the Eastern and Southeastern Europe. Unchanged fresh market, at 19.67 €/q for firm flesh last week, and 18.50 €/q for the soft and mealy flesh. Still some demand from Eastern and Southeastern Europe. The demand is good, and although some quality issues have been observed (damage from mice and wireworms, common scab, rhizo), most batches are sold (export, peeling, packaging..and also processing!). Weeks 39 and 40 usually are the best weeks (in terms of clearing volumes) in FRG, with many promotional actions in supermarkets.

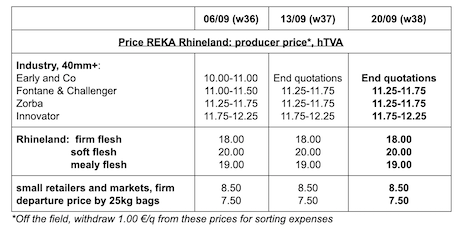

Processing market: stable quotations: Fontane/Challenger at 11.25-11.75 €/q, Zorba between 11.25 and 11.75 €/q and Innovator between 11.75 and 12.25 €/q.

Organic potatoes: current prices around 65.00 -67.00 €/q.

Great Britain

Average AHDB price free markets week 37 (ending on September 14th): 15.37 €/q (17.30 €/q in week 36, all varieties, all markets).

Lower average free price due to the arrival on the market of shipments/varieties of lower value and to the overall decline in prices. The domestic demand remained stable, for the fresh market as well as the industry, but the contracted volumes largely dominate and there is little room for free purchases. Few transactions for the industries, with average prices of 7.43 €/q for Maris Piper. Export re-energized to the continent (industry) and to the Canary islands (fresh).