European physical markets

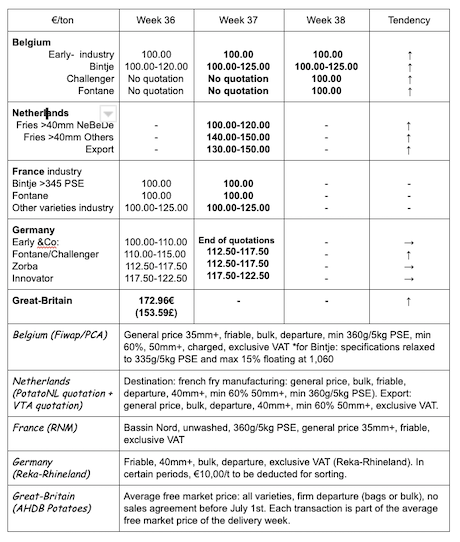

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Firm markets due to a very low offer, difficult harvest conditions, and low yields confirmed in Belgium. Factories are still not buying actively besides their contracted supply. Export presents real opportunities in the short and medium term, to a number of European and African destinations.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery:

Early industrial potatoes: mainly 10.00 €/q, last volumes; firm market;

Bintje: 10.00 to 12.50 €/q, firm market;

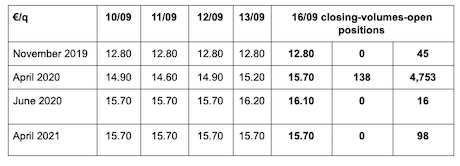

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm+:

France

For the industry, stabilized market with a low point at 10.00 €/q for basic varieties, and 12.00-12.50 €/q for Innovator. Industrials are covered by contracts, but some of them buy nevertheless. Export is promising to the South, the East and Northern Africa, with departure prices around 17 to 22 €/q (calibrated big-bags, depending on the variety and washability). On the domestic market, the soft flesh varieties are between 18 and 25 €/q, and the firm flesh between 30 and 45 €/q.

Grubbing is done at +/- 25% (estimation UNPT). Detopping is being carried out in the Hauts de France, while the harvest is finished at 75% in Beauce/Centre. The persistent drought is a source of worry for the coming weeks.

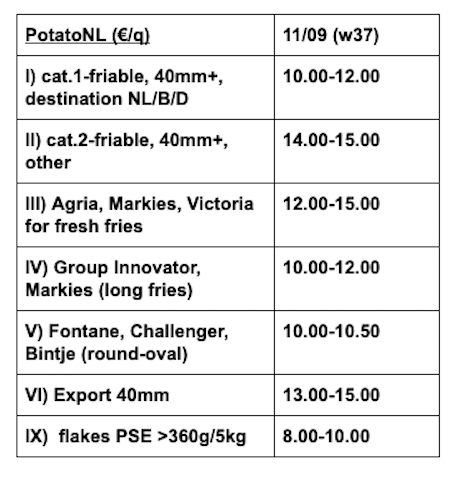

Netherlands

Markets were still firm last week due to the persistent drought and the announcement of the slow increase of late-season yields. Higher supply and grubbing has started. Industrial demand was still around 10.00 €/q for basic varieties (Fontane, Challenger, Bintje), while peelers give a bit more money. Innovator reaches 11.00-12.50 €/q, and Agria 15.00 €/q for export to Spain. In export, the higher offer is easily absorbed, given the demands from Poland, Romania, the Caribbean, the Middle-East and Africa. Shipments are around 18.00-20.00 €/q, calibrated in big-bags departure.

Quotation PotatoNL: also available on www.potatonl.com

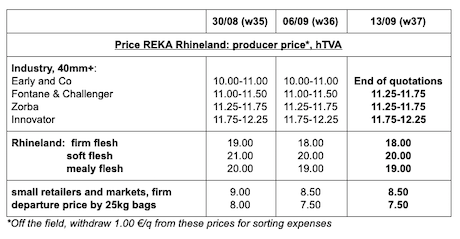

Germany

The early potato season is (nearly) over. Decreases on the fresh market, with 19.67 €/q for firm flesh last week, and 18.50 €/q for the soft and mealy flesh. Demand from Poland and other countries in southeastern Europe.

Processing market, end of quotations for the early industrial potatoes. Fontane/Challenger are up, between 11.25 and 11.75 €/q, Zorba between 11.25 and 11.75 €/q and Innovator between 11.75 and 12.25 €/q.

Organic potatoes: harvest in progress, with yields lower than expected, and lower than the multi-year averages. After a drop in prices (organic first quoted at 75 €/q, we observe a slow price increase around 65.00-67.00 €/q at the moment (variety baskets, mainly on the fresh market; compared to 58 €/q in mid-September last year)).

The demand in July was 9% higher than in July 2018 (and + 30% for the period from January to July 2019, compared to the same months in 2018). The organic potatoes currently represent 7.6% of the sales (5.6% last year). Sales are down 4% for conventional potatoes.

We also note an increase in areas to 9,300 ha (+400 ha, mainly due to the industrial varieties (fries, mashed, organic flakes)). In 2019, we counted 4% of organic potato crops.

In Switzerland, the price for organic (and conventional) potatoes is higher than last year. Firm flesh around 85.80 €/q and mealy flesh around 84.00 €/q. Agria for the industry, prices around 67.30 €/q and Hermès (chips/crispy) around 69.80 €/q.

Great Britain

Average AHDB price free markets week 36 (ending on September 7th): 17.30 €/q (compared to 16.25 €/q (all varieties, all markets) in week 35).

The harvest conditions are still good in the main regions. Very little rain expected in the next 2 weeks, so the conditions will worsen. This “drought” benefits Scotland which has had a lot of rainfall in the past few weeks, with delayed grubbing and damage to the crops for the varieties susceptible to wet decay.