European physical markets

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Firm markets, offer is still very limited. Final yields for conservation varieties remain uncertain (samples regularly confirm a slow and late growth). The persistent drought makes grubbing difficult (some soils become too dry). Factories still do not buy much globally, besides their contracted supply. There is some export to Eastern countries (to Poland in particular), but also to some other destinations (Italy, Middle East…).

Price for all comers, 35 mm+, min 60% 50mm+, min 360g/5kg PSE, bulk, friable, departure, excl. VAT, direct delivery:

Early industrial potatoes: mainly 10.00 €/q for the last available volumes; firm market;

Bintje: 10.00 to 12.50 €/q, firm market. The demand comes mainly from peelers.

Fontane and Challenger: no quotation due to a lack of transactions.

Price in veiling/auction of Roeselare (source: REO via PCA): September 9th: weighted price (red and white) for the hand-picked production: 0.21 €/kg excl. VAT. Approx: 19 t.

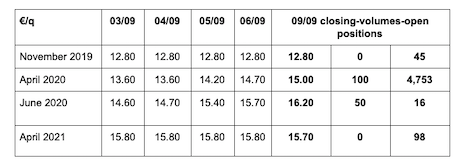

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm+:

France

Yields below the multi-year average (source: UNPT/CNIPT):

240 plots sampled in weeks 33 and 34 showed an average yield of 40.2 t/ha, compared to 42.2 t/ha of multi-year average. The yield had progressed by only 6.1 t/ha in 2 weeks, or 435 kg/ha/day (irrigated and dry plots, all varieties).

Netherlands

(Very) few transactions on a wait-and-see market, influenced by the slow increase in final yields observed in the main producing regions. The factories continue to show prices of 10.00 €/q, but without much buying activity. Offer is limited given the firm market and the persistent drought. The actual transactions observed are between 10.00 and 14.50 €/q, depending on the variety and destination. Export remains active, and the slightly higher offer is easily absorbed by the demand from Poland, Romania, the Caribbean, Africa and the Middle East, between 18.00 and 20.00 €/q, calibrated in big-bags or departure bags.

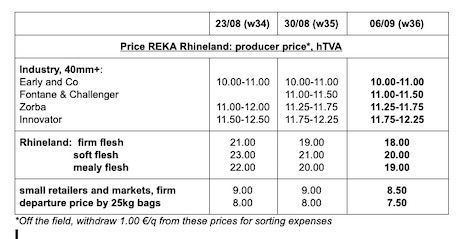

Germany

The early potato season is (almost) over. Decreases on the fresh market, firm flesh at 21.17 €/q last week and soft & mealy flesh at 19.83 €/q. Demand from Poland, Czech Republic and Romania.

Prices unchanged on the procession market, stable prices between 10.00 and 11.00 €/q for the early industrial potatoes, between 11.00 and 11.50 €/q for Fontane/Challenger, between 11.25 and 11.75 €/q for Zorba and between 11.75 and 12.25 €/q for Innovator.

Organic potatoes: the price of organic potatoes is higher than last year.

Great Britain

Average AHDB price, free markets week 35 (ending on August 31st): 16.25 €/q (compared to 17.54 €/q (all varieties, all markets) in week 34).