The Bonduelle Group's revenue for FY 2018-2019 stands at 2,777.1 million euros, unchanged from the previous year, demonstrating the resilience of the group in a fragile consumption climate affecting several areas.

The acquisition of the Del Monte brand, contributing to the revenue and profitability of this FY, coupled with the acquisition of packing and processing capacities for the frozen segment in the US and in Russia confirm the ability of the group to selectively grasp the opportunities offered in a very challenging economic environment.

Global Revenue

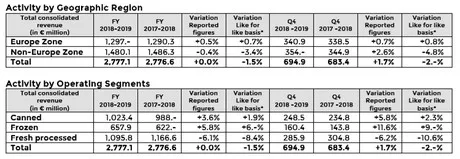

The group's revenue at the end of the financial year (July 1, 2018 - June 30, 2019) stands at 2,777.1 million of euros, stable when compared to last FY reported figures. This change encompasses the contribution of the Del Monte business activities acquired at the beginning of the FY (+1.2%) and the net impact of exchange rates (+0.3%). The negative growth on a like for like basis* (-1.5%) is fully explained by the evolution of the fresh operating segment in the US, the other operating segments of the group posting a +2.8% growth at constant scope of consolidation and exchange rates.

Revenue for Q4 recorded a growth of +1.7% based on reported figures and -2.-% on a like for like basis*.

Europe Zone

The Europe Zone, representing 47% of the revenue of the group, was up +0.5% on reported figures and +0.7% on a like for like basis* on full year. Growth for Q4 stands at +0.7% on reported figures and +0.8% on a like for like basis*.

The retail sales for the Bonduelle and Cassegrain brands continued to grow in terms of volume and revenues for the various operating segments - canned, frozen, fresh ready-to-use and fresh ready-to-eat - despite sluggish markets. The group is thus strengthening its market shares thanks to the various innovations - launches and pan-European deployments - in the plant-based food sector, by combining vegetables, cereals and pulses available in various forms and targeting the different consumption moments.

Non-Europe Zone

The Non-Europe Zone, representing 53 % of the revenue of the group, was down -0.4% on reported figures and -3.4% on a like for like basis* for FY 2018-2019.

This change is explained by the sourcing diversification of a major client in the fresh business activity in North America recorded since the 2nd quarter of this FY, and by the product portfolio rationalization (cessation of fruit cutting and decrease of bagged salads). The canned and frozen activities of this zone, on the other hand, recorded solid growth, fuelled by internal growth and the acquisition of the Del Monte brand in Canada, which is performing in line with the expectations. Additional packing capacities have been added to the frozen operating segment via the acquisition of the Lebanon site (Pennsylvania - USA).

The Eurasian Zone (Russia and other CIS countries) recorded a very dynamic business activity over this FY, thanks to the introduction of successful innovations - young corn range, range of prepared vegetables in jars (investments in a jar line), canned olives - momentum which is going to be strengthened, as early as next FY, by the frozen activity locally produced, via the acquisition of the Belgorod plant (Russia).

Highlights

Acquisition of a frozen plant in Russia

On June 3rd 2019, the Bonduelle Group announced the acquisition of the industrial assets of the LLC SHOCK frozen vegetable production company, based in the area of Belgorod (Russia).

Located in a reputed agricultural region - temperate climate, particularly fertile soils (black central soils) - this industrial site will accelerate the development of the Bonduelle frozen activity in the above mentioned markets through a high quality production.

This production tool, whose initial acquisition cost (circa 7 million of euros) and additional investments remain limited, will ensure an annual production from 6,000 to 10,000 tonnes of frozen vegetables. Circa 50 permanent employees will work at the site and Bonduelle will partner with the local agricultural community, developing its know-how in environmentally friendly agricultural practices.

For the full press release on the financial results, please click here.