European physical markets

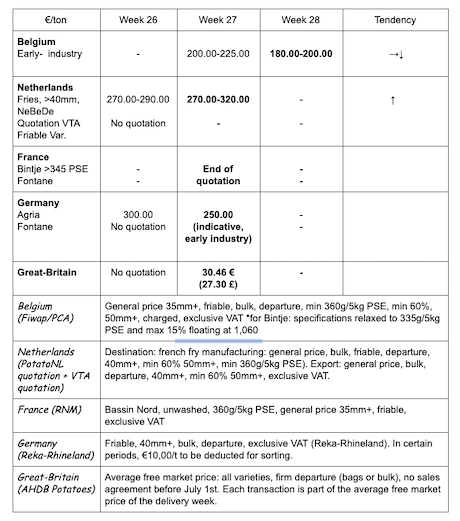

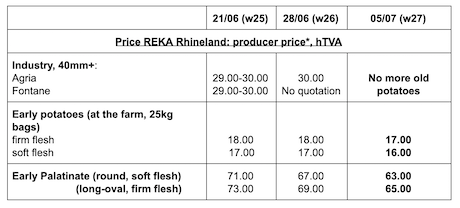

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Early industrial potatoes: the market is fed both by early potatoes from around Bordeaux (often produced by Belgian farmers; with Première and Innovator, with very variable yields and qualities (some disappointing for less than 30 t/ha and some good quality above 40 t/ha, with PSE limit at 360 to 400 gr/5kg)), and some early potatoes from Rhineland and western Flanders.

Price for all comers, 35 mm+, min 60% 50 mm+, PSE min 340 g/5kg, bulk, friable, departure, excl. VAT, direct delivery: 18.00 to 20.00 €/q.

The market is considered stable, without any excessive offer given the uncertain context due to the dry weather forecast in the short and medium term. The demand is limited by the preponderance of contracts. Most observed yields exceed 35 t/ha. PSE levels are high (380 to 400 gr/5kg). The first planted and dug patches will be nicer, because the ones planted late received less water or benefited less from it. In case of irrigation, the yields are around 40 t/ha, which shows the precocity of the season, and a risk of shortage 3 weeks from now, if the weather stays dry.

Price in veiling/auction of Roulers (source: REO via PCA): July 8th: weighted price (red and white) for hand-picked potatoes: 0.27 €/kg excl. VAT. Approx: 21 t.

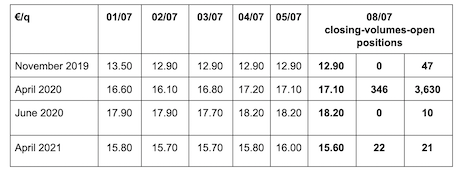

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm+:

The forward market is struggling to go over 17 €/q for the April 2020 deadline. The weather is dry, the stocks of old potatoes are (almost) finished, and we start to realize the harvest of early potatoes from Bordeaux, Germany and Belgium (because of the drought, or grubbing too early due to the pressing demand), the higher number of plots over the NEPG area (UE-05), tuber sets are often high and the irrigation capacities were somewhat extended. All of this tempers the prices. The current situation is volatile, with a “weather forecast price” which could become more important.

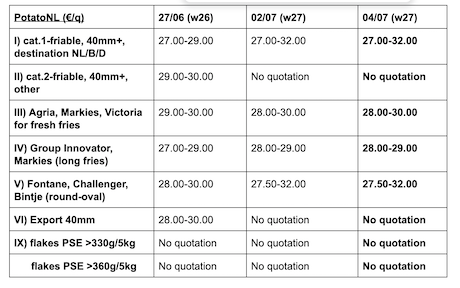

Netherlands

Quotation PotatoNL: also available on www.potatonl.com

France

End of campaign, end of quotations for old potatoes.

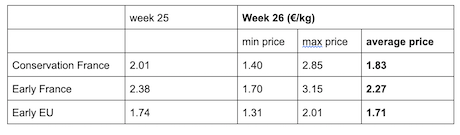

Wholesale market/wholesale departure for organic potatoes:

Germany

The early potatoes of Lower Saxony and Palatinate were quoted at 63 €/q for the soft flesh/round varieties and at 65 €/q for the firm flesh/salad varieties. The first skin potatoes from Rhineland arrive this week. As for potatoes for the industry (fries), the first price indications were around 25 €/q last week.

Globally, the drought is starting to do some damage (limited yields, quality problems due to the heat), but where there is irrigation, the yield prospects are high.

The heat (104°F in the southwest (Bade-Wurtemberg)) and the drought temper not only the consumption (see last week’s message), but also the yields and calibers. There will be no record yields. In some cases, because of the tuber sets (too high), there are not enough big potatoes and/or maturity is delayed. The early for fries/chips leave very quickly to the conversion industries, including 10,000 t last week. Most transactions are done based on pre-seasonal contracts.

Great Britain

Average producer price (all markets) week 27: 30.46 €/q (compared to 27.03 €/q in week 25 for old potatoes) for “white varieties for frying”

Irrigation is under way everywhere possible, the dry matter progresses in the early varieties for fries and chips, and prices are dropping dramatically. From week 26 to week 27, the prices of friable varieties (in the east) such as Daisy or Amora went from 50.76 to 35.70 €/q (Daisy) and from 50.76 to 33.46 €/q (Amora). Prices are dropping because the offer is increasing and the demand remains limited.

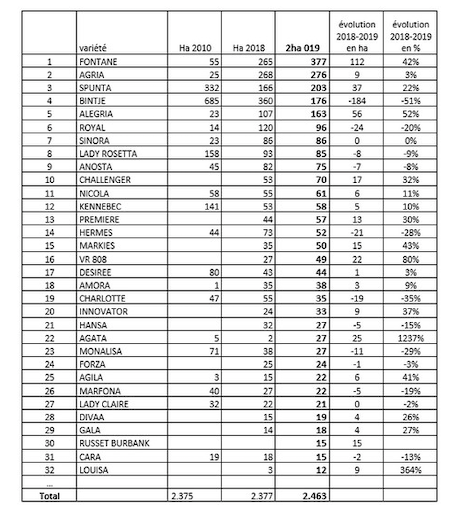

Evolution of plant propagation areas for the main varieties in Belgium

Sources: SPW/DGARNE; Vlaamse overheid/Departement Landbouw en Visserij; Fiwap compilation.

Of the “top 10” of 2010, only 4 varieties remain! Bintje goes from 1st to 4th, and loses 50% of its surfaces. Spunta, which was always 2nd, moves to the 3rd position. Lady Rosetta, the ultimate crunchy potato goes from 3rd to 8th, and Fontane which used to occupy the 9th position is now “number one”.

Fontane, Agria, Spunta, Bintje and Alegria make up the top 5 of the 2019 ranking, very different from 2018 because of the large variation of the plots for all varieties except for Agria. Brintje drops down from 1st to 4th position (-184 ha, which is -51%). Fontane replaces Bintje at the top of the ranking. Alegria (fresh market) and Royal (fries) exchange places 5 and 6 as one goes up and the other goes down.

Globally, we observe that few varieties have a single-digit trend, whether upwards or downwards. This is partly because cultivated surfaces are low, giving significant changes in percentage.

Among the strongest growths, we find Agata (fresh market; +1,237%), Louisa (a variety for chips from the varietal creation program of CRA-W in L’mont, with a good resistance to late blight; +364%), VR808 (another variety for chips; +80%). Regarding the declines: Bintje (- 51%), Charlotte (- 37%).

Among the (re)-appearances of 2019: Russet Burbank (15 ha).