On 4 June, South African investors got an unpleasant surprise. The South African economy shrank by no less than 3,2% in the first quarter. This is according to reports in Bloomberg. This drop is far more than economists initially predicted.

On 4 June, South African investors got an unpleasant surprise. The South African economy shrank by no less than 3,2% in the first quarter. This is according to reports in Bloomberg. This drop is far more than economists initially predicted.

Their average expectation was a decline of 1,6%. This unexpected reduction means the South African Rand (ZAR) also lost value. It fell by more than one percent against the dollar. The agricultural sector in South Africa was the worst hit. This sector shrank by 13%.

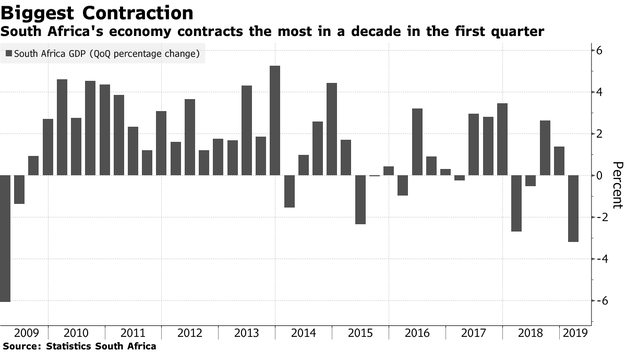

How the South African GDP developed over the last ten years.

How the South African GDP developed over the last ten years.

Eskom is mostly to blame. This state-owned company supplies the entire country with electricity. South Africa is experiencing more frequent power cuts. This is due to mismanagement, corruption, outdated facilities, and billions in debt.

These electricity failures affect other sectors in the country, such as mining and industry. The trade war between China and the US also played a role. It has had a significant impact on South Africa's economy.

This is unfortunate for the current president, the ANC's Cyril Ramaphosa. After all, one of his election promises was that the economy would recover. This, while, in the latest elections, the ANC achieved its worst results since 1994.

The hope is now that the South African Reserve Bank will cut the interest rate. In May, they were still clinging to a rate of 6,75%. However, thanks to these economic results, more people are in favor of lowering the rate.

Source: Financial newspaper, Bloomberg