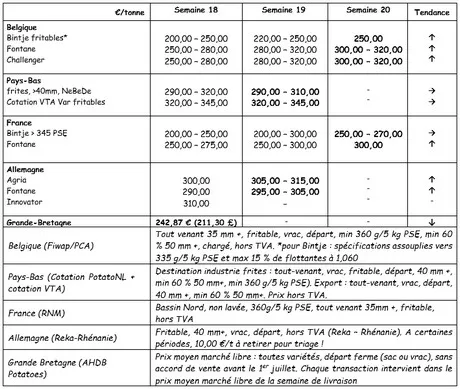

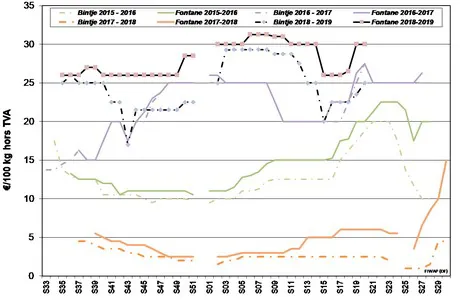

European physical markets: price summary (source: NEPG):

Belgium

Message from the Fiwap / PCA markets :

(Very) little supply (low stocks) compared to good demand from exports (Southern and Eastern Europe) and industry (several factories remain buyers for immediate delivery).

Fontane: 30.00 to 32.00 €/q, most common price at 30.00 €/q, firm market ;

Challenger: 30.00 to 32.00 €/q, most common price at 30.00 €/q, firm market ;

Bintje : "french fries quality": max 15% floating at 1060 g/l and PSE min of 335 g/5 kg, sufficient size and good cooking colour: mainly 25.00 €/q, firm market. Demand for peeling is still high, supply is very limited, french fries quality of potatoes are becoming rare.

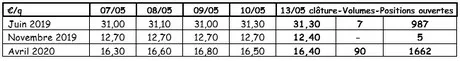

Futures market

EEX in Leipzig (€/q) Bintje, Agria and related transformer var., 40 mm+, min 60% 50 mm +:

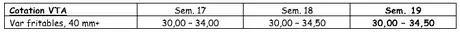

Netherlands

The volumes traded freely for the industry are very low but the price trend remains clearly firm. Quotations have changed only slightly over the past week, some have fallen slightly, while the "Agria" category has increased the most, gaining more than €1 per square metre. Actual transactions range from 30 to 34 €/q for processing, and up to 37.50 €/q for the internal fresh market. Export trade continues to Eastern and Southern Europe, based on 30 to 34 €/q (in bags) for basic quality, 35 to 40 €/q for washable quality and 40 to 45 €/q for Agria 55 mm+ for Spain, Italy or Portugal. In the fields, plantations have been completed and last week's rains have been insufficient to ward off the risk of drought. The forecasts for the next 7 days do not announce any or little rainfall.

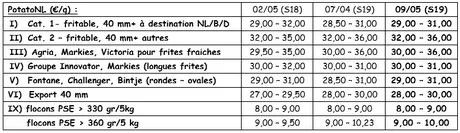

PotatoNL quotation: see also on www.potatonl.com

France

For industry, demand is higher in markets described as quiet. Quotations have strengthened this week with a real price increase for Fontane and other specific varieties. Actual transactions vary within a fairly wide range of €27.50 to €32.00/q, except for Bintje, which remains at a lower level. On the export side, prices remain firm but trade is greatly reduced by the lack of stocks. The end of the season is coming. In the fields, the plantations are finished, many discussions revolve around drought. The departments of the Hauts de France are on alert (North) or vigilant (Pas-de-Calais).

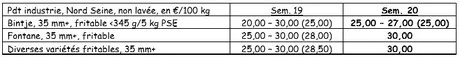

Unwashed industrial potato, bulk, departure, VAT excluded, Nord Seine, €/qt, min - max (average) (RNM) :

Germany

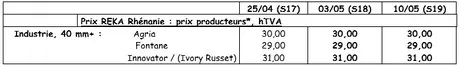

On the fresh market (Rhineland), end of quotations. Prices for the last quotes were up. The market is supplied by the latest indigenous people, French productions and more and more imported / introduced early adopters... The first indigenous early adopters of Baden-Württemberg were quoted at 30 €/25 kg (120 €/q). In potatoes for industry (French fries), prices vary greatly depending on quality. These range from 24 €/q for problem lots to 34 €/q for beautiful Agria for export. Incremental prices for sinterable products: Agria between 30.50 and 31.50 €/q, Fontane between 29.50 and 30.50 €/q.

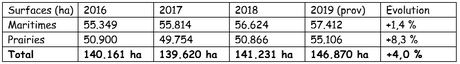

Overall, we expect surfaces to increase.

*During the field start period, you must withdraw 1.00 €/q at these prices for sorting costs

*During the field start period, you must withdraw 1.00 €/q at these prices for sorting costs

Great Britain

Average producer price (all markets combined) week 18: 24.29 €/q (compared to 26.63 €/q in week 17).

Canada

Increase in surface areas in 2019 (source: Stats Canada/NAPM via VTA Nederland): the expected increase is around 4%, according to provisional figures. The Eastern Provinces (Maritimes) cover most of the area (over 57,000 ha), but the increase is highest in the western part of the country (Prairies), with +7.6% and +10.3% respectively in Manitoba and Alberta due to the significant increase in processing capacity. Plantations are very advanced in the west, and late in the east due to cold and wet weather.

For more information:

FIWAP

www.fiwap.be