Belgium

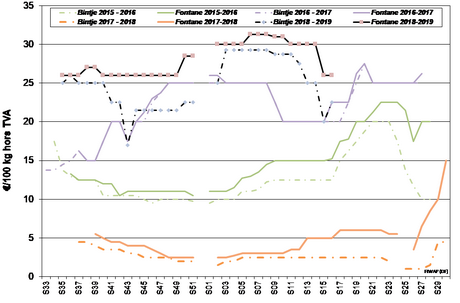

Fiwap/PCA market message:

Industrial varieties: still few transactions on markets that are looking for a new balance.

Fontane: 25.00 to 27.00 €/q, stable. Little industrial demand, low offer (mainly because of work in the fields);

Challenger: mainly 25.00 to 27.00 €/q, stable;

Bintje: “friable quality”: max 15% floating at 1,060 g/l and PSE min 335 g/5 kg: 20.00 to 25.00 €/q depending on quality and destination, calm market. Almost no industrial demand. On the other hand, the trade is buying for export (southern and eastern Europe), to compensate for shortage in contracted delivery, or to deliver to the peelers.

European physical markets

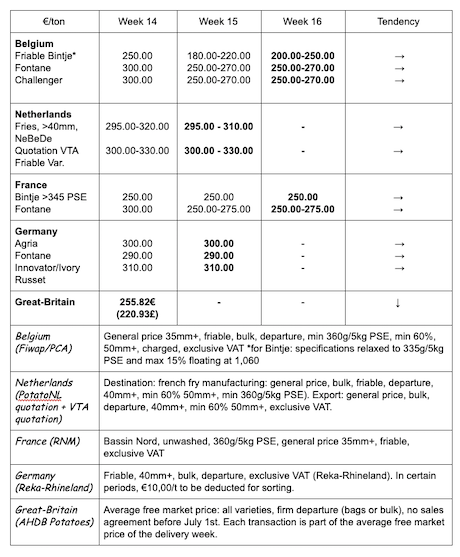

Price summary (source: NEPG):

Bintje plant: Dutch plant, class A, returned April 2019, by 5 tons, in bags, hTVA: prices still down.

Caliber 28-35 mm: 45.00-55.00 €/q

Caliber 35-45 mm: 25.00-35.00 €/q

Caliber 35-45 mm: 25.00-35.00 €/q

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm+:

Netherlands

The recent real transactions remain between 28.50 and 30.00 € for immediate industrial trade, and up to 34.00-35.00 €/q for Agria for peeling or delayed delivery (May). The price decline is more moderate than in Belgium. Work in the fields will limit the offer in the coming days, but the factory activity will also slow down because of the holidays around Easter. Export is difficult, with a demand still present of West Africa and eastern Europe, as well as very discussed prices. Price departure in bags between 27.00 and 30.00 €/q. On the domestic fresh market, the preparers are still on the old harvest because the offer of early Mediterraneans (Israel, Egypt, Cyprus) is low and expensive (0.60 to 0.75 €/kg).

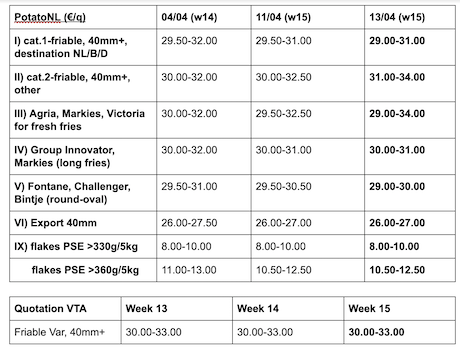

Quotation PotatoNL: also available on www.potatonl.com

France

For the industry, the demand is still very low and the offer hesitant. No change in prices in the past few days on a calm market. On the contrary, the fresh markets are very firm, thanks to a better demand for export (Germany, Italy, Spain and eastern Europe) while stocks are now (very) low. Prices are up for the red varieties at 35-40 €/q (40 mm+, in big-bag) for the washable quality, the washable Agata between 38.50 and 45 €/q, and the firm flesh at 40-45 €/q.

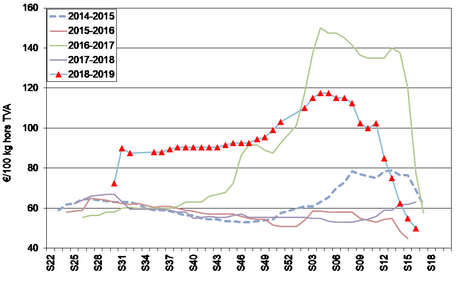

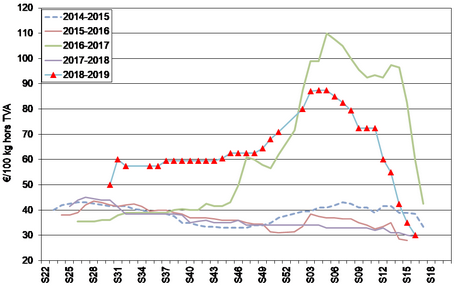

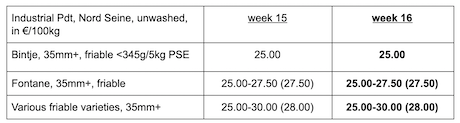

Unwashed industrial potato, bulk, departure, hTVA, Nord Seine, €/qt, min–max (moy)(RNM):

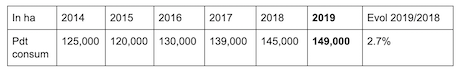

Estimation of surfaces 2019 (source: Agreste): Agreste estimates the French surfaces for consumption potatoes (excluding plants, starch and early) at 149,000 ha, up 2.7%. The needs of the neighboring Belgian factories are at the basis of this increase.

Germany

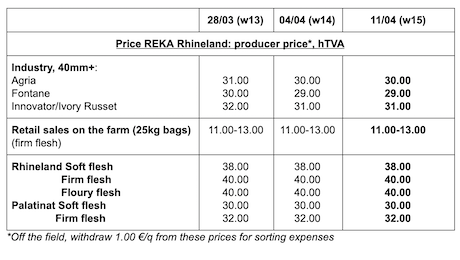

On the fresh market (Rhineland), on April 12th, prices were stable for firm flesh at 40 €/q for the storage output refrigerated crates, and for soft flesh at 38 €/q for storage output refrigerated crates. For the firm flesh sold at the farm (Rhineland), firm prices between 11 and 13 € per 25 kg bag (slight increase).

Imported early potatoes: for the purchases related to the Easter holiday, large retailers have started to turn slowly to the early Mediterraneans: from Egypt, returned between 60.00 and 65.00 €/q and from Israel between 70.00 and 75.00 €/q. By the end of May, the transition between the old and the early potatoes will be complete.

Organic early potatoes: organic potatoes from Egypt around 85.00 €/q returned, and from Israel between 85.00 and 90.00 €/q returned. We expect the first potatoes from Spain around mid-May, with higher volumes than in 2018, thanks to a surface increase and good growth conditions.

Great Britain

Average producer price (all markets) week 14: 25.58 €/q (26.53 €/q in week 12). For the domestic market in bags, preparers seem to have enough potatoes and the downward pressure on prices is significant. Only the prices of the superior quality are progressing, while the offer of lesser quality is developing. The wholesale (bags) and industrial markets are almost inert. Export to the continent continues.

Planting was interrupted last week because of the rain (or even snow) in the south and the west of the country. They could continue in the east (where rain would be welcome!), but the cool temperatures (cold, frost at night) are slowing down the lifting. The availability of plants is a source of constant worry, and the quality of some batches is subject to discussion.

For more information:

FIWAP

www.fiwap.be