Belgium

Fiwap/PCA market message:

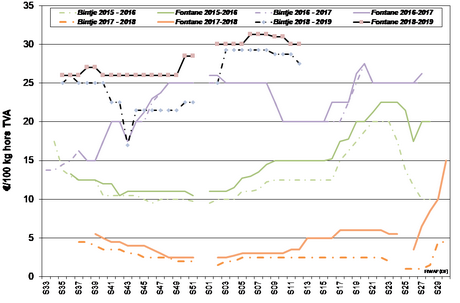

Industrial varieties: very few transactions on the markets, which are even calmer than in the previous weeks. Many buyers are waiting, which reduces the industrial demand. There is some offer, mainly for Bintje, but also for other varieties, which is sufficient to cover the current demand.

Fontane: mainly 30.00 €/q, calm;

Challenger: mainly 30.00 €/q, calm;

Bintje: “friable quality”: max 15% floating at 1,060 g/l and PSE min 335g/5kg: 27.50 to 30.00 €/q depending on the quality (PSE, cooking…), the caliber and the buyer. Most practiced price at 27.50 €/q. Calm market.

European physical markets

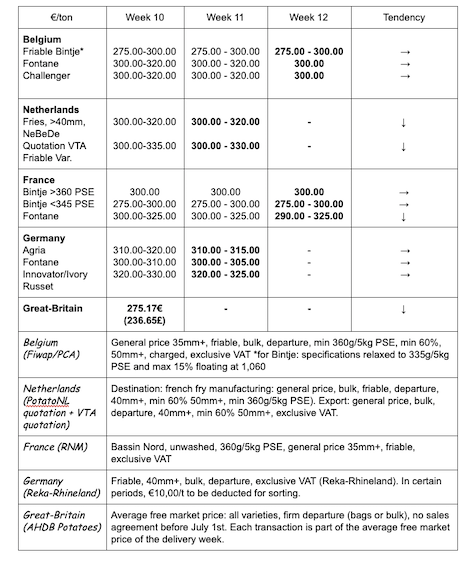

Price summary (source: NEPG):

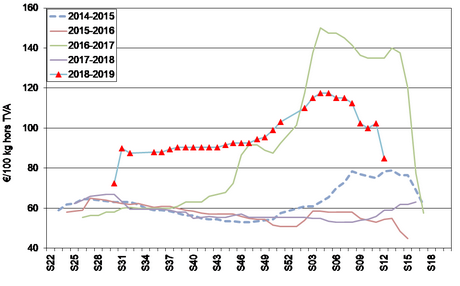

Bintje plant: Dutch plant, class A, returned March 2019, by 5 tons, in bags, hTVA: very little trade due to lack of demand. Prices are going down sharply, but scattering more and more.

Caliber 28-35 mm: 80.00-90.00 €/q

Caliber 35–45 mm: 55.00-65.00 €/q

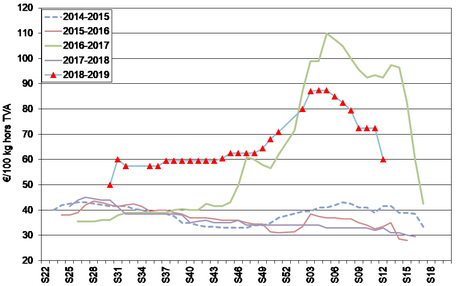

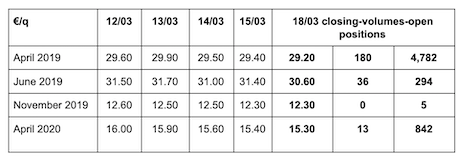

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm +:

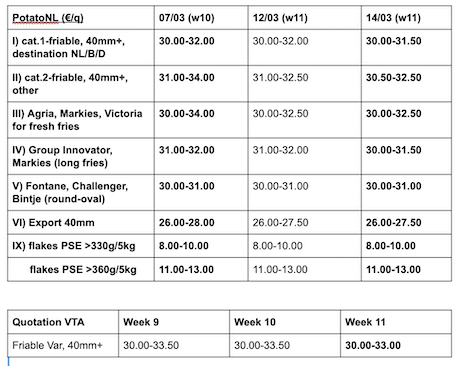

Netherlands

The Dutch industries are not very interested in buying, still being covered by their contracted volumes. No new impulse for the free markets. Some quotations are in decline due to the lack of transaction and show slight declines in numbers. The true transactions still vary between 30.00 and 31.00 €/q for the friable quality of the main specific varieties. Export is difficult given the high prices (30.00 to 33.00 €/q in bags for departure).

Quotation PotatoNL: also available on www.potatonl.com

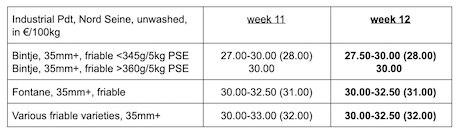

France

Little activity on the market for the industry, with unchanged prices. Some manufacturers make punctual purchases, some are completely absent. The situation for the early potatoes is now watched closely in Belgium, Germany, in the Landes and other early areas in France. Export remains dynamic, especially to Serbia, Romania and Hungary, which makes it possible to evacuate batches of average quality. The top quality is sent to the German large retailers which have difficulties find what they need locally. Prices (calibrated big-bag) are high: washable Agata Cat 1 at 32-41 €/q, washable red varieties at 30–39 €/q.

Unwashed industrial potato, bulk, departure, hTVA, Nord Seine, €/qt, min–max (moy)(RNM):

Record for French export: French export reached 225,000 tons in January, which brings the total over the last 12 months to 2,055 million tons, up more than 250,000 tons (13.7%). This is the highest total since 2010. The main buyers are Spain (+11%), Belgium (+10%), Italy (-7.8%) and

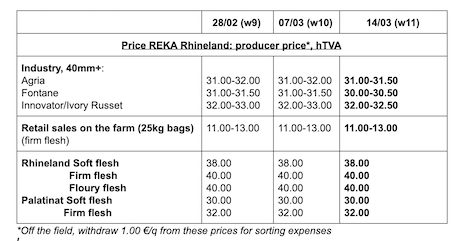

Germany

On the fresh market (Rhineland), on March 15th, prices were stable for firm flesh at 40 €/q for the storage output refrigerated crates, and for soft flesh at 38 €/q for storage output refrigerated crates. For the firm flesh sold at the farm (Rhineland), firm prices between 11 and 13 € per 25 kg bag (slight increase).

Potatoes for industry (fries), prices in slight decline for the friable quality: Agria at 31.00-31.50 €/q, Fontane at 30.00-30.50 €/q, Innovator at 32.00–32.50 €/q.

Great-Britain

Average producer price (all markets) week 10: 27.52 €/q (compared to 28.32 €/q in week 9). Export intensified with first Brexit-related signs in the form of rigorous documentation checks creating long delays. Trade continues towards northern and eastern Europe, on a basis of 23.25 to 25.60 €/q departure for white varieties. Shipments of Maris Piper to Belgium at 23.25 €/q departure. On the fresh markets, despite the low demand, high quality batches maintain their price. The friable varieties are negotiated between 38.40 and 43.00 €/q (calibrated in bags).

British stocks at the end of January at a very low level (source: AHDB). British stocks at the end of January have been estimated at 1.84 million tons, which is 24% less than last year (2.43 million tons), and 5.6% lower than in January 2017.

Fore more information:

FIWAP

www.fiwap.be