Belgium

Fiwap/PCA market message:

Industrial varieties: few transactions observed on the free markets. The demand is globally low, but there are big differences between buyers: some are absent from the market, while others buy everything that is offered. The offer remains limited, given the weak stocks.

Fontane: 30.00 to 32.00 €/q, most practiced price at 30.00 €/q, stable;

Challenger: 30.00 to 32.00 €/q, most practiced price at 30.00 €/q, stable;

Bintje: “friable quality”: max 15% floating at 1,060 g/l and PSE min 335 g/5 kg: 27.50 to 30.00€/q depending on quality (PSE, cooking…), caliber and buyer. Calm market. Highest prices for the nicest lots of very good quality, mainly for fresh fries.

European physical markets

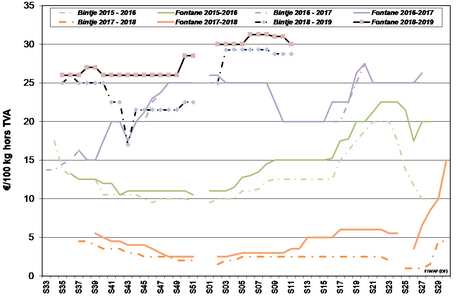

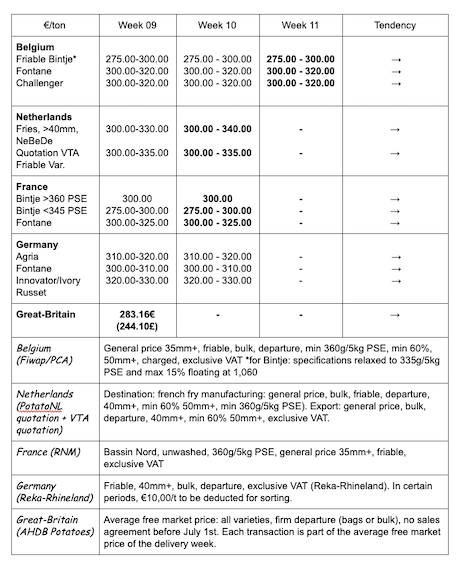

Price summary (source: NEPG):

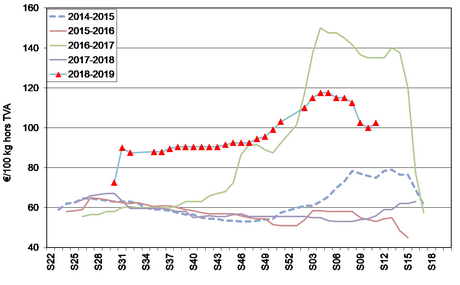

Bintje plant:

Dutch plant, class A, returned March 2019, by 5 tons, in bags, hTVA: very little trade due to the lack of demand.

Caliber 28-35 mm: 100.00-105.00 €/q

Caliber 35–45 mm: 70.00-75.00 €/q

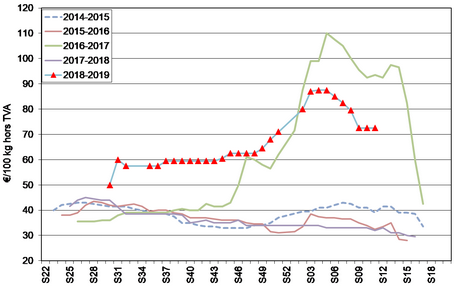

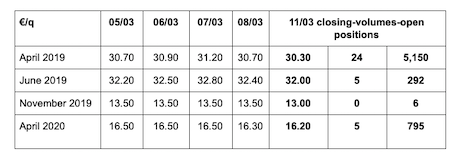

Forward market:

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm +:

Netherlands

The return of a near-winter weather contributed to the stabilization of industrial prices last week. Free volumes are rare, and those who want to buy them must search and discuss...There is however no real increase in prices because this would require a boost of the demand. The main dynamic observed concerns Innovator. The signing of the 2019-2020 contracts is taking place rather easily. The rise in prices has the producers convinced so we do not expect a decrease in surface areas. Contrary to France, Dutch export is very calm, on a basis of 30 to 32 €/q in departure bags. Only Eastern Europe is interested, but it is not sufficient to boost prices.

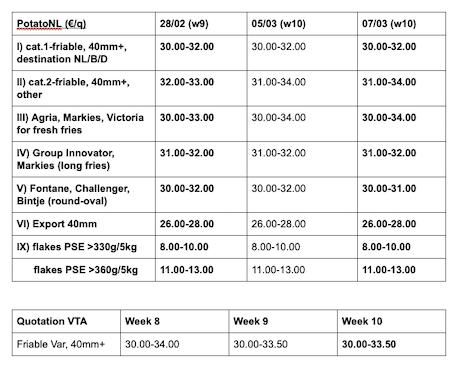

Quotation PotatoNL: also available on www.potatonl.com

France

Sustained and stable prices, for all varieties. But industrial buyers seem to favor their contract supply, which delays the free market prices. The planting of early potatoes started ahead of time in the specialized regions. Export markets are dynamic, with high prices on some batches, and regular volumes on Eastern Europe and Portugal. Prices are becoming an obstacle for some buying countries. The demand continues for friable quality in big-bag. Stocks at the French producers are (very) advanced, which raises questions for the end of the season in several regions.

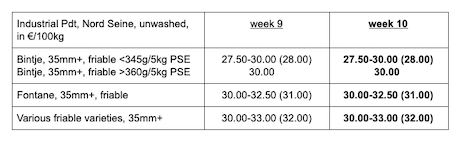

Unwashed industrial potato, bulk, departure, hTVA, Nord Seine, €/qt, min–max (moy) (RNM):

Stocks at the producers at the end of January (source: UNPT/CNIPT): stocks at the end of January are estimated at 1,750,000 tons, compared to 2,400,000 t last year, and 1,994,000 t in 2017. About 62% are intended for industrial conversion.

Germany

After a great start (2-3 weeks ago already…), the planters are now waiting for the nice weather to come back in order to continue to plant their early potatoes. And with the predicted rain, this will not happen any time soon..Covering the potatoes has been difficult (or had to be redone) due to the strong winds.

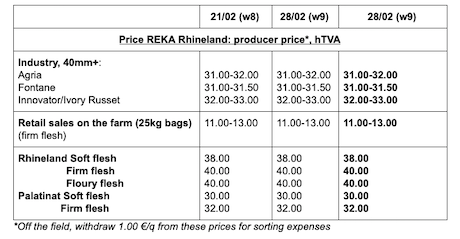

On the fresh market (Rhineland), on March 8th, stable prices for firm flesh at 40€/q for the storage output refrigerated crates, and for soft flesh at 38€/q for storage output refrigerated crates. For firm flesh on sale at the farm (Rhineland), firm prices ranging from 11 to 13€ per 25kg bag (slight increase).

Potatoes for industry (fries), unchanged but firm prices for Fontane: Agria at 31.00-32.00€/q, Fontane at 31.00-31.50€/q, Innovator at 32.00-33.00€/q.

Great Britain

Average producer price (all markets) week 9: 28.32€/q (compared to 28.58€/q in week 8).

Some export activity towards the continent (to Eastern Europe -Poland- and to Spain) on a basis of 15.70 to 23.20 €/q for over-sized Scottish plants, and on a basis of 23.20 to 26.70 €/q (average caliber) for various consumption varieties. We observe some Maris Piper for the Belgian factories at 23.20 €/q departure. This activity helps clear the stocks of average quality. On the domestic market, the friable quality maintains its values at 32.50 to 40.60 €/q, depending on variety and caliber. Very little interest from manufacturers on the free market.

In the fields, planting was very limited last week in Cornwall and the Midlands. The very first planted (Maris Piper and Jazzy) appeared at 100% under plastic sheet, but the growth is very slow. The planting of several varieties (including Premiere for industry) also started in Eastern Europe 2 weeks ago, but was interrupted last week.

For more information:

FIWAP

www.fiwap.be