Belgium

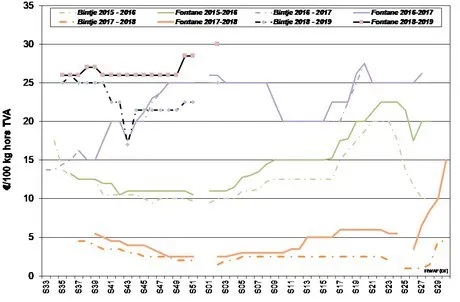

Fiwap/PCA Market Message: markets are more animated since Christmas and prices have gone up. The industrial demand remains active while the offer is limited.

Industrial varieties:

Fontane: 30.00 €/q; firm market;

Challenger: 30.00 €/q; firm market;

Bintje:

• “friable quality”: max 15% floating at 1,060 g/l and PSE min 335g/5kg: 25.00 to 30.00 €/q depending on the caliber and the buyer, with the most common price at 25.00 €/q. Firm market;

• “defective quality”: more than 15% floating and/or PSE <335g/5kg: not quoted. The offer of problematic lots has clearly decreased.

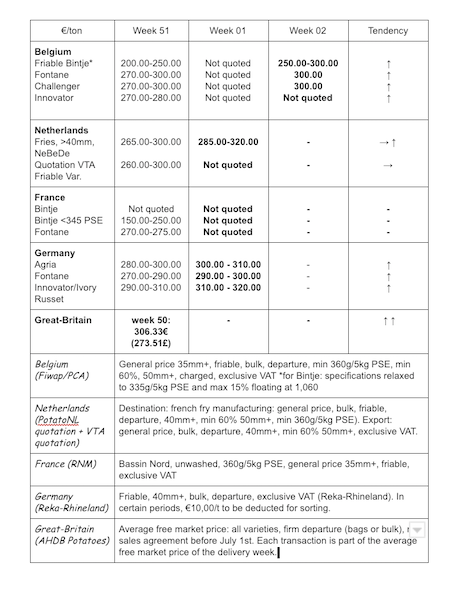

European physical markets

Price summary (source: NEPG):

Bintje plant: Dutch plant, class A, returned March 2019, by 5 tons, in bags, hTVA: firm markets and increasing and progressing prices (inquire very regularly):

Caliber 28-35 mm: around 110.00 €/q

Caliber 35–45 mm: 78.00-82.00 €/q

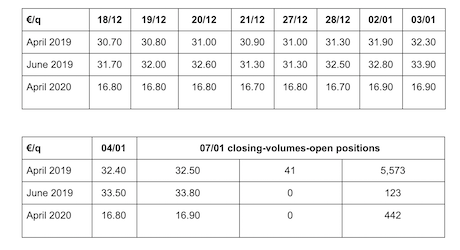

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50 mm +:

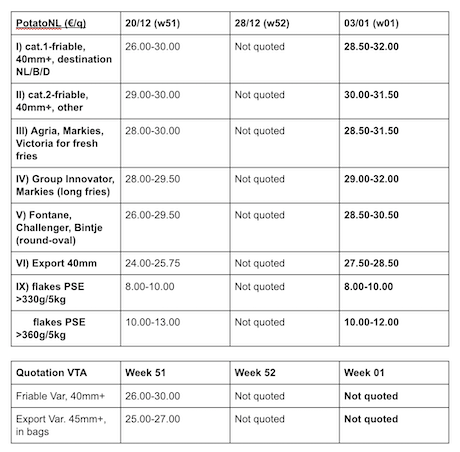

Netherlands

Rising prices on Belgian physical markets forces Dutch industries to adjust their purchase prices. The n.1 category in friable varieties progressed from 0.50 €/q on average to 28.50-32.00 €/q. The Export category jumped from 2.75 €/q to 27.50–28.50 €/q, which slows down trade, especially towards Africa where it currently difficult at more than 30.00 €/q (in bags, departure). On the domestic fresh markets, the firm flesh varieties are sold between 35 and 38 €/q.

Quotation PotatoNL: also available on www.potatonl.com

Dutch exports of fresh potatoes: November in decline (source: NAO): Dutch export reached 59,704 tons last November, which brings the total for the season on November 30th, at 308,678 tons. This is 1.3% less than the previous season. Belgium remains the first buyer with nearly 182,300 tons (52,000 tons more than last year), ahead of Germany (22,200 tons) and France (14,600 tons). Africa imported 38,400 tons, a volume in decline by 50% compared to the 2017/2018 season marked by very low prices.

Dutch industrial processing in November: similar activity to last year (source: NAO): Dutch factories worked 336,500 tons of potatoes last November, just a little less than in November 2017 (339,100 tons). The total over the last 12 months reaches 4,048,700 tons, which is 0.3% more than last season.

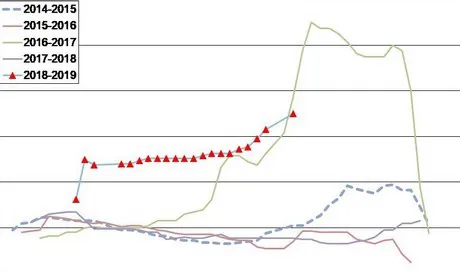

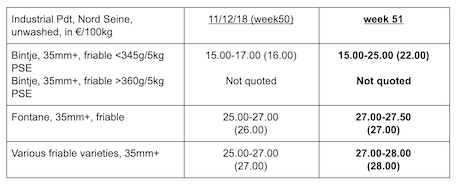

France

Industry: the rise in prices started before Christmas with an average price of 22.00 €/q in Bintje and 27.00-28.00 €/q in the other varieties. The quotations resuming this week should confirm the level of the quotations from neighboring countries, on a market now firm due to the weak offer and the activity of the Belgian buyers. Export: trade to Southern Europe continues towards Italy, Spain and Portugal, as well as to Eastern Europe, with a price around 32.00 €/q (before Christmas) in 45 mm+ in big-bag departure for the friable varieties. We are also expecting firm or even rising prices in those categories, given the good demand for exports.

Unwashed industrial potato, bulk, departure, hTVA, Nord Seine, €/qt, min–max (moy) (RNM):

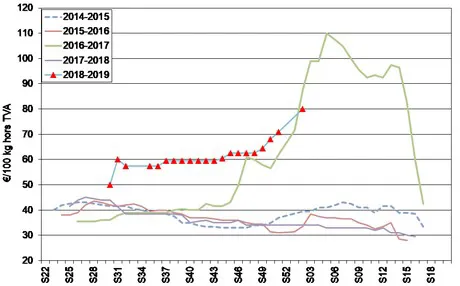

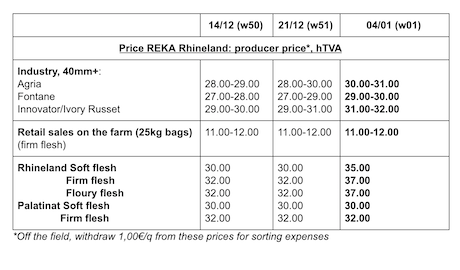

Germany

On the fresh market (Rhineland), on January 4th, strong increase in prices (+5 €/q) for the firm flesh at 37.00 €/q for the storage output refrigerated crates, and at 35.00 €/q for the storage output refrigerated crates for the soft flesh. For firm flesh on sale at the farm (Rhineland), prices ranged from 11.00 to 12.00 € per 25kg bag (unchanged).

Potatoes for industry (fries): prices are again more firm and up! Agria between 30.00 and 31.00 €/q, Fontane between 29.00 and 30.00 €/q, Innovator between 31.00 and 32.00 €/q.

Great Britain

Great Britain

Average producer price (all markets) week 50: 30.63 €/q (compared to 27.51 € in week 49 and 28.94 € in week 48). Despite the short post-holiday week, demand was described last week as higher than usual. Consequently, courses are more firm. The absence of official quotation since week 50 prevents the increase from being quantified, but we are expecting prices to be tight given the weak supply caused by the low production of 2018.

For more information:

FIWAP