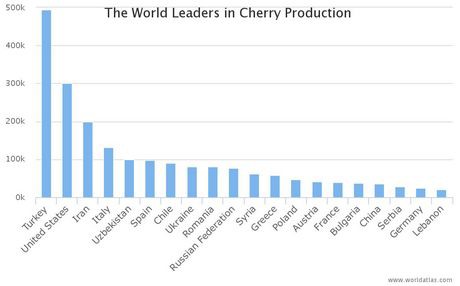

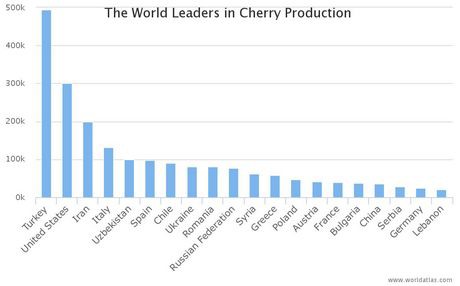

The ranking of largest cherry producers is led by the US and Turkey. However, according to statistics, Russians and Eastern Europeans are the leaders when it comes to the fruit's consumption, followed by other European countries and Latin America. The upcoming season will be challenging. A cool and wet spring followed by a slow start to the summer is likely to cause a clash between the producing countries in the northern hemisphere. In California, Spain, Greece and Belgium, the rain has had a big impact on the harvest. In Bulgaria and Turkey, growers are doing pretty well.

Turkey, the largest producer

Turkey is the world's largest cherry producer. Last year, its harvest volume reached almost 500,000 tonnes. However, in terms of export figures, Turkey ranks third globally. The majority of the exports traditionally go to Russia and the European Union.

The season in the regions at sea level is nearing its end. The cherries have been packed over the past 12 days. The harvest then shifts to the Izmir region, some 600 metres above sea level. These different altitudes make it possible for the season to be extended. After Izmir, the next in line to start harvesting is Afyon, 800 metres above sea level.

As in other growing areas, the volume has been disappointing this year. Consequently, Turkish exporters believe they can take advantage of the room created in the market. In any case, exporters are also facing the closure of the Russian borders this year, and Russia was their main market.

Hail and rainfall, dramatic for Italian cherries

Heavy hailstorms were recorded on 20 May in Apulia. Hail struck the northern region of Bari and rain hit Turi. The latter region is known for its Ferrovia cherries. The rest of the region of Bari, Taranto and Foggia were also affected by rainfall. The losses suffered by the Ferrovia and Conversano are estimated by a grower at 60 to 80 percent. For the Giorgia, the damage stands at 30 percent. In Casamassima and Acquaviva, the last cherries that had survived earlier downpours have also been lost.

The season started early. Prices in Casamassima-Castellaneta stood at 7 to 7.50 Euro per kilo for the Class 1 cherries. Giorgia cherries cost between 4 and 4.50 Euro per kilo.

Cherry cultivation in Apulia accounts for 40% of the entire Italian production. After bad weather damaged some 23,000 tonnes of cherries, the losses were estimated at 90 million Euro. This makes it one of the worst seasons on record for the growers.

In the north of the country, producers are having a great season. The quality is good and the first Durone and More cherries are already available. The demand for cherries comes from the domestic market, but also from the UK, Germany, Austria, Switzerland, Scandinavia, the Czech Republic, Eastern Europe, the Middle East and China.

On the wholesale market of Bologna, the first cherries from Apulia yielded 2 to 2.50 Euro per kilo. Local fruit, from the Vignola region, cost 4 to 5 Euro, with 5 to 7 Euro for the premium quality. The price for Spanish cherries stands at 3 to 5 Euro per kilo. Compared to last week, prices have fallen, but traders are not dissatisfied.

Considerable fall in Greek cherry supply estimated

Due to the high temperatures, the cherry production could be smaller than expected this year. Prospects point to 40,000 to 50,000 tonnes, compared to 80,000 tonnes last year. The Greek industry is investing in new varieties. Over the past decade, some new ones, such as the Star, have been introduced.

UK market difficult

Spanish cherry imports started arriving two weeks ago. The main varieties are the Chelan and Santina. Volumes have been growing in recent days. An importer explains that, in a normal year, the volume imported during this period should be greater, but the rain in Spain has reduced the harvest. As a result, prices are high, which brings demand down. It usually takes a few weeks before consumers become accustomed to having cherries available and for the fruit's purchases to start, but that momentum is now over, and while larger volumes are arriving from Spain, demand is still low. The British season is also having a slow start. It kicked off two weeks later than normal, and according to a trader, it should last until mid-July. In a normal year, the start of the US and Canadian season would follow the British season, but the harvest in those countries has already started. The first volumes are expected for August if British cherries are still on the market.

Rainfall reduces Spanish harvest

In March, the season still looked good. It seemed the harvest was arriving early with large volumes. Then the rain arrived, damaging a large part of the harvest, and the temperature dropped to 14 degrees Celsius, while the normal temperature should be of around 20 degrees Celsius. The cool period delayed the harvest by two weeks.

Spanish cherries currently reach nice prices. Because of the lower supply, prices have been extremely high at the beginning of the season. The rain last weekend took a toll on the harvest in the Jerte Valley. The fruit is currently being harvested in all major growing regions (Tarragona, Aragon, Jerte Valley and Alicante), causing prices to stabilise. Demand is high and stable in the export markets. The main destinations for the fruit are in Europe, but Scandinavia, Hong Kong and Brazil are also important. Colombia has also imported the first Spanish cherries. Exporters fear the competition from Turkey, as the Russian boycott will force Turkish exporters to look for new markets.

Dutch season kicks off with high prices

Only cherries grown in greenhouses are currently available. The cherries from open ground fields will arrive very late this year. The first cherries are expected next week. Normally, the Dutch season lasts between 6 and 8 weeks. Most of the cherries are marketed in the Netherlands, but there are also exports going mostly to Scandinavia. There are more export markets that have shown interest, but trade across the border also has disadvantages. The more distant the market, the sooner the fruit must be harvested. Dutch supermarkets are increasingly opting for Dutch cherries. Besides the sale of loose cherries, small packs are also becoming increasingly popular.

The price is currently high: 2.80 Euro for 250 grams of thick cherries. Smaller sizes cost between 1.60 and 1.80 Euro.

The supply from Spain and France is very disappointing this year. While the fruit would normally arrive in containers, at the moment they are doing so on pallets. Turkey is the most likely to fill this gap in the market. Traders are happy with this situation. Their preference is for the sale of Dutch cherries. Some marketers have been quite critical about the quality of Spanish cherries.

Popular breeds in the Netherlands include the Karina, Kordia and Regina. These varieties account for about 40 to 50% of the total volume. The new cherry varieties are larger, juicier and "even better" than the traditional ones.

The acreage devoted to sweet cherries is now close to 450 hectares, which is twice as much as in 2000. The market mainly demands large cherries, and this year it appears there won't be any issues to supply them.

Belgium: apple growers making the switch

The first cherries are expected to arrive by the end of this month. With favourable weather conditions, the harvest can sometimes start in early June, but this spring has been marked by frequent rainfall in the main cherry-growing areas. It has been estimated that the volumes available at the start of the season will be smaller, but that the production should grow later in the campaign. The cultivation of cherries appears to be popular again. As a result of the Russian boycott, apple producers are under pressure. For these growers, cherries are probably a more lucrative alternative.

French season shortened by late start

The French cherry season started two weeks later than usual. Overall, the quality of the cherries is good, but the volume is smaller than it should be. Prices currently oscillate between 6 and 15 Euro per 4 kilos (a box with four 1 kilo punnets). The Lazare is a very popular variety and its prices are consequently high. The quality of cherries from greenhouses is usually better than that of open ground crops. The majority of French cherries are sold on the domestic market, but there are also exports. In this sense, the UK is the largest market. The season was shortened by this year's late start and it is expected to last until 10 July. Especially in the south, many cherries have been damaged.

Finally a good season for Israel

Israeli cherry growers will enjoy a good season after a period of oversupply and low prices. The warm and dry winter has led to a decrease in production volumes ranging between 30 and 40 percent. The total harvest will amount to around 2,500 tonnes, a sharp decrease compared to the 4,000 tonnes reached in recent years. A kilo of cherries currently costs around 6.50 Euro in the supermarket. Prices are expected to continue fluctuating between 5.50 and 9 Euro per kilo, which is considered a normal price for the cherries. Sometimes, peaks of up to 15 Euro per kilo and lows of 3 Euro per kilo are reported, depending on the production.

The cherry market is attractive, as demonstrated by the growing acreage in recent years. Historically, all cherries are grown in the north of the country, particularly in the Golan Heights and Upper Galilee. However, the crop has been expanding to the central regions around Jerusalem. These regions are warmer, so the campaign starts earlier. The most popular variety is the Burlat. Other major varieties are the Bing, Sam, Chinook, Stella, Heidl and Rainier.

In recent years, the supply has exceeded demand in the local market. Many growers have therefore looked across the border to foreign markets. The season overlaps with the European campaign, which makes exports difficult. Nevertheless, growers have managed to market their early cherries through supermarket programs. The United Kingdom was one of the main clients for their cherries. Furthermore, some 100 tonnes of cherries were shipped to South Africa. Organic cherries are another product with potential, as there is a strong demand for them in Europe. In the coming years, the volume of organic cherries available is expected to grow.

More competition in the Chinese market

About 60 percent of the Chinese cherry cultivation concentrates in the Shandong Province. Other growing areas include Dalian (northern China), Shaanxi and Sichuan. Cherries are popular in this market, as they are often given as gifts. Both imports and the domestic production are on the rise.

The Chinese season kicks off in early May. Yantai cherries are known as American-like cherries, "because the characteristics of this variety are similar to those of the cherries grown in the US. The cherries produced in Sichuan are of a Chinese variety that is usually richer in colour and slightly sweeter.

Last week, Yantai cherry prices ranged between 20 and 40 yuan (2.80 to 5.40 Euro) per kilo. Dalian cherries are better valued, with a price of 100 yuan (14 Euro) per kilo. Prospects pointed to prices being lower this year due to the increasing supply; however, prices stabilised in mid-May. Prices should fall as cherries from Shandong come into the market.

Currently, there are also cherries from Washington on the market. Popular varieties include the Ruby and Bing. These cherries cost around 300 yuan (40 Euro) per 5 kg. The supply will continue until mid-July. Competition on the cherry market has become tougher, as more big companies have decided to import the fruit. Smaller companies are trying to distinguish themselves with their own labels for the cherries. Chile is China's largest cherry supplier. These cherries usually become available around the Chinese New Year, when demand for the fruit is very high. This season, Chile exported 90,000 tonnes to China. Other noteworthy cherry suppliers include Canada, Australia and New Zealand.

Mexico, a growing market for cherries

The climate in the North American country is not favourable for cherry cultivation; therefore, the volume that can be grown in this country is limited to around 10,000 5 kg boxes. Despite this demand for the stonefruit is rising, partly because of its health benefits. Cherries are mainly imported from the northwest of the US, where the season runs from June to September. The peak season takes place during the summer months, but the first cherries hit the market in May.

The market for cherries is growing larger after an introductory period that lasted 5 to 7 years. Last year, 230,000 boxes were imported from the North-west of the United States; a year earlier, this figure reached just 130,000, and in 2014, the volume stood at between 70,000 and 120,000 tonnes. The cherry market is expected to continue growing in the coming years.

Fewer cherries in the United States

The best growing areas for cherries are in Washington, Idaho, Montana and Oregon, in the north western United States. Thanks to a well-developed infrastructure, the US has a good export capacity.

In Washington State, the season started earlier than usual. Although the volumes were small in the first period of the season, they are expected to grow larger later in June. The smaller volume, however, can have a positive impact on the market. The season kicked off with good prices, but ever since they have been in a downward trend. From the third week of June, greater stability in terms of both prices and volume is expected. It has been predicted that the season will finish two weeks earlier than normal.

In California, the prospects were good until the rainfall arrived. Rainwater has reduced the volume from 9 million boxes to 4.5 million boxes.

Canada expects early start

In the Canadian province of British Columbia, the season has started earlier than usual, thus getting closer to overlapping with the season in Washington. It is not considered desirable for Canadian cherries to compete with US cherries, according to a trader. The volume is much smaller. The season is kicking off three weeks earlier than normal, mainly as a result of a mild spring, with higher temperatures than usual. In the south of the province, the harvest volume may be slightly smaller; however, sizes should be large.

Chile finished a difficult season

Last season was difficult for Chile. Volumes were disappointing, partly because of the weather. For this year, a better season is expected. The weather is stable, and the influence of the rain is limited. The harvest starts in November and lasts until January. Demand for Chilean cherries is good, especially from China. Traders also hope to receive good prices.

Every week, FreshPlaza andAGF.nl publish an overview of the market situation of a product in a globalcontext. With these articles we aim to provide a view of a global market shrinkingdue to globalisation. Next week, cauliflower and broccoli will be in the spotlight.