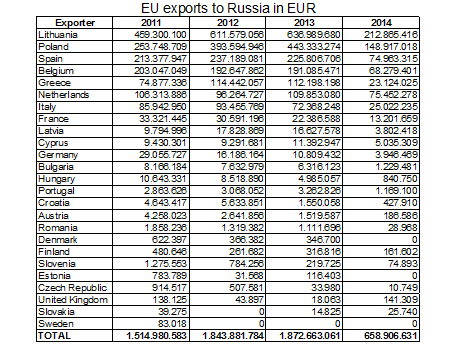

A week ago it was a possible threat, but now the Russian import ban is a fact. How much it will cost is difficult to say, but it will have an impact on the trade for sure. In above overview you’ll find export to Russia of fruit and vegetables per country.

FreshFel

These sanctions are above normal trade risks, according to FreshFel. “We now have to look how we can minimise the effects on the European growers and exporters,” says Frederic Rosseneu from FreshFel. At the moment Freshfel is gathering all info on how big the impact will be. “We hope that the European Commission will show solidarity to the growers and exporters and give appropriate solutions for these companies.”

Poland

Polish apple exporters were bannen a week ago, which will leave them with a big stock. “We hope the situation will change soon. We have no other markets to sell to,” said Ilona Kolacz from Eurosad. With regards to China, she doesn’t expect to much. “We are not developed enough to sell into China.”

France

The peach and nectarine shippers will probably feel the ban, as they export most volume in August to Russia. “It's bad in the short term for summer fruit, but in the long term, I don't know,” said Marc Peyres of Blue Whale, a French apple grower and exporter. Blue Whale doesn't export much fruit during the early part of their apple season, so the situation hasn't affected them yet, and it's not likely it will affect them directly in the coming months. But if the situation continues as it is into January of 2015, when they ramp up exports, the ban will directly affect them.

“What is more problematic is how this will affect the entire European market,” said Peyres. “People are panicking, there will be changing of fruit and more fruit will come from the fresh market into the processed market, so you will have more polished fruit in the processed market. So this will affect more than just direct sales.”

For apple exporters specifically, the ban came on the same day that the World Apple and Pear Association released their 2014 apple forecast predicting a large apple crop. The 11.9 million ton crop is nine percent larger than last year's crop and 12 percent larger than the three-year average.

“The same day it's announced we have a big crop our largest customer, Russia, stops buying, so it's like a Black Thursday,” said Peyres.

The Netherlands

Gert Mulder of the Dutch branche organisation GroentenFruit Huis said that the first 70/80 trucks to Russia were turned back. A similar amount of trucks didn’t even go to Russia and are still at the dock. How big the costs will be is difficult to measure, but it will be serious, that’s for sure. “We have had bans before, but two things are new: that nothing can enter Russia from anywhere in the EU, and it will be for a full year. That has never happened before.”

He fears for at least 10 exporters, who focus mainly on Russia, that “they will be empty handed.”

Belgium

The Verbond van Belgische Tuinbouwveilingen (VBT) isn’t pessimistic. General Secretary Philippe Appeltans of VBT: “For August and September there isn’t a lot of export to Russia. We hope that there will be a solution very soon in the conflict with Eastern Ukraine.” For pears, main important export products from the Belgian growers, there are many opportunities.

Click here for more info on Russia