The production of apples, pears and table grapes is estimated to decrease slightly in the 2022/23 marketing year (MY), based largely on stagnated production area and a return to normal yields following record production for all three commodities. Apple and pear producing regions experienced hailstorms in November 2022 which damaged the crop, while the heatwave in January 2023 in the Northern Cape led to table grape losses. South Africa is self-sufficient in production of deciduous fruits and only imports small quantities to fulfill niche markets or to satisfy demand during the off-season when supply is limited. Lower exportable supply and challenges in port access are forecasted to reduce exports of apples, pears and table grapes in MY 2022/23.

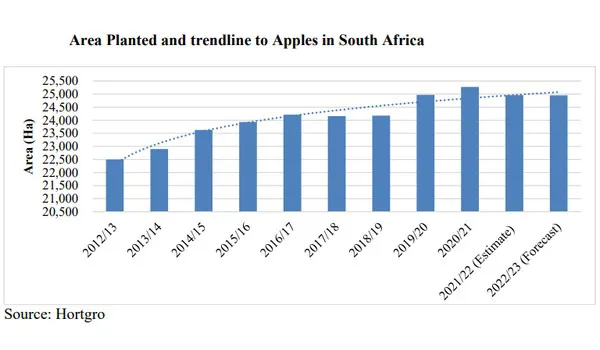

The area under apple production has enlarged steadily over the past decade with an average growth rate of more than one percent per annum (see figure above). This positive trend has been driven by ongoing investments into the deciduous fruit sector on relatively high earnings and improved profitability from export markets. In addition, enhanced cultivars and better farming practices that included investment in netting, resulted in higher yields.

However, despite excellent production seasons the area under apple production in South Africa is estimated to flatten in MY 2022/23 to 24,950 hectares (ha) or almost 36 million apple trees, with negligible new planting. Accelerating farming input costs, elevated costs of packaging materials and storage costs, high shipping rates and depressed markets are diminishing the profitability of apple and limiting continued investment in crop expansion.

Consumption

Apples are popular in South Africa and are widely consumed throughout the year. Hailstorms in MY 2022/23 increased supply of non-export quality apples and apple juice in the local market. High costs of cold storage fueled by loadshedding and pressure on coldstore capacity also contributed to a significant volume of apples (largely goldens) appearing on the local market immediately following harvest. The increased supply and lower prices are expected to drive many South African consumers to apples, an affordable fruit, as they seek options to maintain healthy diets despite high food inflation. As a result, consumption has been revised upwards to 615,025 MT in MY 2022/23.

Click here to read the full report.

Source: apps.fas.usda.gov