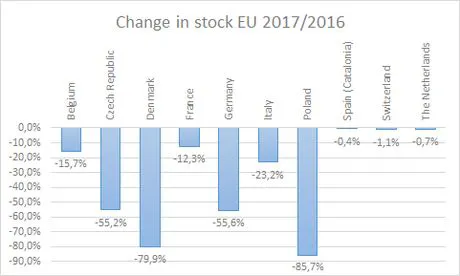

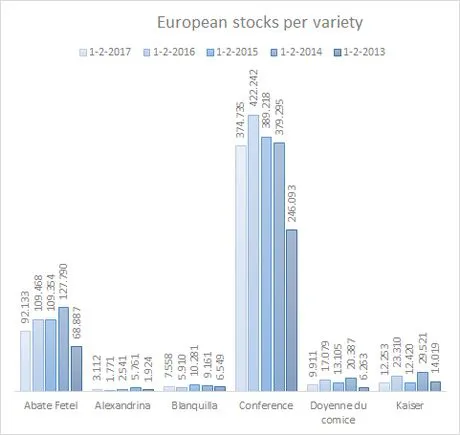

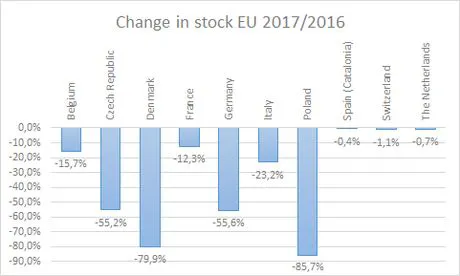

In the northern hemisphere, there are currently pears from storage available. Last month, the World Apple and Pear Association (WAPA) published the updated stock figures. In Europe, stocks are lower than last year, but in the US there are more pears available for sale. In these countries, producers are already preparing for the next season, although it's still too early in most countries to offer accurate prospects.

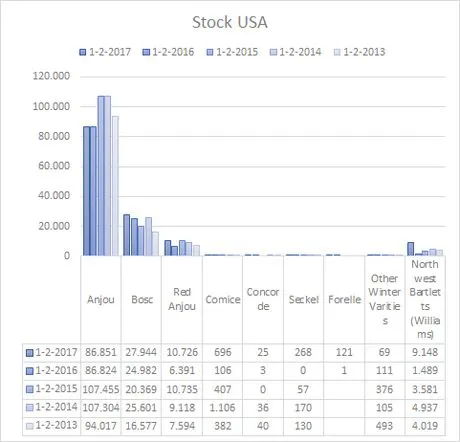

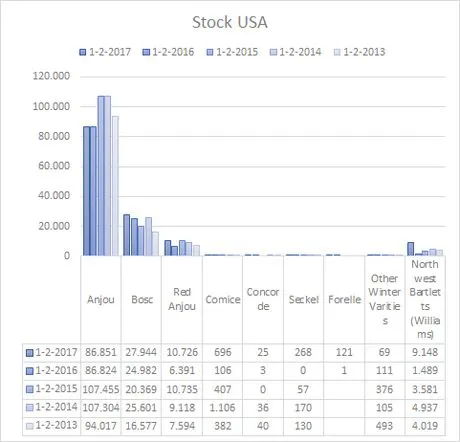

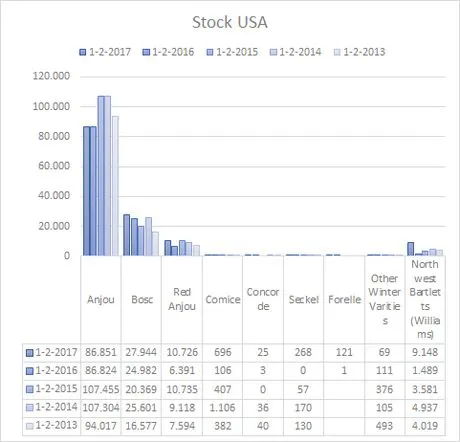

US expects good season

The supply of domestic pears is abundant and remains at a normal level. There are plenty of D'Anjou and Bosc pears available. A trader explains that the season is expected to finish in June. For the Bartlett and Comice, the season is already over, and within days it will also come to an end for the Seckel; however, US retailers want to be able to offer a wide range of pear varieties. Imports from Argentina and Chile usually fill this gap, mostly with Packham pears.

Customers still have a few months to wait before the new harvest, according to a trader. It is expected to kick off no earlier than mid-June. The prospects are optimistic. This winter's snowfall and the high humidity are favourable factors for the growing of pears.

Israel increasingly relying on imports

Another dry winter will probably result in a lower production. About 80% of pears are grown in the Golan Heights and Upper Galilee, in the north of the country. These areas recorded only 40% of the average annual rainfall, so the estimates have been significantly revised. While it is still too early to offer accurate prospects, it is unlikely for the average production of 30,000 tonnes to be reached.

The entire production is intended for the domestic market. The season usually starts in July and lasts for about ten months with the pears from storage. In most years, there are some small imports to fill the gap before the new harvest. Due to weather conditions, the share of imports has increased over the past two years. This year, imports are expected to gain ground. This situation has also taken a toll on prices. Although the price level is still normal, with 1.50 to 2 Euro per kilo, the developments of previous years prove that prices could easily double. There is a chance for a repeat of this situation if imports are insufficient.

Bosnia-Herzegovina scrambles on after tough year

After a cold winter, growers in the Republic of Srpska expect an above-average harvest in the coming season. The acreage stands at 3,000 hectares, with the Williams, Santa-Maria and Abate Fetel as the most common varieties. The Conference and Carmen have also started being planted recently. The sector seems to have already overcome the problems caused by the Russian boycott introduced in the summer of 2016. Although the boycott lasted ten weeks, the damage was severe. According to the Russian phytosanitary service, the certificates were not in order and it was too easy to commit fraud. Last year was a difficult season due to frost in late April, which damaged the crop. Approximately 1,100 hectares were affected and the damage was estimated at between 60% and 90%.

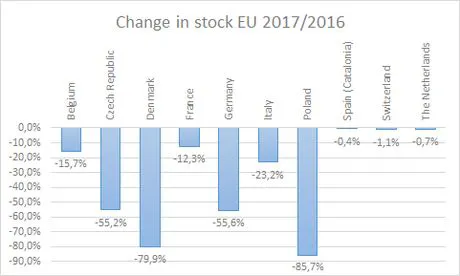

Smaller stocks in Italy

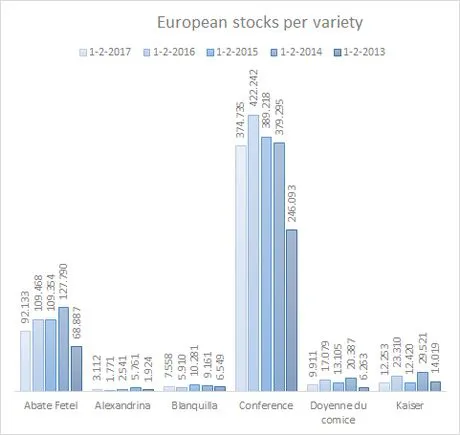

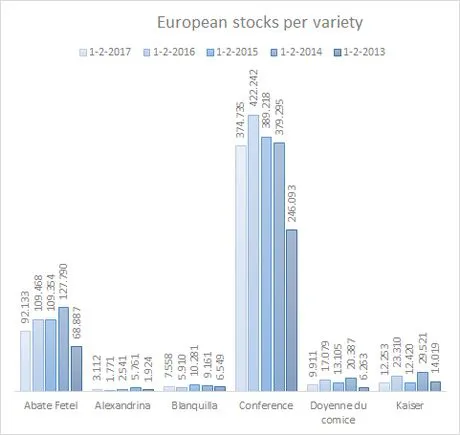

In mid-March, the situation for the different varieties in stock in Italy was variable. The popularity of Kaiser pears continues to fall among European consumers. The stock was about 57% lower than in the same period a year earlier. The season for this variety lasts until late April.

Meanwhile, the volume of Decana pears in storage is about 82% lower than in the same period a year ago. Overall, calibre 75+ is doing well. Besides, a good marketing and reasonable prices contribute to this positive picture. The sale of the Conference has accelerated. The stock is 43% lower than in 2016.

The Abate, the flagship of the Italian pear sector, shows a stable picture. The stock is almost unchanged compared to last year (-5%). There are constant sales, with stable prices and a balanced demand for all calibres. Calibre 75+ is the one preferred by consumers. The good shelf life and quality of the pears also has a positive impact. The export season lasts until mid-April. On the domestic market, pears remain available until late April.

High prices in France

While the stocks of apples are smaller than last year, the situation is the opposite for pears. After a 7% smaller harvest in the previous year, the volume of apples in storage is 6% lower; meanwhile, the volume of pears is 2% greater than in the previous year. In any case, if we look at the long-term average, the stock is actually 11% lower. The stock of Conference pears is 2% lower than last year; however, prices have increased by 12% compared to the average for 2012-2016.

According to figures from the Ministry of Agriculture, the prices at the beginning of the year were 30% higher than in 2015 and 22% above the average for 2011-2015. This was a consequence of the lower production and a good demand; however, due to competition from summer fruit, this trend subsided again.

In the autumn, the sale of Williams pears went well despite fierce competition from Dutch and Belgian Conference pears.

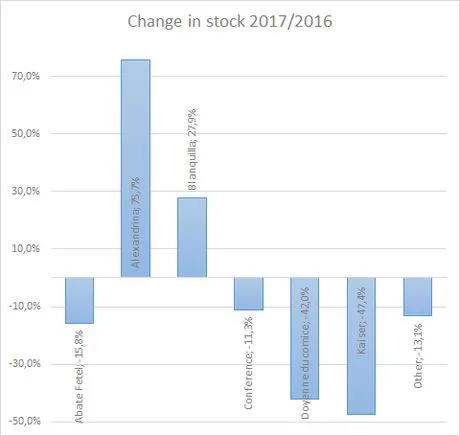

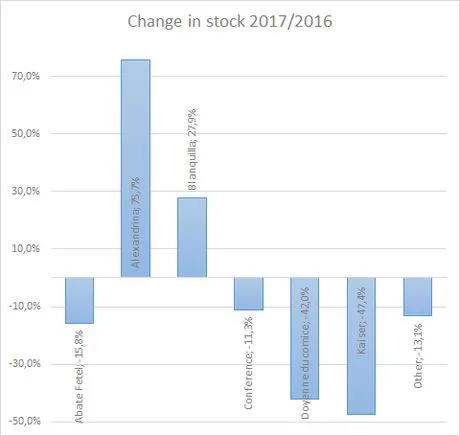

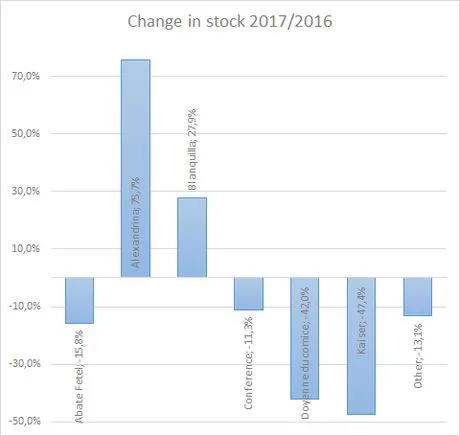

Fewer pears in storage in Spain

Only in the regions of Catalonia and Aragon are there still pears in storage. In total, there are about 40,000 tonnes, 6% less than a year earlier. This is due to the smaller harvest last season, which stood at 295,900 tonnes, when the total volume usually reaches 344.3 thousand tonnes. The largest volume in storage corresponds to the Conference, accounting for 76% of the total, followed by the Blanquilla (13%) and the Alexandrine (6%).

While in Europe there is around 10% less product in stock, prices are slightly lower than in 2016. Recently, the prices have stood at a similar level to last year's. Large sizes are the most popular. This year, Spain imported fewer pears from the Netherlands and Belgium.

The Russian boycott has less serious consequences for the pear sector than for the apple sector. Before the introduction of the boycott, Spain was exporting to 70 countries, and last year Spanish pears were shipped to 73 countries. The main destinations are Italy, Morocco, France, Brazil, Germany, Portugal, Saudi Arabia, Israel, UAE and Poland.

Netherlands: Pear market revived since New Year

The pear market has been achieving a positive development. Early this year, the price of Conference pears went up and has since remained stable. Traders expect the market to remain good. Besides domestic supermarkets, the export market also absorbs good volumes of Conference pears. For the next few months, prices are not expected to change significantly. For long-term storage Conference pears, the flagship for the Netherlands and Belgium, there may be a price rebound in June.