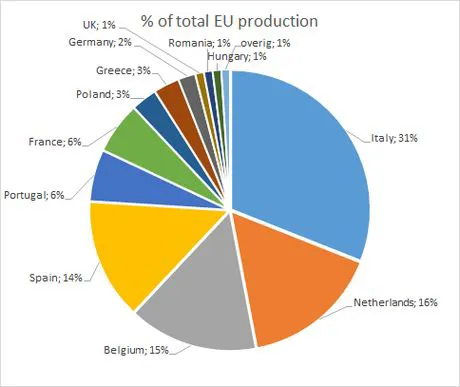

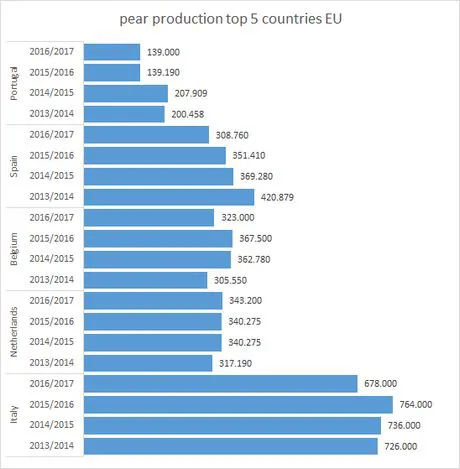

Europe is the second largest producer of pears, only behind China. For the season 2016/2017, the EU's production is estimated at 2.3 million tonnes, down 8 percent from the previous year. With the exception of the Netherlands, the most important producers are all expecting double digit drops. This applies to Italy, Belgium and Spain. The Netherlands, for its part, should record growth.

About 40 percent of Europe's total production corresponds to Conference pears, which are mainly cultivated in Belgium and the Netherlands, with a small crop also in Spain. Other popular varieties are the Abate Fetel, William Bon Crétien/Bartlett and Rocha. The closed Russian border seems to be having a lower impact on the pear sector than it did in 2014. Back then, nearly 60,000 tonnes had to be withdrawn, according to figures from the USDA, while this year the US institution expects only 5,500 tonnes to be withdrawn from the market.

Italy market leader in Europe

The pear production in Italy, leader within the EU, stands at 678,000 tonnes. That's down 11 percent compared to the 2015/2016 campaign and 9 percent below the average of the past three years. The bulk of the production is found in the northern region of Emilia-Romagna, which expects to harvest 448,396 tonnes, a 13 percent drop. Meanwhile, Veneto estimates a harvest of 77,531 tonnes, a 10 percent drop, and Verona expects a satisfactory volume, even though the Abate harvest will be little lower than last year.

This decrease is affecting all varieties. The Abate Fetel is the most widely cultivated pear, but it is under pressure, with many growers switching to the more lucrative cultivation of stonefruit.

In recent years, the demand for pears among Italian consumers has increased by 24 percent. In the first half of this year, demand rose by 7 percent. The domestic market is still the most important market for the pears. Recently, a major campaign has been launched to promote the fruit.

Italy annually imports a little over 100,000 tonnes of pears, although that volume is steadily declining. Last year, imports were 11 percent lower than in 2014. In the first quarter of 2016, this volume has dropped by 5 percent. Imports from the southern hemisphere are under the most pressure. Imports from other European countries, including Spain, the Netherlands, France and Portugal, are slightly increasing. The Spanish and French summer pears are available on the market between July and September. In the months that follow, the Dutch and Spanish Conference pears hit the market, followed by the Portuguese Rocha pears.

Italian pear exports are mainly intended for the European market, which receives about 90 percent of the exports. Outside the EU, Switzerland is the most important market. Recently, some new markets have been added, including Libya, Israel and Saudi Arabia.

The Netherlands benefits from damage in Belgium

The Netherlands expects a slight increase in production, which should reach 343,200 tonnes. That is 3 percent above the average of the past three years. The impact of the larger acreage is partly offset by lower yields. Traders are more optimistic this season. The market picture is similar to that of apples. Exports to the UK, Germany and emerging markets are developing well. Conference pears cost between 50 and 65 cents. It is especially worth noting that small sizes are reaching much higher prices than last season. In recent weeks, the market has seen increasing demand for pears compared to last year. The high Brix values are playing a role in this. The Netherlands is also benefiting from the impact of hail damage in neighbouring Belgium.

Belgian pears hit by hail

Belgium's pear production is expected to fall by 10 percent this year and will be 6 percent lower than the average of the past three years. Low temperatures and high rainfall in the spring have resulted in a lower yield. Furthermore, in June, a number of pear orchards were hit by a hailstorm which caused damage to the fruit.

The prices were low at the beginning of the season, but were still better than the apple prices. Currently, prices are stable. In the next three years, the Netherlands and Belgium will again promote Conference pears on the German market. This action is supported by the European Union. A trader argues that "the most popular pear in Germany is currently the Abate Fetel and we also want the Conference to have a place on the shelves. It is striking how apple consumers are able to choose from so many varieties, but pear consumers don't have as much choice. There needs to be a wider range on the pear shelves. Pears are usually perceived in Germany as a kind of fruit for older people, so we focus a lot on young people and families. There is a huge potential, not only for the Conference. The majority of promotions are carried out in North Rhine-Westphalia, but they are also annually expanded to other federal states. Ultimately, our goal is to reach all of Germany with our Conference pears. We are looking for partners willing to keep these pears on the shelves for the long term."

According to him, Germany is not a solution to the Russian problem. "Russia was buying very large volumes; figures which Germany won't be able to reach for a long time. It is actually good to focus on several countries. The pear industry has now learned that it should not put all its eggs in one basket." He believes that Germany will need the promotions for the long term. "Other European countries will accept certain new features quickly, but Germany is a much more conservative country. If you introduce something new, it takes a long time before it is accepted."

Portuguese Rocha recovered

Although the production has recovered this year after a drop in 2015, the volume is not back to normal levels. The production is expected to be 15 percent greater than last year, when the harvest volume stood 30 percent below average. Every year, some 20,000 tonnes of Rocha pears are harvested, with this being the main pear variety in Portugal. While many pears remain on the domestic market, there are also exports to destinations like the UK, the Middle East, Africa, and Brazil.

Spanish harvest at lowest point

The harvest this year is expected to reach 306,760 tonnes, which is 42,650 tonnes less than in the previous campaign. The production volume is thus expected to stand 19 percent below the average of the past three years, mostly due to the lower yield. Bad weather in the spring in Catalonia and Aragon resulted in a poor setting of the fruit. Moreover, in the last month before the harvest, the crop was affected by the impact of hail. The production of all varieties has fallen. In the coming years, the downward trend in the acreage is expected to continue. Pear growers are gradually switching to the cultivation of stonefruit, which is more profitable.

Mixed results in France

The French government estimates that the harvest this year will be 7 percent lower than in 2015 and reach 130,000 tonnes. The warm month of September has had some impact on the market, but the prices remain stable due to the small supply. In Provence-Alpes-Côte d'Azur, the hot summer has resulted in a smaller harvest. Meanwhile, the harvest in Languedoc-Roussillon has fallen by 9 percent due to frost and heavy rains. In Pays de la Loire, the harvest kicked off a week later. The acreage is under pressure, especially for Williams pears.

The harvest of the Comice in Aquitaine has been 4 percent greater than last year. In Centre, the harvest is just 3 percent lower due to the cold weather and floods in the spring.

After a slow start of the season, demand increased in August. Prices for summer pears (Guyots) were 30 percent higher than last year and stood 22 percent above the multi-annual average. That high price is the result of a smaller production and a good demand.

The high temperatures in September led to pears having to compete head to head with summer fruits. The small supply of the Williams variety resulted in a price 22 percent higher than the multi-annual average. Prices for the first autumn pears remained stable. The price stood 3 percent above the multi-annual average.

Russia is investing in cultivation

Pears are one of the favourite fruits of Russian consumers, according to a large retailer. The sale of pears is also stable all year round. The peak of the season is recorded in early spring, when the supply from the southern hemisphere hits the market. The main varieties in that period are the Vermont and Packham.

Before the Kremlin closed its borders to European fresh products, the Netherlands and Belgium were the country's largest pear suppliers. At present, Serbia has achieved a significant position in the period from January to April. Then we see the arrival of imports from South Africa, Argentina and Chile, which are on the market from April to September.

Despite frost damage in the spring, there are no supply problems in Serbia. The prices are at a similar level compared to last year. The green varieties are the most popular among Russian consumers. Since the boycott in 2014, the country has invested heavily in pear cultivation. Despite these investments and the expansion of the acreage, the production is still insufficient to prevent them from having to rely on imports.

Israeli harvest is satisfactory

The harvest in Israel is as good as complete. Growers are satisfied with this year's production, which is about average. Early in the season, there were concerns about the possibility of a lower production due to bad weather. Now the harvest is expected to reach about 40,000 tonnes, all of which are intended for the domestic market. The largest share of the pears is placed in storage and marketed during the rest of the year. Most pear orchards are found on the Golan Heights and Upper Galilee, where 80 percent of the pears are harvested. Last winter was exceptionally dry, with less than 60 percent of the average rainfall. The region was hit by several heat waves in the spring. This resulted in low estimates, which kept prices high early in the season. At present, the prices are stable at 2.40 Euro per kilo. That is on the high side, but still within the normal range of between 1.50 and 2.50 Euro per kilo. A small volume will be imported this season. The most popular varieties are the Spadona and Cosia, but there have also been some tests with the Canadian Harrow.

The United States prepares for winter season

The pear industry in the northwest of the US reported a harvest of 18 million boxes, which is similar to last year's production. The harvest has already been completed and the pears are in storage. The market is preparing for the arrival of winter pears, with the D'Anjou being the most important variety. Traders are optimistic about the upcoming season and expect the campaign to last until spring and maybe early summer. The market is preparing for a peak period leading up to the holidays, when promotions will play an important role. With these campaigns, consumers should be made aware once again about the fruit's presence on the shelves. Moreover, they should provide clear information about possible uses for the fruit, for example with recipes, as well as about the ripeness of the pears.

The seasons play a role in the demand. Now that summer pears are scarce and winter pears are coming to the market, the D'Anjou, Bosc and other red pears do well.

Pear cultivation costly in Brazil

Due to unfavourable weather conditions, the harvest volume has dropped by 21 percent down to 15,000 tonnes. Pear cultivation in Brazil is small; therefore, the market depends on imports. This small production is to be found in Rio Grande do Sol, Santa Catarina, Parana, Sao Paulo and Minas Gerais. The fruit is mostly sold on the local market, particularly in small towns. A small volume is brought to the wholesale market. Compared to other crops, pear cultivation is a costly undertaking which does not attract new growers. Imports fell last year by 14 percent, down to 179,306 tonnes, compared to 208,346 tonnes a year earlier. The United States is a major supplier of pears.

India, an importing market

The Indian pear market is essentially an importing market. Major suppliers are China, Belgium, Italy, South Africa and the US. The quality of the South African and Australian fruit has been good, according to a trader. Chinese pears, for their part, have suffered some quality issues. However, China's production is available all year round and the country is by far the largest supplier. This concerns varieties like the Ya, Shandong and Nashi. The demand is quite high. One importer stated that they bring 3 to 4 containers per week, and that prices are stable. The biggest challenge, according to this trader, is keeping the right temperature during transport. This means that pears sometimes arrive too ripe in India.

Every week, FreshPlaza and AGF.nl publish an overview of the market situation of a product in a global context. With these articles we aim to provide a view of a global market shrinking due to globalisation. Next week, soft fruit will be on the spotlight.