Based on the data regarding set-weight sales in hyper and supermarkets (which represents 87% or retail sales), it emerged that, between 2012 and 2015, the sector's value increased by 16.8%, while this year a 17.6% growth is expected compared to last year (a little over €100 million).

FreshPlaza's photo report at Sana.

Silvia Zucconi from Nomisma during Ccpb's convention.

The most popular product is fresh fruit (fresh-cut not included) with €79 million and a 5.8% share of the segment, i.e. 37.8% more than 2012 and 26% more than last year.

It is followed by fresh vegetables for a total value of €34 million, an increase of 30% in the past four years and of 17% with respect to 2015.

For what concerns the organic fresh-cut range, there is a big difference between vegetables and fruit. The former is worth almost €17 million and has grown by 47.7 and 20.7% compared to 2012 and 2016 respectively. The fresh fruit sector is worth only €103 thousand and its share is dropping (-85.9% compared to 2012 and -52.4% compared to last year).

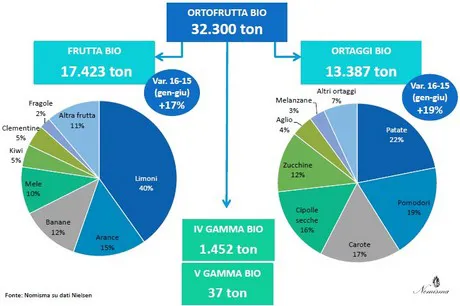

Nomisma data indicate that, between January and June, 17,423 tons of organic fruit were sold - +17% with respect to the same period last year. The most popular products were lemons (40%), oranges (15%), bananas (12%) and apples (10%).

Organic produce sales in hypermarkets, supermarkets, small self-service stores and discounts between January and June 2016. Click here to enlarge. (Nomisma chart made with Nielsen data)

13,387 tons of organic vegetables were sold during the same period - +19% compared to last year. The top five products were potatoes (22%), tomatoes (19%), carrots (19%), dried onions (16%) and courgettes (12%).

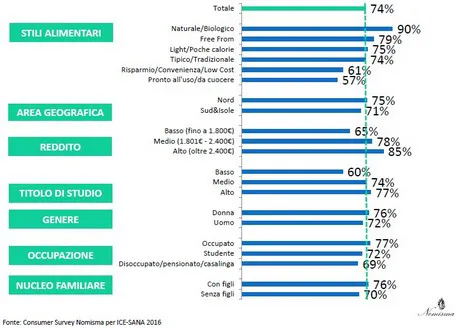

Nomisma also analysed the purchase of these products. In the past 12 months, 3 out of 4 families (74%) purchased organic fresh fruit or vegetables at least once. These are the two most popular organic products after extra virgin olive oil. Among those who purchase organic products, 29% would like to see more organic fruit on the shelves and 26% would like to see more vegetables.

FreshPlaza's photo report at Sana.

A moment during Sana 2016.

Another analysis concerned purchase channels, buyer profiles and purchase criteria. 43% of consumers buy these products in hyper and supermarkets, 26% directly from producers, 12% in specialist stores and 10% in small grocery shops, 5% in discounts and 2% online.

Profile of Italian consumers. Click here to enlarge. (Nomisma chart made using ICE-Sana 2016 data)

But what do consumers consider when buying organic products? 29% looks at the seasonality, while 27% for the Italian origin. Only 13% of consumers prefer lower prices and 12% consider the appearance.

FreshPlaza's photo report at Sana.

Retailers and producers

The convention was also attended by representatives of the retail and production worlds.

Claudio Mazzini, sales manager for Coop Italia, explained that "the average prices of organic products are double those of traditional products. At Coop, we are testing loose products so as to eliminate packaging costs." At Coop Italia, organic fruit and vegetables represent 5% of sales for value and 2.5% for volume, "but we have seen how they can actually reach even 8/9% in case of loose product with a nice layout. In order to improve this sector, we need to improve the average quality of products, reduce the price gap between organic and traditional products and carry out thorough checks on producers, as the better profits attract even those who are not exactly growing organic produce."

Claudio Mazzini, sales manager for Coop Italia, explained that "the average prices of organic products are double those of traditional products. At Coop, we are testing loose products so as to eliminate packaging costs." At Coop Italia, organic fruit and vegetables represent 5% of sales for value and 2.5% for volume, "but we have seen how they can actually reach even 8/9% in case of loose product with a nice layout. In order to improve this sector, we need to improve the average quality of products, reduce the price gap between organic and traditional products and carry out thorough checks on producers, as the better profits attract even those who are not exactly growing organic produce." Paolo Pari, Almaverde Bio director, added that "even though the market is increasing, it is still impossible to cut costs. In the spring, for example, it has been a nightmare to fight off aphids and rotting on stone fruit. Prices should be slightly higher because cultivating this way is harder. At a retailer level, often these products are not presented as well as other products."

Paolo Pari, Almaverde Bio director, added that "even though the market is increasing, it is still impossible to cut costs. In the spring, for example, it has been a nightmare to fight off aphids and rotting on stone fruit. Prices should be slightly higher because cultivating this way is harder. At a retailer level, often these products are not presented as well as other products." Tom Fusato, Brio sales manager, reported that "the comparison between the price of organic and traditional produce is incorrect because it only considers certain channels. In order to grow, the production chain must be ethical and provide more guarantees. The market share in Italy is only 3% and it is due to the fact that the chain is inefficient and yields are lower. Soon, we will start collaborating with Nomisma to obtain correct and comparable data on organic produce sales."

Tom Fusato, Brio sales manager, reported that "the comparison between the price of organic and traditional produce is incorrect because it only considers certain channels. In order to grow, the production chain must be ethical and provide more guarantees. The market share in Italy is only 3% and it is due to the fact that the chain is inefficient and yields are lower. Soon, we will start collaborating with Nomisma to obtain correct and comparable data on organic produce sales."  Gianmarco Guernelli, procurement manager for Conad, said that "consumers want guarantees on the quality of the products, so we need to find a way to convey the fact that supermarket certifications can be trusted." A few days ago, Conad introduced the new VersoNatura brand, which also includes an organic section.

Gianmarco Guernelli, procurement manager for Conad, said that "consumers want guarantees on the quality of the products, so we need to find a way to convey the fact that supermarket certifications can be trusted." A few days ago, Conad introduced the new VersoNatura brand, which also includes an organic section. FreshPlaza's photo report at Sana.