While in Aberdeen the banana was recently banned from a festival to appease superstitious sailors, banana traders in Europe are getting ready for the quiet summer months. The banana is facing competition from summer fruit across the continent. In the producing countries, a division is visible. The Philippines are mainly worried about El Niño. In Latin America, Ecuador sees the competition from other countries increase, which are able to export more cheaply through favourable trade agreements with the EU.

Worldwide, the sector is worried about the threat posed by El Niño, which could cause quite a bit of damage to the production in Latin America. This year, there have already been lower supplies from Ecuador and Colombia due to the extreme weather conditions, and production on the Philippines is halved. The banana diseases are also worrying the sector, although nobody expects the popular fruit to disappear completely.

In terms of trade, Asia, and especially China and India, takes up an increasingly large share. Because demand from this region is increasing, Europe is becoming less and less interesting for the producers. Within Europe, there are doubts whether the price of 1 Euro per kilo would be tenable, should China significantly increase its import. In China, however, there is currently an oversupply, with more being imported, but also more being produced. And although the consumer prefers the imported bananas, the supply causes prices to go down.

Costa Rica and Colombia supply the same quality bananas as Ecuador, but they have a logistical advantage compared to Ecuador. Transport times are shorter, and there's no need to go through the Panama Canal for the export to Europe. In addition, these countries have agreed favourable export conditions with the EU, which provides a competitive advantage.

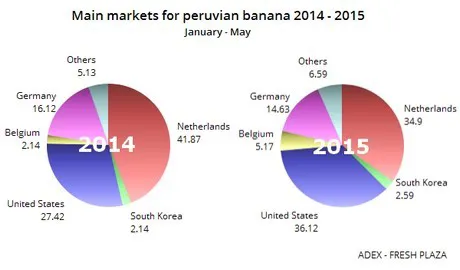

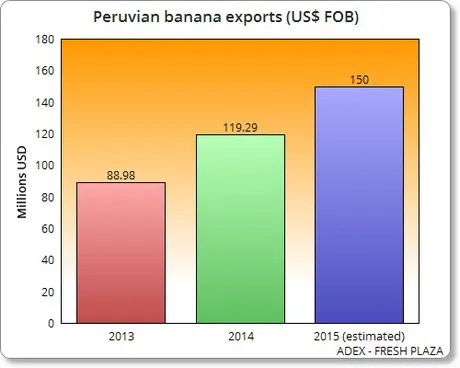

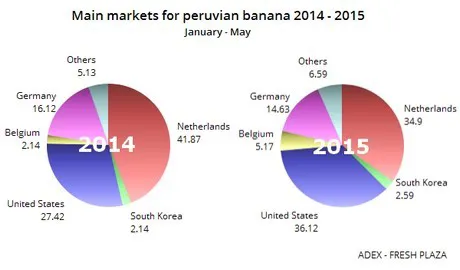

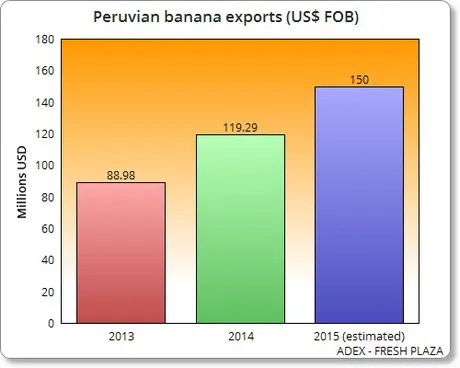

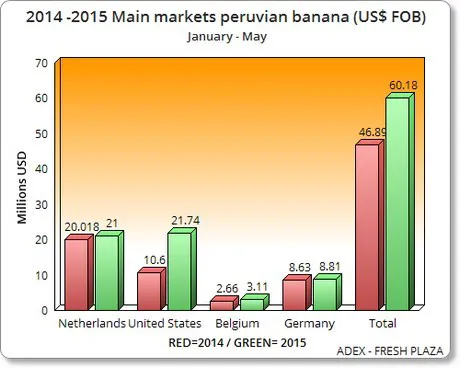

Organic and Fairtrade are also doing well. Demand for these bananas is rising fast, and a trend is visible of growers switching from conventional cultivation to production under these labels. On the markets, interest in these bananas is also on the rise. Peru is a big exporter of organic bananas. Below you'll find an overview of the main export markets.

Latin AmericaGrowing competition for Ecuador

Latin AmericaGrowing competition for EcuadorEcuador is one of the top banana producing countries in the world. Still, the banana giant is suffering from competition from countries in the region. The export to Europe in particular is hampered by the trade tariffs, one exporter from Ecuador knows. Last year, bananas from Colombia and Costa Rica were 0.36 dollars cheaper per box, because these countries signed a free trade agreement with the EU. This year, the difference is 0.50 dollars per box. "A big difference when you realize our margin is around 0.30 dollars," the exporter says. Ecuador is also negotiating with the EU about a trade agreement, which is expected to come into force in September next year. Competition from other countries in Central America is fierce, and companies in Ecuador feel at a disadvantage due to governmental rules, higher trade tariffs and higher transport costs. Fairtrade and organic bananas are on the rise, and the mini banana is mainly popular on the German market.

Mexican organic bananas cheaper

The prices for organic bananas from Mexico have gone down in the past weeks. Normally the price is around 13 dollars, while at the moment the bananas hardly yield 11.50 dollars. One cause is decreasing demand from Europe, which slows down export. A similar trend is visible for Fairtrade bananas from the Central American country. A side effect is the good harvest, partly because of the favourable weather. According to one Mexican exporter, it could take months for the market to recover, he doesn't expect any improvements for 2016.

Peru exports more organic bananas to US

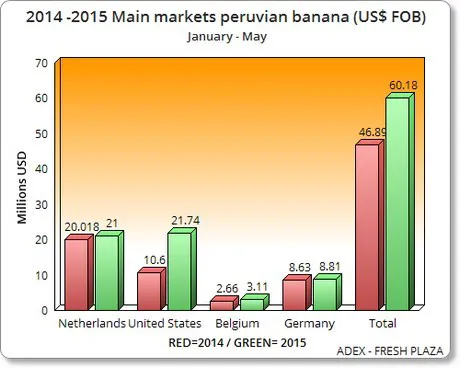

Worldwide, Peru is among the top organic banana exporters. Between January and May 2015, the export increased in value by 28.32%, the volume increased by 24.17% compared to the same period a year earlier. Although the export to the most important markets increased slightly, the biggest growth is visible in the export to the US. The export to the US amounted to 21.74 million dollars. That means the US took over the lead from the Netherlands. The Netherlands imported 21 million dollars' worth.

EuropeNetherlands and Belgium: good spring, quiet summer

EuropeNetherlands and Belgium: good spring, quiet summerIn the summer months, the banana market in the Netherlands and Belgium is always quiet, but compared to last year the situation has improved. The competition from summer fruit was delayed longer due to a cold spring. In the coming weeks, the market will traditionally decrease when the school holidays are starting.

The pricing in Belgium is different than in the Netherlands. While Dutch supermarket Jumbo offers bananas for 99 cents per kilo year-round, the price in Belgium is higher. The Belgian retailers do use the banana as bait for customers, and there's a special promotion for the fruit four times a year on average. The prices in Belgium are reasonably stable for the green bananas, because there's no oversupply. The situation can be called rather unique, one trader knows. In the Netherlands, the prices for the yellow brand bananas are between 11 and 17 Euro.

Polish supermarkets dumping banana prices

Because of the large number of internationally operating retailers that are also active in Poland, there is a lot of competition on the market, lowering prices to an average of 98 cents. Bananas are constantly on sale. "It's comparable to the British market, where the bananas are also cheap," a Polish trader explains. "Bananas were even cheaper than apples, although the apples were already cheap due to the boycott." The Polish summer fruit competes with the bananas, with strawberries being a particularly big competitor. If the summer lasts too long and the temperature is high, fewer bananas are imported.

Canary Islands biggest banana supplier Spain

In April, Spain imported 50,335 tonnes of bananas, 36,916 tonnes of which came from the Canary Islands. In addition, 19,020 tonnes were imported from Africa and Latin America. The Spanish market bought over 50,000 tonnes. The remaining 5600 tonnes were intended for re-export.

Diverging prices, no room for price stunts in Germany

The prices for 100 kilos of bananas are divergent in Germany. On the wholesale market in Munich, the premium bananas yielded 135 Euro, while in Cologne the price rose to 152 Euro. In the past weeks, the price has remained reasonably stable, although, at around 140 Euro. Although in Germany the banana also has competition from the summer fruit during the summer months, the market is still going well. That's partly thanks to the lower temperatures, which slow down demand for summer fruit. Due to an unfavourable exchange rate with the dollar, prices for bananas are already 20% higher than normal. Prices of 99 cents per kilo are impossible, according to one German trader. When it comes to promotions and sales, things have remained quiet in Germany, with one trader saying that in the past year, hardly any promotions were held by the retailers.

Italians opt for summer fruit

Bananas are no longer seen as an exotic fruit, which doesn't do much for demand from the Italian consumer. There is some increase in the Fairtrade segment, which reached a value of 90 million Euro in 2014 (+17.8% compared to 2013). The banana is by far the biggest in the Fairtrade segment, with the sold volume increasing by 11% to 10,000 tonnes. The price developments on the various wholesale markets are divergent. In Turin, prices went down after a stable period. On June 19, the price was 85 cents, with Chiquitas yielding 1.19 Euro that day. In Rome, prices increased between May 26 and June 23. The price was 90 cents for the lower classes, and 1.20 for Chiquita. The market in Fondi was stable, with prices varying from 80 cents to 1 Euro per box.

Asia & Oceania

Philippines worried about impact El Niño, up to 60% less volume

Regarding the banana cultivation on the Philippines, El Niño has major consequences for growers. Due to the change of weather, there is less rain, and only growers with a good irrigation system are able to keep up production. Still, 50 to 60% less volume is reckoned with. Important markets for the archipelago are China and the east of Russia. One grower says he exports 80% of his production to China, with the other 20% going to Russian Vladivostok.

Chinese market defined by oversupply, import popular

The wholesale markets in China are seeing supplies of bananas increase. Supplies from both domestic cultivation and import increased. Main suppliers are the Philippines, but Ecuador is also focusing more on export. The domestic production can mainly be found in the south of the country. The weather condition in this part of China have been favourable since January, so a bigger volume of bananas is expected. And although the domestic production is on the rise, consumer, also in the south of China, prefer the imported bananas. Filipino bananas also have a better taste, size and appearance.

Australian growers positive despite diseases and storms

The Australian banana growers are facing various challenges. Extreme weather has significantly limited production in the past years. Some months ago, a cyclone destroyed a large acreage in Western Australia. Earlier this year, the Panama Disease TR4 was discovered on two plantations in Australia. The disease has now been contained, and with strict measures, spreading of it is prevented. The government is working on a compensation plan for the banana growers. The government reportedly also wants to contribute to the development of new, resistant varieties.

Nevertheless, the market is stable. The production is taken completely to the domestic market, export is unattractive due to the high wage costs for growers. Domestic demand is high enough to absorb the entire volume. There is even a brief oversupply, with around 400,000-500,000 boxes a week.

Indian consumption increases during Ramadan

Demand in India is boosted by the start of the Ramadan. The prices are higher because the new season is starting. During the Ramadan, sales figures are better than in other months. It's hard to draw a comparison with the international market, seeing how the country doesn't import bananas. The import of the yellow fruit is not allowed from any country. That makes the market completely dependent on domestic cultivation.

North America

Market US stable because of contracts

The United States mainly import from Guatemala, Ecuador, Colombia, Costa Rica and Honduras. The biggest part of the market is supplied with contracts, so there are few fluctuations in the market. The contract prices are slightly higher than last year, the prices for packing, transport and materials have increased. In the United States, they're also getting ready for a quiet summer period. Here there's also competition from summer fruit, and school holidays are lowering the demand. With the start of the new school year, demand generally increases again. There is growth in organic bananas. According to the USDA, sales of organic fruit have increased by 16.7% in 2014.

Every week, FreshPlaza publishes an overview of the market situation of a product in a worldwide context. With these articles, we're aiming to give an idea of a global market that's becoming ever smaller as a result of globalization. Next week, the spotlight is on limes.